Enclosed is a copy of Frequently Asked Questions (FAQs) on the Mandanas-Garcia Supreme Court (SC) Ruling as of November 9, 2021, for information and reference.

This FAQ provides all the information needed in understanding important concerns involving the DepEd being one of those National Government Agencies (NGAs) covered/affected by the SC ruling with devolved functions to the Local Government Units (LGUs) per the 1991 Local Government Code (LGC) and other subsequent pertinent laws.

Table of Contents

General Backgrounder

The Mandanas-Garcia Supreme Court (SC) ruling refers to the SC’s final decision on the two (2) separate (consolidated on October 22, 2013) petitions filed before the SC: (1) the petition filed by Congressman Hermilando I. Mandanas and other local officials vs. Executive Secretary Paquito N. Ochoa, Jr., etal. (G.R. No. 199802); and (2) Congressman Enrique T. Garcia, Jr. vs. Executive Secretary Paquito N. Ochoa, Jr., etal. (G.R. No. 208488).

Both petitions challenged the manner in which the National Government (NG) computed the Internal Revenue Allotment (IRA) shares of local government units (LGUs). In particular, the petitioners pleaded with the SC to mandate the NG to compute the IRA based on the “just shares” of the LGUs.

In its July 3, 2018 Decision, the SC granted the Mandanas-Garcia petition, declaring as unconstitutional the phrase “internal revenue” appearing in Section 284 of the Local Government Code (LGC) of 1991. As such, the SC ordered the deletion of the said phrase.

The SC ruled that the determination of the just share of the LGUs should not be based solely on national internal revenue taxes but on all national taxes.The SC also ruled that any mention of “internal revenue allotment” in the LGC of 1991 shall be understood as pertaining to the allotment of the LGUs derived from the national taxes. It further ordered the Secretaries of Finance and Budget and Management, Commissioners of Internal Revenue and Customs, as well as the National Treasurer to include all collections of national taxes in the computation of the base of the just share of the LGUs, based on the ratio provided in the now-modified Section 284 of the LGC.

The SC Ruling became final and executory on April 10, 2019, affirming its earlier decision promulgated in July 3, 2018.

The impact of the SC decision significantly increased the tax base on which the share of the LGUs is computed from, and thus, strengthened fiscal decentralization. It clarifies the distinction between “national internal revenue taxes” and “national taxes” as base in the computation of the IRA of LGUs.

National internal revenue taxes include only taxes collected by the Bureau of Internal Revenue (BIR) while “National taxes,” consists of all taxes and duties collected by the NG through the BIR, the Bureau of Customs (BOC), and other collecting agencies.

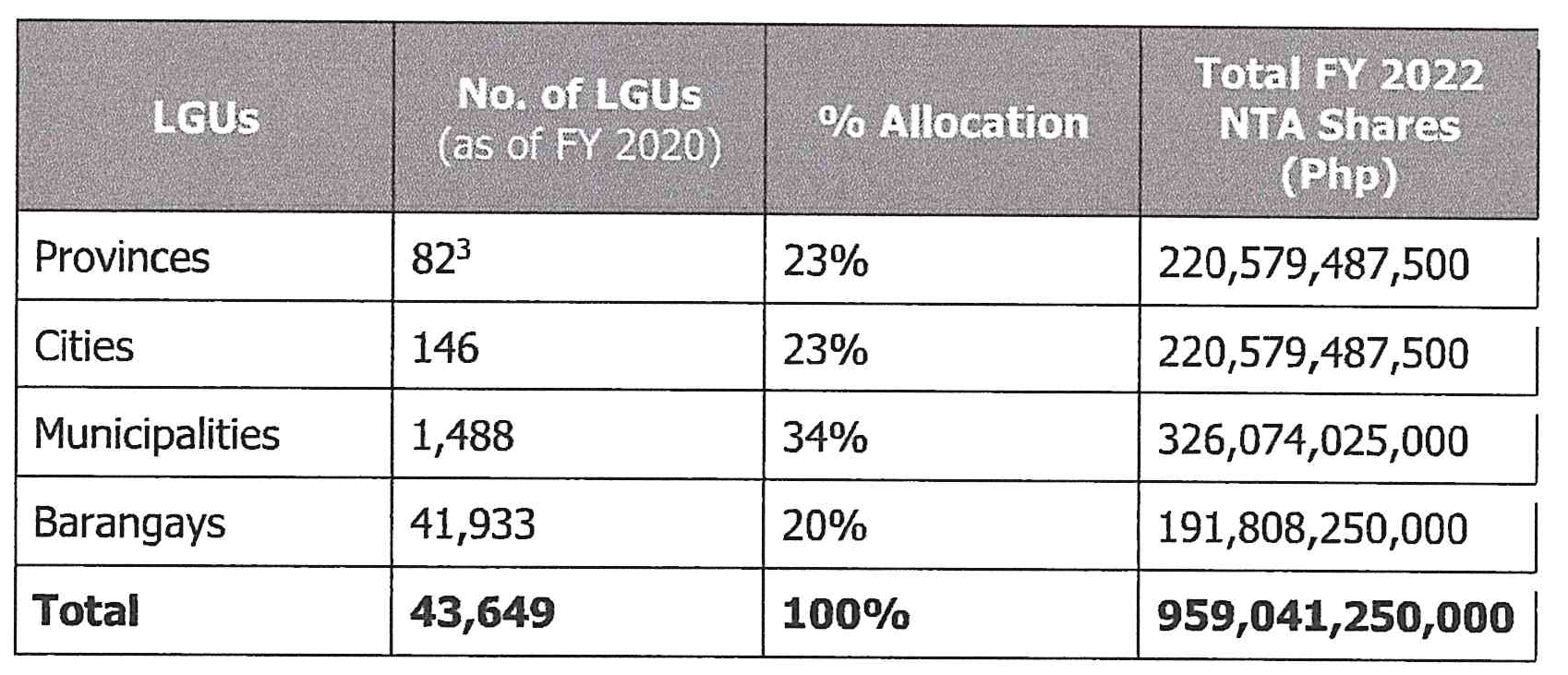

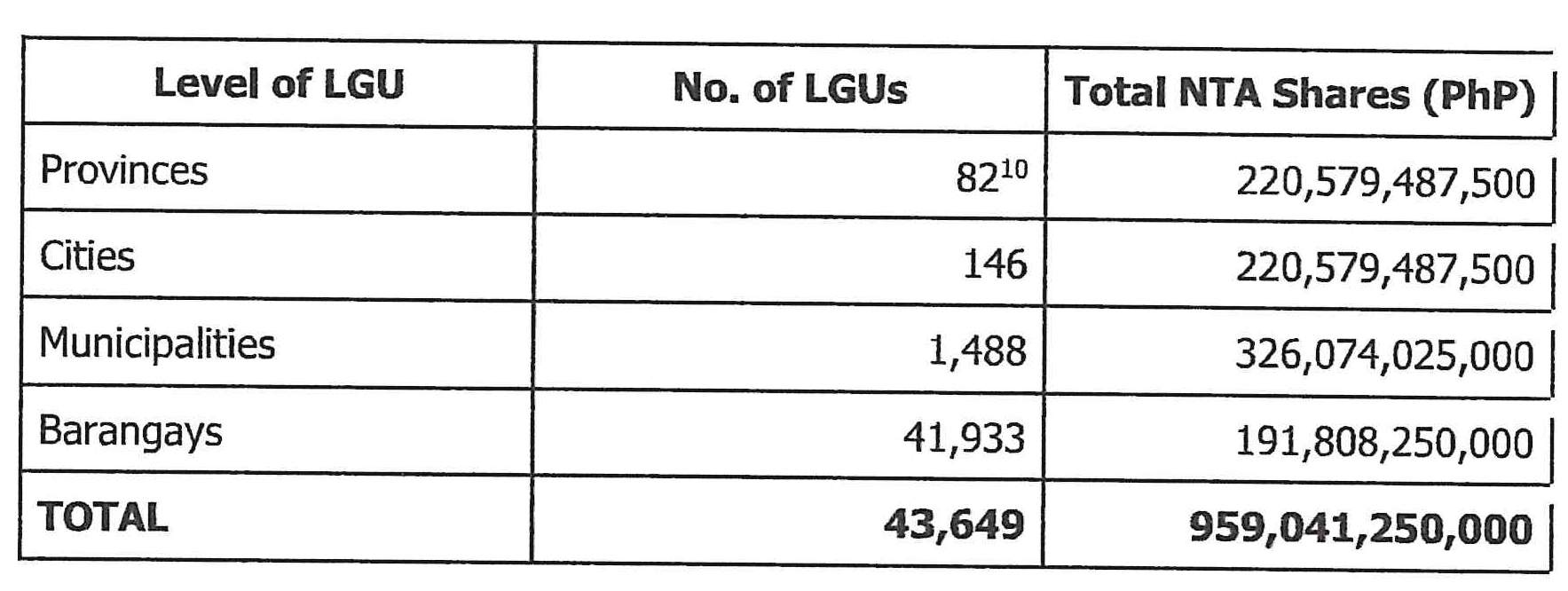

Based on the certifications issued by the BIR, BOC, and Bureau of the Treasury (BTr), the fiscal implication of the SC ruling implementation is about PhP959.04 Billion,1 which is equivalent to a 37.89 percent increase or around PhP263 billion from the FY 2021 IRA shares of LGUs.

