April 25, 2016

DepEd Order No. 24, s. 2016

Table of Contents

GUIDELINES ON ACCEPTING DONATIONS AND ON PROCESSING APPLICATIONS FOR THE AVAILMENT OF TAX INCENTIVES BY PRIVATE DONOR-PARTNERS SUPPORTING THE K TO 12 PROGRAM

To:

Undersecretaries

Assistant Secretaries

Bureau and Service Directors

Regional Directors

Schools Division Superintendents

Public Elementary and Secondary Schools Heads

All Others Concerned

–

- For the information and guidance of all concerned, the Department of Education (DepEd) issues the enclosed Guidelines on Accepting Donations and on Processing Applications for the Availment of Tax Incentives by Private Donor – Partners Supporting the K to 12 Program.

- Promulgated to enable schools and donating entities to mutually benefit from their partnership, these guidelines conform with the tax incentives provision of Republic Act No. 8525 otherwise known as the Adopt-a-School Act of 1998 and of the Revenue Regulations No. 10-2003.

- These guidelines aim to provide details on the availment of tax incentives by private sector partners and on valuation of their support.

- Existing Adopt-a-School Program (ASP) rules and regulations on the treatment and valuation of other forms of support/donation at all school levels, shall continue to apply in processing tax incentive applications.

- All applications for the availment of tax incentives shall be processed expeditiously and efficiently, and shall be given priority attention. All private sector partners planning to avail of tax incentives should be advised to immediately complete all documentation requirements for submission to the Bureau of Internal Revenue.

- All DepEd Orders and other related issuances, rules and regulations, and provisions which are inconsistent with these guidelines are repealed, rescinded, or modified accordingly.

- For more information, all concerned may contact the External Partnerships Service – Adopt-a-School Program (ASP) Secretariat, Department of Education (DepEd) Central Office, Teodora Alonso Building, DepEd Complex, Meralco Avenue, Pasig City at telephone no. (02) 638-8637.

- Immediate dissemination of and strict compliance with this Order is directed.

BR. ARMIN A. LUISTRO FSC

Secretary

(Enclosure to DepEd Order No. 24, s. 2016)

Guidelines for Accepting Donations and Processing Applications for the Availment of Tax Incentives by Private Donor-Partners Supporting the K to 12 Program

I. Rationale

Recognizing the contribution of the Private Sector towards the realization of the goals of the K to 12 Program, the Department of Education (DepEd) provides opportunities for its donor partners to apply for the availment of tax incentives or tax exemption arising from the partners’ expenses incurred in the program since such entitlement is permitted under Republic Act No. 8525 otherwise known as the Adopt-a-School Act of 1998 and of Revenue Regulations No. 10-2003.

As the door for the tax incentives availment is opened for Private Sector partners, DepEd is responsible for ensuring that all applications conform with the existing policies and that they are processed efficiently.

II. Scope

These guidelines are intended to provide direction to Private Sector partners about the application process for the availment of tax incentives, the requirements for submission to the Adopt-a-School Program Secretariat and Revenue District Office (RDO) of the Bureau of Internal Revenue (BIR), qualifications of donor partners as applicants, and valuation of the different assistance packages.

III. Definition of Terms

a. “Private Sector partner” shall refer to an individual engaged in trade or business or in the practice of his/her profession or to business organizations, like corporations, partnerships or cooperatives who/which partners with the DepEd towards providing much needed assistance and services to all public schools.

b. “Assistance” shall refer to the aid/help/contribution/donation provided by a Private Sector partner to public schools implementing the K to 12 Program . Assistance may be in the form of, but not limited to, infrastructure, real estate property, use of facilities, training and skills development support, funding, consultancy, logistics, technology support, and equipment.

c. “Agreement” shall refer to Memorandum of Agreement (MOA) , Deed of Donation/Acceptance or Usufruct Agreement entered into by and between the Private Sector partner and the public school specifying the terms and conditions of the partnership, including the tasks, responsibilities and rights of the concerned parties.