The implications of this bigger allocation for LGUs are as follows:

This presents a unique opportunity for the LGUs to assume the functions that have been devolved to them under the 1991 LGC and other subsequent and pertinent laws.

On the other hand, this will significantly diminish the fiscal resources available to the NG for its key priorities and commitments in reducing poverty, promoting infrastructure and human capital development, and pursuing peace and order in the country, starting 2022.

For fiscal sustainability, however, the devolved functions under the LGC should be fully and permanently, albeit gradually, be turned over by the NGAs to the LGUs. The NGAs should then pursue a long-term institutional development program for the LGUs to strengthen their capacities and capabilities to assume the devolved functions.

Section 6, Article X, General Provisions of the 1987 Philippine Constitution, provides that the LGUs shall have a just share, as determined by law, in the national taxes which shall be automatically released.

Section 284 of RA No. 7160 provides that the LGUs shall have a 40 percent share in the national taxes based on the collections during the third fiscal year preceding the current fiscal year.

Sections 18 and 286 of RA No. 7160 and Articles 383 and 390 of its Implementing Rules and Regulations (IRR) provide that the share of LGUs shall be automatically and directly released to the provincial, city, municipal, or barangay treasurer without the need for any further action, and shall not be subject to any lien or holdback that may be imposed by the NG.

Section 4 of RA No. 9358,2 appropriating a supplemental budget for FY 2006, provides, among others, that the IRA is considered automatically appropriated and that future local government share in the national taxes or IRA shall be likewise automatically appropriated.

During the budget preparation phase, the BIR, BOC, and the BTr submit to the DBM a certification showing the corresponding 40 percent shares of LGUs in the collection of national taxes made in the third fiscal year preceding the budget year.

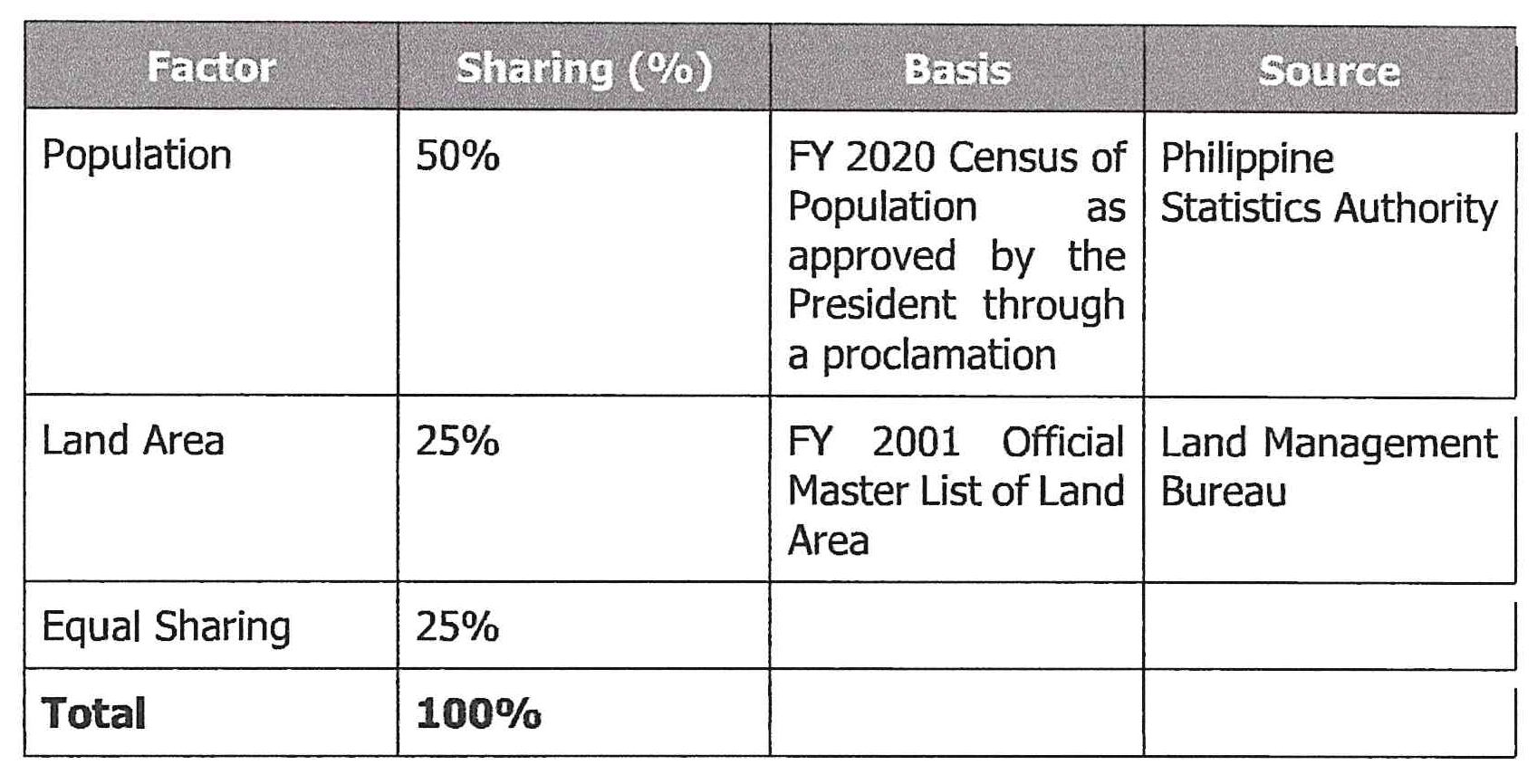

Afterwards, the DBM computes and allocates the individual share of LGUs based on the formula provided under Section 285 of RA No. 7160 (kindly refer to Question No. 7), using as bases pertinent supporting documents/data including the approved Census of Population and approved Master List of Land Area.

The 40 percent share is determined per Section 284 (Allotment of Taxes) of the LGC: Local government units shall have a share in the national taxes based on the collection of the third fiscal year preceding the current fiscal year as follows:

(a) On the first year of the effectivity of this Code, thirty percent (30%)

(b) On the second year, thirty-five percent (35%); and

(c) On the third year and thereafter, forty percent (40%).

LGUs are mandated to utilize their NTA shares to deliver the basic services devolved under Section 17 of RA No. 7160. Furthermore, each LGU shall appropriate in its annual budget no less than 20 percent of its NTA for development projects pursuant to Section 287 of the same law.

Moreover, pursuant to Article 409 of the IRR of RA No. 7160, the DBM issues a local budget memorandum not later than June 15 of every fiscal year to inform, among others, the beneficiary LGUs of their respective NTA shares and the guidelines in the preparation of their annual budgets, while also reiterating the provisions of existing laws and policies (i.e., LGC, executive issuances, etc.) on the allocation and utilization of their local budgets.

The share of LGUs in the national taxes is allocated in the following manner:

The distribution of the shares of individual provinces, cities, and municipalities is based on the following formula prescribed in Section 285 of the LGC:

The share of each barangay is computed as follows:

PhP80,000 for each barangay with a population of not less than one hundred (100) inhabitants

The balance is allocated as follows: Population – 60% and Equal Sharing -40%.

Yes, because the LDF comes from the NTA. As mandated in Section 287 of RA No. 7160, each LGU shall appropriate in its annual budget, no less than twenty percent (20%) of its annual NTA to LDF which shall only be used on development projects.

To promote greater autonomy, transparency, and accountability, the said development fund shall be utilized in accordance with DBM-Department of Finance (DOF)-Department of the Interior and Local Government (DILG) Joint Memorandum Circular (JMC) No. 1 dated November 4, 2020

The said JMC sets the general policies and guidelines to be observed by the LGUs in identifying and implementing development projects, including the prescription of the prohibited expenditure items.

No. The increased local share will not perpetuate NTA dependency. In fact, when comparing the FY 2020 figures from the projections for FY 2022, the share of the NTA in the LGUs’ total income is anticipated to increase from 81 percent to 87 percent for provinces, 81 percent to 85 percent for municipalities and 43 percent to 49 percent for cities. This means that LGUs will have significantly higher shares in 2022 compared to 2020.

Nonetheless, there have been continuous efforts in addressing concerns on NTA dependency. In particular, oversight agencies, especially the DOF-Bureau of Local Government Finance (BLGF), have been advocating for the strengthening of the LGUs’ own revenue-generating measures and borrowing capacity from the Government Financing Institutions (GFIs), as well as its ability to enter into publicprivate partnerships and joint ventures with the private sector.

That is why, the DOF-BLGF will be conducting capacity-building programs on revenue generation and fiscal management to enable LGUs to fund the devolved services on their own. This is also mandated under EO no. 138. LGUs will also be provided with technical assistance on public financial management processes, from local planning, investment programming, resource mobilization up to local budgeting.

In addition, the NG is also pushing for the enactment of the passage of Package 3 of the Comprehensive Tax Reform Program (CTRP) on Real Property Valuation Reform. This reform will enable the development of a more efficient real property valuation system, which in turn will broaden the tax base of the LGUs without necessarily increasing tax rates. This reform, once in place, will favorably impact revenue mobilization at the local level, enabling LGUs to fund the growing needs of their constituents.

The increase in the NTA shares of the LGUs puts them in a better position to directly implement programs, projects, and interventions that are tailor-fit to the priorities and needs of their respective localities and constituents, thereby supporting the LGUs’ economic development and growth.

The Role of LGUs

The PPAs that will be scaled down or phased out by the NGAs concerned are those which involve functions and services that have already been devolved to the local governments pursuant to Section 17 of the LGC and other pertinent laws (See Annex A). The final list of PPAs that will be scaled down/phased out by the NGAs will be based on their respective DTPs submission.

In view of the administrative autonomy afforded to the LGUs pursuant to the LGC, the NG cannot directly impose on the local governments, which specific programs and services to fund. It is recognized that the LGUs may have different priorities considering the characteristics of their localities, the needs of their constituents, and their capacities.

Nonetheless, the NG can, at most, encourage and coordinate the prioritization and spending of the LGUs on certain programs and services through the issuance of policies and guidelines. Hence, together with the DILG, the NGAs have been encouraged to coordinate with the LGUs on the former’s devolution strategy, as stipulated under Joint Memorandum Circular No. 2021-2 dated August 12, 2021.

Likewise, the NG will continue to institute mechanisms that will encourage and support the LGUs to carry on the functions devolved to them. For instance, the NG is studying how the performance of the LGUs in implementing the devolved functions be incorporated among the performance indicators under the Seal of Good Local Governance (SGLG). Likewise, the DBM is developing its eBudget System to present the proposed budget submitted by the LGUs. This is being linked with the eSRE System of the DOF-BLGF to facilitate the tracking of the budget submissions of the LGUs as they are implemented during the year.

There will be no new and/or additional functions in the set of devolved functions that the LGUs are encouraged to assume starting FY 2022. The provision of basic services and facilities to be gradually phased out or scaled down by the NG and assumed by the LGUs shall be consistent with Section 17 of the LGC and its IRR and other pertinent laws.

However, the full assumption of devolved functions and services by the LGUs may require the modification of their organizational structure and competency requirements, that will consequently entail updating their Organizational Structure and Staffing Pattern and Capacity Development.

The differing level of financial capacity of LGUs is recognized. For instance, the increase in NTA share for some LGUs may be sufficient to carry out their devolved functions, while this may not be the case for some.

Hence, it is important for the LGUs to review their financial resources, as well as their expenditure requirements and absorptive capacities, to meet the urgent needs of their constituencies and local economies as well as to develop a transition strategy to be able to identify the gaps and on how to gradually address them.

This can start with the updating of the Comprehensive Development Plan, Comprehensive Land Use Plan, and Annual Investment Program needed for their 2022 budget preparation. The LGUs concerned can also start attending the seminars being conducted by the DOF-BLGF and the Philippine Tax Academy on revenue and borrowing mobilization, as well as those being given by the Public-Private Partnership Center on developing public-private partnership projects.

No, there will be no automatic or mandatory transfer of NGA personnel to the LGUs. In fact the LGUs shall not be compelled to hire any affected personnel as determined by the NGAs covered by the devolution efforts.4 This is provided under Section 24 of the IRR of EO No. 138 and indicated under DBM-DILG JMC No. 2021-3.

However, should the LGUs choose to hire these personnel, it shall be subject to the pertinent provisions of RA No. 7160, and the Civil Service Law, rules, and regulations. The hiring of affected personnel shall also depend on the local development priorities/thrusts and financial capacity of the respective local government unit.

It may also be good to note that the affected personnel may apply to vacant positions that shall perform the devolved functions in the LGU. In this regard, they shall be subject to the compensation system of the LGU concerned, and that such reemployment shall be considered as a new entry to the civil service.

Support to LGUs

Central to the full devolution effort is the provision of capacity development (CapDev) interventions for the LGUs.

Pursuant to Section 9 of EO No. 138, and Rule 9 of its IRR, a CapDev agenda for LGUs shall be formulated based on the assessment framework and guidelines to be issued by the DILG-LGA to enable them to absorb, manage, and sustain their responsibilities under a fully devolved set-up. In this regard, the DILG issued Memorandum Circular No. 2021-067 last June 24, 2021 which provides the guidelines on the Adoption of a Capacity Development (CAPDEV) framework in the planning, design and implementation of CAPDEV Interventions for LGUs.

Under EO No. 138, the DILG-LGA shall oversee and harmonize the provision of technical assistance and capacity building interventions for all LGUs to ensure the efficient utilization of government resources on this effort, and the implementation and management of the devolved functions.

Examples of CapDev interventions, per Section 31 of the IRR, include public financial management processes, such as local planning, investment programming, budgeting, and revenue generation measures which shall be organized by the DILG, the DBM, and the DOF-BLGF. To facilitate the provision of capacity development interventions and technical assistance in the execution and management of the devolved activities, the LGUs may enter into memoranda of agreement with the NGAs, as may be necessary.

For the LGUs that are financially incapable of allocating funds and are technically weak in the implementation of devolved services (i.e., LGUs with high poverty incidences, low financial capacity), the Growth Equity Fund (GEF), is being established pursuant to Section 8 of EO 138 and Rule XIII of its IRR. The GEF shall be included in the proposed FY 2022 national budget and shall supplement NTA shares to enable LGUs to have supplementary funding for devolved functions and services pursuant to Section 17(b) of RA 7160, but subject and limited to identified priorities on the respective DTP of beneficiary LGUs. However, the GEF shall only be available for a fixed time period. Simultaneous with the establishment of the GEF is the conduct of capacity-building programs for revenue generation and fiscal management to be provided by DOF to enable them to fund the devolved services on their own.

Under Section 8 of EO No. 138 and Section 40, Rule XIII of the IRR, the GEF was conceptualized to address issues on marginalization, unequal development, high poverty incidence, and disparities in the net income of the LGUs. As such, it will be made available to the LGUs that are financially incapable of allocating funds and are technically weak in the implementation of devolved services to top up their NTA.

In this regard, a necessary amount constituting the GEF shall be included by the DBM in the National Expenditure Program starting FY 2022. Specifically, under Special Provision No. 3 of the Local Government Support Fund-Growth Equity Fund appropriated an amount of PhP 10 Billion, which shall be used as financial assistance to the identified poor, disadvantaged, and lagging LGUs for the implementation of various infrastructure projects to gradually enable the full and efficient implementation of the devolved functions and services to the LGUs.

Further, pursuant to Section 41 of the IRR of EO 138, the DBCC shall issue guidelines on the release of the fund to the LGUs to ensure the equitable, performance-based, and time-bound allocation and distribution of the funds to the LGUs.

Likewise, the implementation of the GEF shall be monitored by the Inter-Agency Steering Committee composed of the DBM, DILG, DOF, and NEDA.

No. The GEF is only available to the poor, disadvantaged, and lagging LGUs with high poverty incidence, and low financial capacity, as provided under EO No. 138.

The GEF shall be exclusively released to eligible provincial, city and municipal LGUs, with the exception of those under Bangsamoro Autonomous Region in Muslim Mindanao. The identification of eligible beneficiaries and the allocation of funds for GEF shall be determined based on the following prioritization criteria: (1) Poverty Incidence, and (2) Per capita NTA.

Per National Budget Memorandum (NBM) No. 138, the NGAs shall include in their FY 2022 budget proposals the funding requirements for the capacity building of the LGUs. Under this memorandum, the NGAs were also advised to focus on policy and service standards development, provision of technical assistance, monitoring, and performance assessment of the LGUs.

The DILG-LGA, in coordination with NGAs and oversight agencies concerned, shall implement the integrated capacity development program and technical assistance to all the LGUs to build the necessary competencies and capacities in implementing the devolved functions.

EO 138 or its IRR does not contain any provision on the entitlement of the members of the LGU Devolution Transition Committee (DTC) to honoraria. In the absence of any provision on the matter, the members of the DTC shall not be entitled to honoraria.

Nonetheless, the civil society organizations/ private sector representatives who are sitting as members of the Committee may be entitled to honoraria if they will serve as resource persons during the Committee meetings, by virtue of their expertise in a specific subject area, subject to the guidelines prescribed under DBM Budget Circular No. 2007-15 dated April 23, 2007.

Impact on NGAs

The NGAs covered/affected by the SC ruling are those with devolved functions to the LGUs per the 1991 LGC and other subsequent pertinent laws. (See list of NGAs per Annex A of the IRR of EO No. 138 and Attachment 1 of DBM-DILG JMC No. 2021-2).

As noted under EO No. 138 and subsequent pertinent guidelines, and as previously advised under NBM No. 138, the NGAs shall be focused more on their steering roles including policy and standards setting, provision of technical assistance to LGUs, monitoring and performance assessment of the LGUs.

The identification of the PPAs that are proposed to be phased out/scaled down is based on the functions which have been devolved to the LGUs under the 1991 LGC and other pertinent laws.

The phasing out/scaling down of PPAs is being resorted to in order to sustain a manageable public sector deficit, increase the fiscal space left to the NG for major national programs and projects, and to empower and provide flexibility to the LGUs in the phasing and implementation of their priority programs and projects from 2022 onwards.

The proposed phasing out/scaling down will be done in phases, within a three (3)-year transition period, as provided under EO No. 138. Specifically, as provided under DBM-DILG JMC No. 2021-2 and as suggested in NBM No. 138, the NGAs may first phase out/scale down the implementation of local projects in the richest and most capable LGUs (i.e., 1st to 4th class LGUs) and provide technical assistance to these LGUs when requested. This will enable the NGAs to focus their financial and technical assistance to the least financially able LGUs (i.e., 5th and 6th class LGUs), particularly those with the highest poverty incidences and have multiple GIDAs.

Aside from existing legal mandates, the determination of the functional assignments between and among the different levels of government shall be guided by the following principles, as stipulated under Section 2 of EO 138:

1. Public services with little or no benefit spillover are best administered and financed by lower-level governments, while public services with significant inter-jurisdictional externalities or benefit and cost spillovers are best assigned to higher levels of government;

2. The provision of public goods and services that involve economies of scale is best assigned to higher levels of government; and

3. Functions related to the redistributive role of government should be best assigned to the national government.

As directed under EO No. 138, devolved functions, services, and facilities per Section 17 of RA No. 7160 and other pertinent laws shall be fully devolved from the NG to the LGUs no later than FY 2024. Hence, NGAs concerned have been advised to transition from directly implementing and funding devolved functions/services/facilities, to communicating and transferring the execution of the same to the LGUs starting FY 2022.

In cases where the NGAs deem it not feasible to fully devolve certain functions to the 1st to 4th class LGUs by FY 2022, the NGAs shall present strong justification for retaining the pertinent PPA in their proposed budgets and provide a time-bound plan that will address capacity building and other concerns to prepare the LGUs for the full devolution of functions at the soonest feasible time, within the three (3)-year transition period.

It is expected that LGUs will be primarily and ultimately responsible and accountable for the provision of all basic services and facilities fully devolved to them by FY 2024 onwards, consistent with the directive under EO No. 138.

The NGAs will now focus on their steering functions and provide support to the LGUs through policy and standards setting, technical assistance and capacity building, and monitoring and performance assessment in the delivery of devolved services.

Under Section 12 of EO No. 138, personnel hired on a permanent basis in NGAs who may be affected by the devolution, shall have the option to:

1. Apply for transfer to other units/offices within the department/agency/GOCC concerned, without reduction in pay;

2. Apply for transfer to other agencies in the Executive Branch, without reduction in pay; or

3. Avail of the retirement benefits and separation incentives provided in the EO and subject to the discretion of the LGUs, apply to vacant positions therein; Provided, that their reemployment shall be considered as a new entry to the civil service and that they shall be subject to the compensation system of the LGU concerned.

No. It is understood that the availment of any of the personnel options provided under EO No. 138 and its IRR, particularly the retirement benefits and separation incentives authorized therein, are intended only for those who may be affected by the full devolution effort. The same shall be based on the list of affected personnel identified by the department/agency concerned in its DTP to be submitted to the DBM for evaluation and approval.

Yes. In fact, the DBM and the DILG, in coordination with the Civil Service Commission and with prior consultation local leagues, have already issued Joint Memorandum Circular No. 2021-3 last September 13, 2021, prescribing guidelines on the implementation of personnel policies and options. Pursuant to Section 12 of EO No. 138 and Section 28 of IRR of EO No. 138.

Non-permanent personnel are not covered by the options for affected personnel under Section 12 of EO No. 138 considering that the nature of their employment is dependent on the terms and duration of a project.

Nevertheless, departments/agencies shall prepare a list of affected personnel hired on a contractual, casual, and contract of service/job order basis who are involved in the implementation of devolved services, for ready reference of the DBM, DILG, and the LGUs.

The DILG shall set up a mechanism to identify those who are willing to be absorbed by the LGUs, and shall provide the LGUs with said list upon request of the latter. Subject to the discretion of the LGU, they may be given preference, after those with permanent appointment, in the application process. This is pursuant to Item 4.4.4 of the DBM-DILG JMC No. 2021-3.

Accordingly, COS and job order workers from the affected NGAs will be subject to the usual application and recruitment process and procedures of the LGU concerned. May we we reiterate however that the hiring of personnel by the LGUs will still depend on the development priorities and financial capacity of the LGU concerned since the LGUs are not mandated to absorb the affected employees.

No. As provided under Section 24 of the IRR of EO No. 138, the LGUs shall not be compelled to hire any personnel affected by the implementation of EO No. 138.

However, should the LGU decide to hire these personnel, they shall be subject to the compensation system of the LGU concerned, and that such reemployment shall be considered as a new entry to the civil service. For this purpose, the affected personnel shall sign a waiver or manifestation that they accept these terms as a condition for their employment with the LGU.

One of the key components of the DTPs to be prepared by the NGAs concerned is an organizational effectiveness proposal, which shall contain the proposed modifications in the organizational structure, staffing complement, and resource allocation of the department/agency/GOCC to ensure it will be able to perform its “steering” functions efficiently and effectively. This will mainly reflect the organizational changes needed as NGAs shift towards capacity development and performance assessment of the LGUs instead of direct service delivery.

For instance, the Department of Trade and Industry (DTI) plans to focus on innovation and helping industries through the devolution transition. Meanwhile, the Department of Agriculture (DA) is looking towards the clustering of farms and promoting the diversification of agriculture based on the spatial analysis of commodity production.

The proposed changes in the organizational structure and staffing complement by the NGAs shall be evaluated by the DBM pursuant to existing laws, rules, and regulations.

A total of PhP450 million was recommended to be included in the Pension and Gratuity Fund under the FY 2022 National Expenditure Program to cover the payment for the retirement/separation incentives and terminal leave benefits of personnel who may be affected by the full devolution.

However, the NG would like to clarify that this is an organizational effectiveness program and not a rationalization program, and thus, is not expected to cause much disruption and displacement in the bureaucracy. Affected personnel may be redeployed to other offices/units within the Executive branch, or may apply to an LGU after retiring/separating from the NG.

In order to further clarify the delineation of responsibilities between the NG and the different levels of the LGUs, among the key annexes of the NGA DTPs is on the unbundling of the devolved functions wherein NGAs shall identify the appropriate assignment of functions, services, and facilities to each level of government, specifically determining the specific level of LGU wherein said functions and services have been devolved and shall be transferred to, based on RA No. 7160 and other relevant laws.

The specific guidelines and steps on how the NGAs could undertake the unbundling of their respective functions and PPAs, including the DTP template/annex for the purpose are contained in DBM-DILG Joint Memorandum Circular (JMC) No. 2021-2 dated 12 August 2021.

Given that the FY 2022 National Expenditure Program (NEP) was prepared while the DTPs of concerned NGAs are still pending for official and final submission, budgetary allocation for most of the devolved local PAPs are still provided for in the 2022 NEP.

It should also be noted however that under EO 138 and its IRR, the devolution of existing/current local PAPs from national government agencies to local government units shall be gradually scaled down/ phased out for the next three fiscal years, as detailed in the submitted DTPs of concerned NGAs.

Moreover, proposals for new and expanded local projects of NGAs associated with identified devolved services will no longer be accommodated under the Tier 2 budget for FY 2022, as stated in National Budget Memorandum No. 140 s., 2021. The GEF shall serve as the main NG support to the extremely poor and disadvantaged LGUs.

The proposed phasing out or scaling down of devolved functions/services/facilities by the NGAs may be done in phases within a three (3)-year transition period, pursuant to Section 4 of EO No. 138. As suggested in Sections 2.6 and 2.7 of NBM No. 138, the NGAs may first phase out/scale down the implementation of local projects in the richest and most capable LGUs (i.e., 1st to 4th class LGUs) and provide technical assistance to these LGUs when requested. This will enable the NGAs to focus their financial and technical assistance to the least financially able LGUs (i.e., 5th and 6th class LGUs), particularly those with the highest poverty incidences and have multiple GIDAs.

The strategies to undertake the full devolution transition shall be detailed and provided under the respective DTPs of both the NGAs and the LGUs. Specifically, on the part of the NGAs, one of the key contents of the NGA DTP is the implementation strategy and phasing of the devolution transition activities per level of LGU, taking into consideration the capacity and resources of the LGUs to take on these devolved functions based on the experience and assessment of the NGA concerned. With regard to the LGUs, the LGU DTP shall likewise contain the phasing of their full assumption of devolved functions/services/facilities, to ensure strategic, systematic, and coherent actions towards the same starting FY 2022.

Parallel to the preparation of their respective DTPs, the NGAs concerned have been encouraged to consult and coordinate with the LGUs and the LGU Leagues to enhance the likelihood of consistency between the NG and the local government transition plans, as well as understand the issues and gaps in the capacity and resources of the LGUs.

Central to the full devolution transition effort is the provision by the NGAs of technical assistance and capacity development programs to all the LGUs to build their competencies and capacities in implementing the devolved functions.

Moreover, as part of their DTPs, the NGAs are consolidating, refining and/or developing the standards of service delivery for the devolved activities. These service delivery standards will be shared with the LGUs, as well as with the Development Academy of the Philippines and the DILG-LGA for use in the capacity development programs for LGUs to ensure that they are able to provide the same standards of services to their constituencies as provided for in the LGC.

Further, a framework for monitoring and performance assessment of the LGUs in undertaking the devolved functions will be established and/or strengthened to ensure that the NGAs are able to effectively and efficiently monitor and assess the performance of LGUs in the delivery of devolved functions and services, following the minimum service delivery standards set by the NG. For instance, the Seal of Good Local Governance (SGLG) scorecard of the DILG has been institutionalized by RA No. 11292 which will rate different devolved programs and projects of the different LGUs, providing an incentive through the Performance Challenge Fund to the LGUs who successfully hurdle the scoring thresholds.

One of the safeguards in place to ensure the proper use of local funds is the ability of LGUs to design and implement its own organizational structure and staffing pattern, subject to the minimum standards and guidelines prescribed by the CSC.5 With this authority, the LGUs can design an organization where several personnel are tasked to ascertain the proper management of funds and other sources. Nonetheless, this must be reflected in the DTP of the LGUs. Refer to Question No. 6 for information on the utilization of NTA.

As provided under Section 5 of EO No. 138, the NGAs concerned and all LGUs are directed to prepare and implement their respective devolution transition plan (DTP) to ensure the smooth implementation of the full devolution of basic services and facilities.

Per Section 12, Rule V of the IRR of EO No. 138 and as further detailed in DBM-DILG JMC No. 2021-2, the NGA DTPs shall comprise a narrative report with the following elements:

The strategic directions/shifts which will lay out the strategic vision of what the department/agency/GOCC should or intends to do considering the changes in its work as a result of the full devolution of certain functions it is currently performing to the LGUs, including the new thrusts and emerging challenges which the NGA intends to address as part of the strengthening of its steering functions.

The identification of the: (i) appropriate assignment of functions, services and facilities to each level of government, determining the specific level of LGU wherein said functions and services have been devolved and shall be transferred to, based on RA No. 7160 and other relevant laws; and (ii) implementation strategy and phasing of the devolution transition activities, subject to the capacity and resources of the LGUs to take on these devolved functions based on the experience and assessment of the NGA;

The identification and inventory of standards for the delivery of devolved services, which cover the minimum cost, scope, specifications, and quality of the services to be delivered by the LGUs, as well as the minimum organizational structure and manpower complement recommended for the LGUs by the NGA;

The strategy for capacity development of NGAs to enable them to effectively and efficiently perform their “steering”, as well as monitoring and evaluation functions;

The strategy for and phasing of capacity development of the LGUs to enable them to fully absorb and manage the devolved functions and services starting FY 2022, which shall include the checklist of criteria and conditions necessary to determine the readiness of the LGUs to take on the delivery of the devolved functions/services consistent with their local growth priorities, and resources, as well as other capacity development requirements anchored on the DILG-Local Government Academy’s (LGA) LGU capacity framework;

The framework for monitoring and performance assessment of the LGUs in undertaking the devolved activities, including the grant of incentives and the imposition of sanctions provided by pertinent laws; and

An organizational effectiveness proposal (OEP) to strengthen the department/agency/GOCC in assuming “steering functions” as a result of the full devolution efforts. The OEP shall contain the following components:

1. Modifications in the organizational structure of the departments/agencies/GOCCs concerned, as applicable, stating the specific changes in the offices/units in said department/agency/GOCC;

2. Modifications in the staffing complement of the departments/agencies/GOCCs concerned, specifying the number of personnel who may be affected by the full devolution efforts; and

3. Modifications in resource allocation, highlighting the effects of the revised set-up on the budgetary allocations of the departments/agencies/GOCCs concerned.

The DTP annexes/templates for the purpose which shall be accomplished by the NGAs concerned are likewise provided under DBM-DILG JMC No. 2021-2.

Linder Section 12 of the IRR of EO 138, concerned Department Secretary/Agency Head shall lead and oversee the preparation and implementation of their respective DTP. There shall be only one (1) DTP for each department, which shall already cover the agencies and GOCCs under the control or supervision or attached to such department.

Agencies and instrumentalities not under the control or supervision or attached to a department shall prepare and implement their own DTPs in consultation and coordination with the DBM and DILG. Hence, they shall submit their DTPs directly to the DBM for evaluation and approval.

To facilitate the preparation and implementation of the DTP, the departments concerned shall organize and assign their respective Devolution Transition Committee (DTC), consisting of the attached agencies and GOCCs, and headed by a senior official second in rank to the head to coordinate and oversee the entire process. The agencies and GOCCs concerned are not precluded from establishing their own DTCs, to be called the Agency DTC. The constitution of these committees and the names of their heads shall be submitted to the Committee on Devolution (ComDev) Secretariat for communications and monitoring purposes.

Yes, under Section 5 of EO No. 138 and Section 15, Rule V of its IRR, all LGUs shall prepare their DTPs in close coordination with the pertinent NGAs concerned, especially on devolved functions and services critical to them. In line with this, the DBM and DILG issued JMC No. 2021-1 dated August 11, 2021 to prescribe the guidelines on the preparation of LGU DTPs. The LGU DTPs, among others, shall serve as the LGU’s roadmap to ensure strategic perspective, systematic, and coherent actions towards their phased implementation of devolved functions and services starting in FY 2022. This shall also serve as a guide by the DBM, DILG and the NGAs concerned in the monitoring and assessing the performance of the LGUs.

The DTPs of provinces, cities, and municipalities contain the following:

• State of devolved functions, services and facilities;

• Phasing of Full Assumption of Devolved Functions, Services, Facilities;

• Capacity Development Agenda;

• Proposed Changes to Organizational Structure and Staffing pattern;

• Local Revenue Forecast and Resource Mobilization Strategy;

• Performance Targets for Devolved Functions and Services.

On the other hand, the DTPs of barangays shall be comprised of the following:

• State of devolved functions, services and facilities;

• Phasing of Full Assumption of Devolved Functions, Services, Facilities; and

• Capacity Development Requirements.

Electronic copies of the forms can be accessed and downloaded through the link, https://bit.ly/LGUDTPGuidelines_Annexes, and on the DBM website.

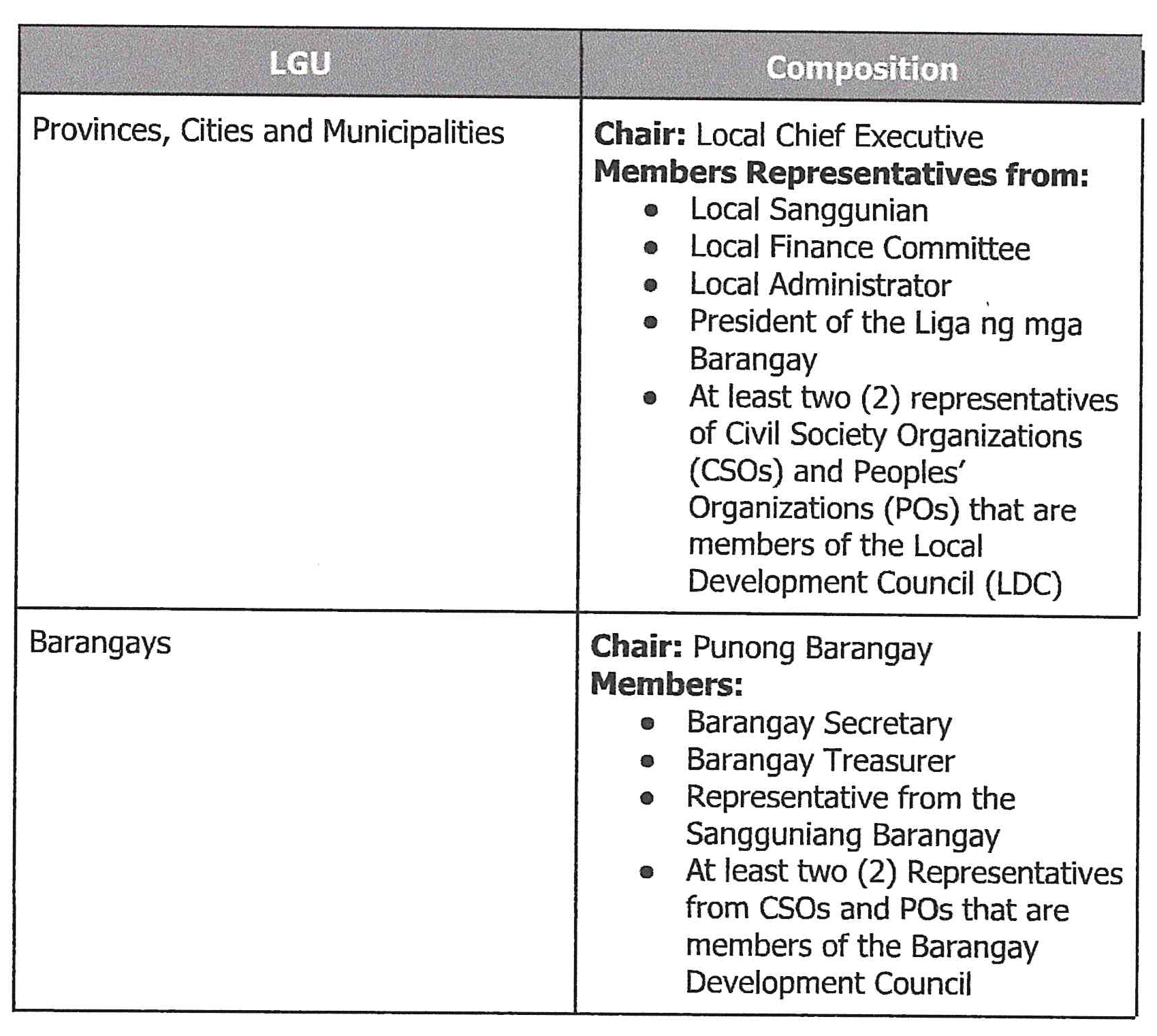

Under Section 15 of the IRR of EO 138, The Local Chief Executive (LCE) concerned shall spearhead the preparation of the LGU DTPs and ensure that this is approved within the timeframe indicated in DBM-DILG JMC 2021-1. The LCE shall organize the LGU DTC which shall be responsible for the preparation of the LGU DTP and in monitoring of the implementation thereof. The Local Sanggunian (Barangay/Bayan/Panlungsod/Panlalawigan) shall review and approve the LGU DTP through a Sanggunian Resolution.

The LGU DTC will have the following minimum composition and the LGU may expand the membership of the LGU DTC when the representation of relevant public officials/experts are deemed necessary:

As provided in Section 5 of EO No. 138, the NGAs concerned are given one hundred twenty (120) calendar days after the effectivity of the EO, or until September 30, 2021, to prepare and submit their respective DTPs to the DBM for evaluation and approval.

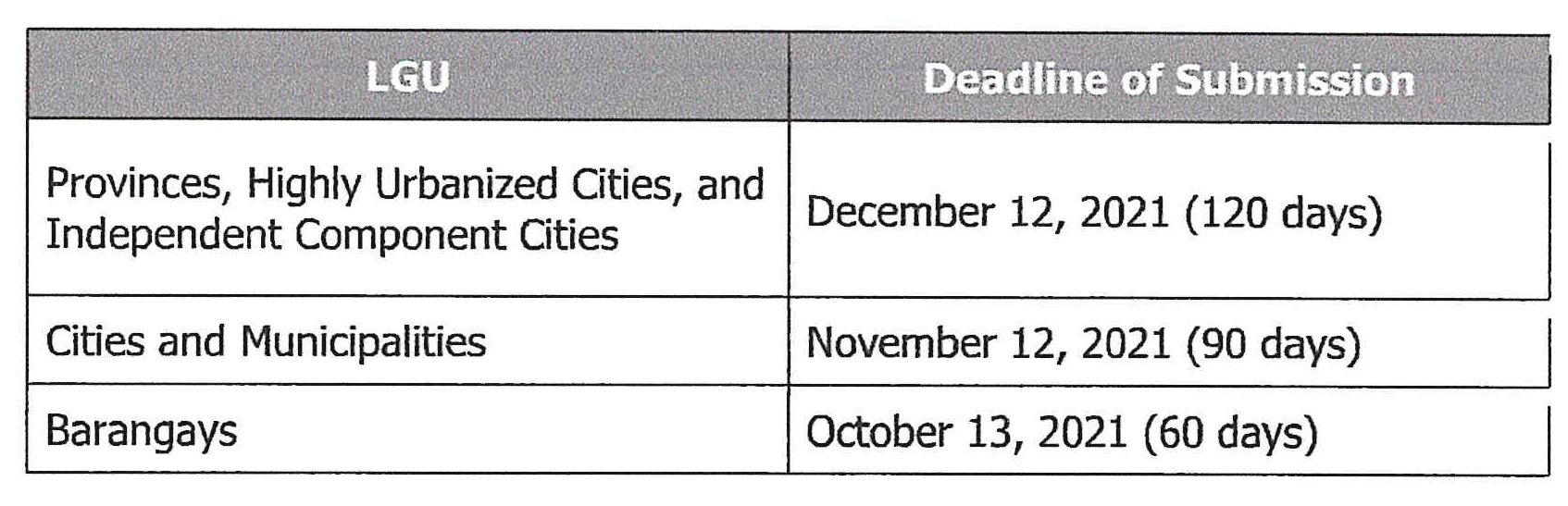

Meanwhile, as provided under DBM-DILG JMC No. 2021-1, the timeline of submission of the DTPs of LGUs shall be in phases, as follows:

As provided in Section 5 of EO No. 138, the NGAs concerned are given one hundred twenty (120) calendar days after the effectivity of the EO, or until September 30, 2021, to prepare and submit their respective DTPs to the DBM for evaluation and approval.

Meanwhile, as provided under DBM-DILG JMC No. 2021-1, the timeline of submission of the DTPs of LGUs shall be in phases, as follows:

Further, to monitor compliance and to enable access to submitted LGU DTPs as basis for future actions and decision making, LGU DTPs will be submitted online through the following link: https://dtp.dilg.qov.ph.

There are no sanctions provided in existing laws, rules, and regulations. However, the following possible effects may manifest:

LGU concerned will not have a proper guide in the preparation of their annual budget and other local plans (i.e., Comprehensive Development Plan, Annual Investment Program [AIP]);LGU’s capacity development requirements will not be incorporated into the NGAs’ capacity development plans, hence, may not be addressed; and

If the LGU concerned is eligible for the GEF, they cannot receive the same. The grant of the said fund requires the submission of DTP from the LGU concerned.

Government Revenue Generation and Fiscal Deficit

Based on the National Government (NG) deficit program considered in the FY 2021 BESF, the deficit-to-GDP ratio is expected to hit 9.6 percent in 2020 before tapering off to 8.5 percent in 2021 and 7.2 percent in 2022. However, for 2020, the NG realized a deficit of 7.6 percent, 2.0 percentage points lower than the program given better than expected revenue collections. For 2020, revenues collected amounted to PhP2.856 trillion, PhP336.20 billion higher than the program.

For FY 2021, the deficit is expected to register at 9.3 percent of GDP, 0.8 percentage points higher than the 8.5 percent program. The adjustment already considers the expected increase in spending due to the extended validity of the FY 2020 GAA and the Bayanihan II law.

The increase in the deficit level for FY 2021 is on the back of supporting three stimulus programs that aim to hasten economic recovery. These are: a) Build Build Build Program, b) increased investments for the improvement of health care and other social amelioration programs, and c) the reduction of corporate income tax rates under the Corporate Recovery and Tax Incentives for Enterprises Act (CREATE). In 2022, the deficit is expected to taper off to 7.5 percent as the National Government moves towards fiscal consolidation.

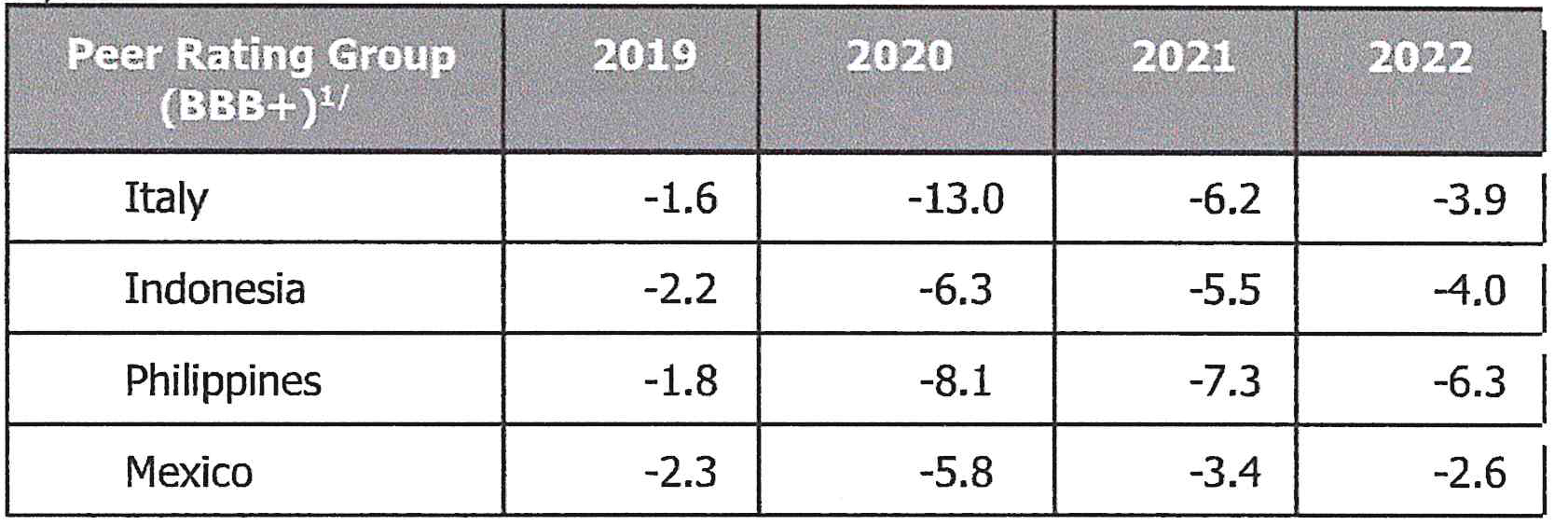

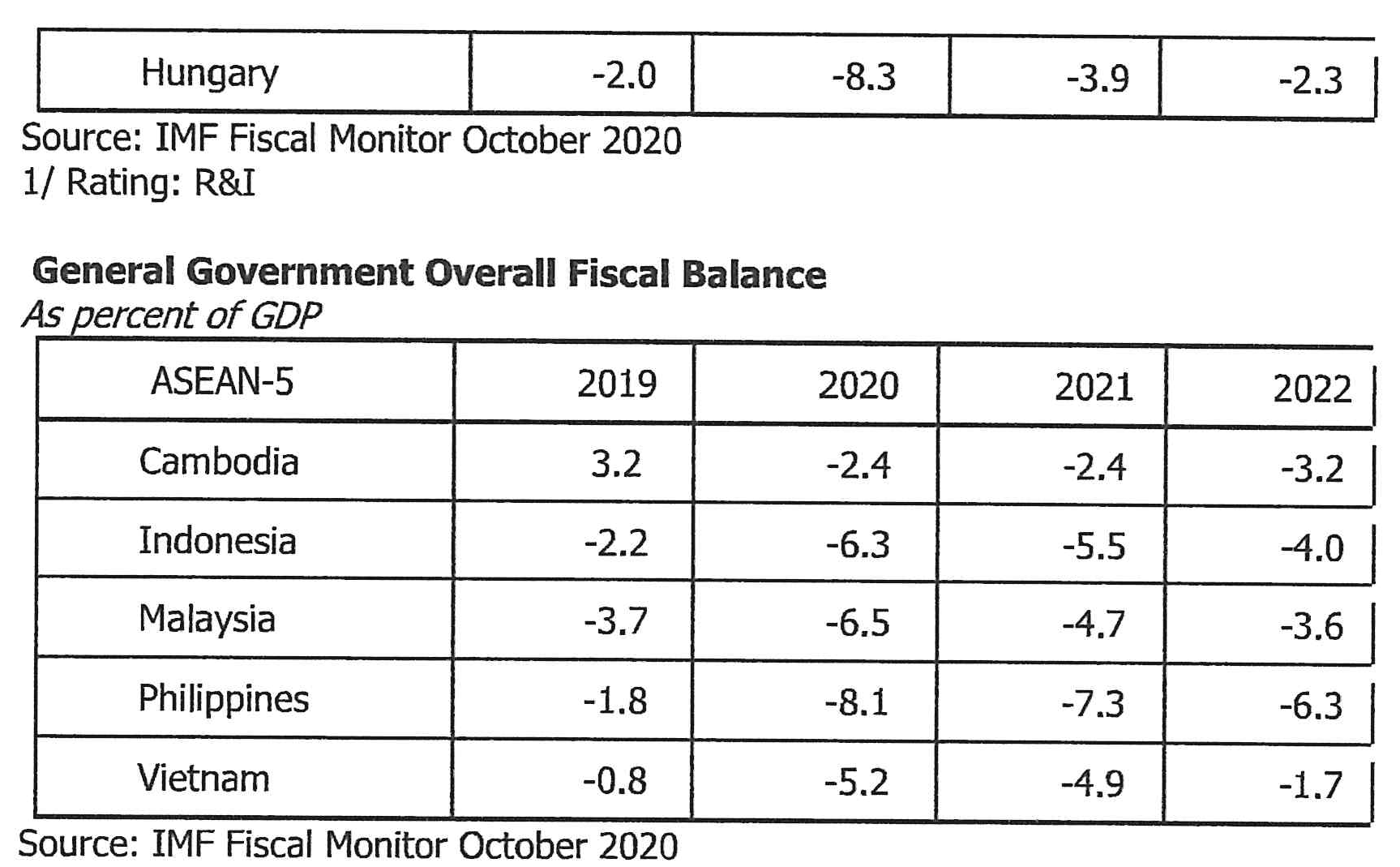

Given its robust macroeconomic fundamentals and strong track record on prudent fiscal policy making, the Philippines is in a better position to weather the economic and fiscal impacts of the crisis relative to its peers. The upticks in the deficits in spite of the pandemic are seen as cyclical adjustments relative to the business cycle rather than structural. The fiscal position of the country is expected to return to pre-pandemic levels once the health crisis has been contained. As can be seen on the 1st table below, the country’s deficit is in the mid-range of the peer country deficits.

General Government Overall Fiscal Balance

As percent of GDP =

The country has a strong fiscal position and has a very manageable debt situation. Our debt to GDP ratio at the end of 2019 was at its lowest at 39 percent of GDP.

The additional NTA requirement necessary to implement the SC ruling is already factored in the 2022 deficit program published in the FY 2022 BESF of 7.5 percent of GDP. The said fiscal program also already took into account the PhP118.8 billion projected revenue reduction from CREATE. We are aiming for a gradual fiscal consolidation program to reduce our budget deficit back to pre-covid levels while still supporting economic growth targets.

The Executive is working closely with Congress to pass the remaining packages of the Comprehensive Tax Reform Package (CTRP) comprising several strategies that aim to broaden the overall revenue base and improve collection efficiency in the coming years. Aside from CREATE, CTRP also includes packages 3 and 4 on Land Valuation Reform and Passive Income Tax and Financial Intermediary Tax, respectively. Both have been approved by the Lower House of Congress. It will be noted that the Land Valuation Reform will build up the property tax collections of the LGUs rather than the NG.

Moreover, the NG, particularly the DOF-BTr through its risk management and cash management strategies keeps the exposure of the country’s financing requirements to external and domestic shocks manageable. These strategies include Treasury Single Account (TSA) so that BTr has at the tip of its fingers, the amount of cash balances of the NGAs and GOCCs it can tap, keeping borrowings to the minimum. Hence, it was able to raise over PhP160.0 billion through cash sweep and interest payment savings to finance Bayanihan 1 and 2. It monitors domestic and international developments to calibrate their borrowing operations and the continuous policy coordination with monetary policy response.

CREATE is one of the most important priority legislative agendas endorsed by the DBCC that will help the country gradually recover from the effects of the pandemic over the medium term. By reducing corporate income tax rates from 35 percent to 30 percent for smaller businesses especially, businesses are left with more resources which they need to deal with this economic downturn and later on can invest back into the economy when the economy recovers. The lower rates also make Corporate Income Tax in the Philippines closer to the rates of its neighbors. The law also makes our fiscal incentives regime more transparent, performancebased, and timebound, making the country more competitive in attracting possible investments.

It is also important to note the other tax reforms the government has implemented to keep tax effort at respectable levels, such as Tax Reform for Acceleration and Inclusion (TRAIN) increase in taxes for sin products and sweetened beverages, improved tax administration through digitization and modernization of the operations of the Bureau of Internal Revenue and Customs. As previously mentioned, the passage of all the packages of the CTRP is expected to broaden the revenue base and improve collection efficiency, thereby, favorably impacting overall revenue generation and mobilization.

It must be noted that the NTA is based on actual tax cash collections of the NG in the third preceding year. Hence the base for the FY 2023 NTA will be the actual collections in 2020 while the base for the FY 2024 will be the 2021 actual collections. The NTA for 2023 is expected to be significantly lower compared to the 2022 level due to lower revenue collections in 2020 because of muted economic activity due to the pandemic. In 2024 the NTA is expected to register an increase as economic conditions improve in 2021 vis-a-vis the 2020 outturn. Based on the medium-term fiscal program in the FY 2022 BESF, revenues for 2021 are expected to reach PhP2,881.5 billion. This is 0.89 percent higher than the actual revenues collected for 2020 amounting to PhP2,856 billion.

However, we should not forget that the LGC vests LGUs with autonomy to be able to deliver better services to their constituencies. Hence, the LGC vests them with the capacity to generate revenues, borrow from GFIs, and even enter into PPP arrangements with the private sector. As of end-Q3 of 2020, LGUs have collected PhP 205.71 billion own-source revenues which already exceeded the PhP 193.04 billion own-source revenue targets7 set by the DOF-BLGF for all provincial, city, and municipal treasurers. Let us not pre-judge the ability of LGUs to manage this NTA situation. The key will be the ability of the LGUs to anticipate and plan for these developments.

Part of the LGU capacity development strategy by the NGAs concerned, as contained in their respective DTPs, is a checklist of criteria and conditions necessary to determine the readiness of the LGUs to take on and manage the delivery of the devolved services, taking into consideration the capacity and resources of the LGUs and consistency with their local growth priorities. The approved DTPs of NGAs containing these will be posted in the DBM website for access by stakeholders, especially the LGUs.

The DILG and LGA are likewise currently doing a capacity assessment of the LGUs based on their performance in order to determine the type of capacity development (CapDev) needed by different LGUs in recognition that a one size fits all model of CapDev program will not be efficient and effective.

The SC Mandanas-Garcia ruling has presented the local governments with the unique opportunity to assume the provision of basic services which have been devolved to them. With the additional funds that will be made available to the LGUs, the LGUs can take a more active role in providing specific and targeted interventions to address the current challenges affecting their respective localities and constituencies due to the COVID-19 pandemic.

On the other hand, this will enable NGAs to shift their focus on addressing urgent and strategic challenges currently facing the country, such as the strengthening of the health care sector for resiliency to fight COVID-19 and other contagious diseases, reviving the economy due to the pandemic, climate change and disaster management, and promotion of innovation to cope with the changes under the Fourth Industrial Revolution, among others.

No, the implementation of the SC ruling on the Mandanas-Garcia cases cannot be deferred since it has already become final and executory last April 10, 2019. Thus, the adjusted NTA shares of LGUs shall be released to them starting FY 2022, as mandated by the SC Ruling.

Moreover, the indicative FY 2022 NTA shares of LGUs based on the certifications issued by the Bureau of Internal Revenue (BIR), Bureau of Customs (BOC) and the Bureau of the Treasury (BTr) have already been issued through Local Budget Memorandum (LBM) No. 82 dated 14 June 2021,8 as adjusted by LBM No. 82-A dated 19 August 2021.9 The said LBM also prescribes the guidelines on the preparation of the FY 2022 annual budget of the LGUs.

Below is the summary of the total shares by level of LGUs in the FY 2022 NTA:

Vertical and horizontal linkages of planning, investment programming, and budgeting shall be strengthened to align the national, regional, and local priorities. This will involve the cascading of sectoral outcomes and targets to the regional and local levels as well as determining how regional and local plans can contribute to national outcomes and targets.

The RDCs will serve as a venue for convergence to ensure alignment of the national, regional, and local priorities based on the Philippine Development Plan and Regional Development Plans. They may also facilitate coordination of sectoral programs and projects, including those to be devolved or provided assistance through their Sectoral Committees.

CSOs, NGOs, and POs are considered active partners in pursuit of local autonomy per Sections 24 and 35 of RA No. 7160 and Article 62 of its IRR. With this, CSOs are encouraged to participate in the preparation, implementation and monitoring of the DTPs of the NGAs and the LGUs through consultations and public dialogues.

The NGAs and LGUs shall ensure that their DTPs have undergone consultation with CSOs, NGOs and POs prior to its implementation. At the local level for instance, their representation in the LGU DTC as provided under Section 15, Rule V of the IRR provides an opportunity for greater participation.

Moreover, Sections 38 and 39, Rule XII of the IRR of EO 138 provides for the roles of the NGOs, CSOs, and POs and recognizes their role in enhancing transparency, accountability, and good governance, and as active partners in pursuit of local autonomy, particularly, but not limited to the following:

• Providing feedback on programs, activities, and projects of the government;

• Pushing for various advocacies and initiatives;

• Formulating plans, policies, and issuances; and

• Implementing capacity development programs and other activities.

The current efforts towards full devolution pursuant to EO 138, in light of implementation of SC ruling on Mandanas-Garcia cases, is a separate issue and should not be misconstrued as a preview and effort towards Federalism. The full devolution effort is primarily intended to empower LGUs in undertaking the provision of devolved basic services per Republic Act No.7160 or the Local Government Code of 1991, given their increased resources with the implementation of the SC ruling.

Nonetheless, the SC decision is in line with and strengthens the declared policy of the state on decentralization, under Republic Act No.7160 or the Local Government Code of 1991. The SC decision also promotes the principle of subsidiarity which means that if the public service benefits directly the local population, then it should be appropriately assigned to lower levels of government.

List of Programs, Activities, and Projects (Paps) For Discontinuance per FY 2021 General Appropriations Act

Department of Agriculture

DA-OSEC Farm to Market Road (FMR) Sub-program

DA-OSEC Operational Plan for Rabies Elimination

DA-OSEC Production Support Services

DA-OSEC Irrigation Network Services

DA-OSEC Agricultural Machineries, Equipment and Facilities

DA-BFAR Aquaculture Subprogram

DA-BFAR Coastal and Inland Fisheries Resource Management

DA-BFAR Post-Harvest Equipment and Facilities

DA-FPA Quality and Control Inspection

DA-NMIS Meat Establishment and Meat Inspection Assistance to LGUs Services

Department of Environment and Natural Resources

DENR-OSEC Management of Coastal and Marine Resources/Areas

DENR-OSEC Forest Development, Rehabilitation, Maintenance and Protection

DENR-OSEC Soil Conservation and Watershed Management including River Basin Management and Development

DENR-OSEC Land Survey, Disposition, and Records, Management (Rapid Land Tenure Assessment)

DENR-EMB Implementation of Clean Water Regulations

DENR-EMB Implementation of Ecological Solid Waste Management Regulations

DENR-MGB Mineral Regulation Services

Department of Education

DepEd-OSEC Basic Education Facilities

Department of the Interior and Local Government

DILG-OSEC Capacitating LGUs on Resettlement Governance

Department of Health

DOH-OSEC Health Facilities Enhancement Program

DOH-OSEC Human Resources for Health Deployment

DOH-OSEC Environmental and Occupational Health

DOH-OSEC Family Health, Immunization, Nutrition and Responsible Parenting (Former Family Health, Nutrition, and Responsible Parenting)

DOH-OSEC Elimination of Disease such as Malaria, Schistosomiasis, Leprosy, and Filariasis

DOH-OSEC Prevention and Control of Communicable Diseases (former Prevention and Control of Other Infectious Diseases)

DOH-OSEC Prevention and Control of Other Non-communicable Diseases

Department of Labor and Employment

DOLE-OSEC Jobstart Philippines Program: Life Skills Training (LST), Technical Skills Training (TST), and Apprenticeship/Internship

DOLE-OSEC Job Search Assistance: Public Employment Service

DOLE-OSEC Livelihood Program / DOLE Integrated Livelihood Program (DILP)

Department of Science and Technology

DOST-OSEC Diffusion and Transfer of Knowledge and Technologies and other related projects and activities

DOST-OSEC Community Empowerment thru Science and Technology

DOST-ITDI Locally Funded Project: Industrial Technology Research and Development Program

Department of Tourism

DOT-OSEC Tourism Planning

DOT-OSEC Tourism Standards Development, Regulation and Accreditation, Monitoring and Enforcement

DOT-OSEC Locally Funded Project: Branding Campaign program

DOT-NPDC Rehabilitation of Water & Sprinkler System, Dredging and Waterproofing of Lagoon

DOT-NPDC Landscaping and Park Redevelopment of Light and Sound complex

DOT-NPDC Pest control of NPDC Offices & Park Building Facilities

Department of Transportation

DOTr-OSEC Locally Funded Projects: Maritime Infrastructure Program (Social Ports)

Department of Public Works and Highways

DPWH Local Infrastructure Program (LIP)

Department of Social Welfare and Development

DSWD-OSEC Supplementary Feeding Program

DSWD-OSEC Sustainable Livelihood Program

DSWD-OSEC Protective Services for Individuals and Families in Especially Difficult Circumstances (Assistance to Individuals in Crisis Situation [AICS])

DSWD-OSEC Recovery and Reintegration for Trafficked Person

DSWD-OSEC Comprehensive Project for Street Children

DSWD KALAHI-CIDDS11

Department of Trade and Industry

DTI-OSEC Establishment of Negosyo Centers

DTI-OSEC Shared Service Facilities (SSF) Project

DTI-OSEC Conduct of National and Regional Trade Fairs

DTI-OSEC One Town, One Product (OTOP): Next Generation

DTI-OSEC Livelihood Seeding Program and Negosyo Serbisyo sa Barangay

Local Government Support Fund

LGSF Assistance to Municipalities

LGSF Assistance to Cities

LGSF Conditional Matching Grant to Provinces (CMGP) for Road Repair, Rehabilitation and Improvement

LGSF Provision for Potable Water Supply (SALINTUBIG)

Other Executive Offices

OEO-SPDA Locally Funded Projects: Development of SPDA Veterans Property, Zamboanga City into a 10-storey Hotel and Commercial Spaces

Government-Owned or -Controlled Corporations

GOCC-NHA Comprehensive and Integrated Housing Program

GOCC-NHA Housing Program for Calamity Victims-Permanent Housing

GOCC-NIA Establishment of Groundwater Pump Irrigation Systems Project (EGPIP)

GOCC-NIA Communal Irrigation System (CIS) Sub-program

GOCC-NIA Extension/Expansion of Existing Irrigation System (CIS)

GOCC-NIA Repair of Groundwater Pump Irrigation Systems

GOCC-NIA Feasibility Study and Detailed Engineering (FSDE) and Preengineering Activities of Various Projects – CIP and CIS

GOCC-NIA Irrigation Management Transfer Support Services

GOCC-NIA Balikatan Sagip Patubig Program

GOCC-NIA Small Irrigation Project (SIP)