d. “Adopt-a-School Program Secretariat” shall refer to the unit under the External Partnerships Service which reviews, facilitates, and endorses the application of the Private Sector partner to the Revenue District Office having jurisdiction over the place of business of the donating partner.

e. “Application for tax incentives or tax exemption” shall refer to the application for tax credit by the Private Sector partner referred to under Section 4 of the Adopt-a-School Act of 1998, which is an application for additional deduction in arriving at the net taxable income.

f. “Work Immersion” shall refer to the component of the Senior High School Program consisting of 80 hours of hands-on experience or work simulation which Grades 11 and 12 students will undergo to obtain much needed exposure and learn competencies related to the actual workplace setting.

g. “Partnership” shall refer to linkage or relationship established by DepEd (Central Office/Regional Office/Schools Division Office/School) with other organizations to implement projects or programs aligned with the K to 12 curriculum.

IV. Policy Statement

DepEd recognizes the important role of the Private Sector in the promotion of quality and accessible education. As a way of recognizing the active involvement of the Private Sector in the implementation of the K to 12 Program which entailed providing various support packages to public schools , the DepEd supports the tax incentivization campaign of the Bureau of Internal Revenue, one of which is through the implementation of the tax incentive provision of RA 8525, “Adopt-a-School Act of 1998”. With private entities given the opportunity to help public schools, these adopting entities become eligible for tax incentive claims, as such entitlement is contained in RA 8525.

V. Procedure for the Availment of Tax Incentives by the Private Sector Partner

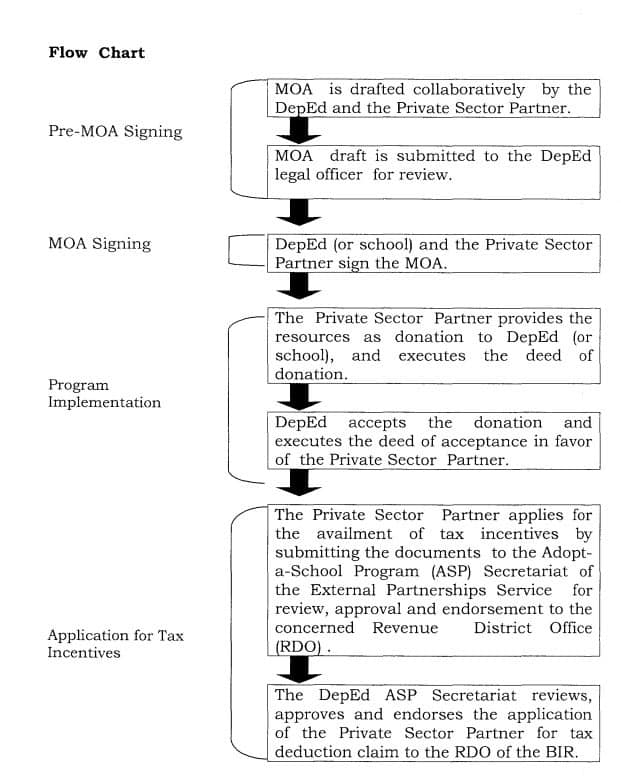

PRE-MOA SIGNING

1. The DepEd (or school) and the Private Sector partner shall draft a Memorandum of Agreement (MOA), the latter specifiying the responsibilities and rights of both parties, including details of the donation/contribution, program implementation term, beneficaries, donation value, and others. Please see template of the MOA as an enclosure of these guidelines.

2. The draft MOA is reviewed by the DepEd legal personnel.

MOA SIGNING

3. After the draft MOA has been reviewed and is determined to be in order, official representatives from each concerned party will sign the MOA.

PROGRAM IMPLEMENTATION

4. As a result of the MOA signing, the Private Sector partner provides/delivers support packages to the DepEd (or school) as scheduled and executes a deed of donation (DOD) in favor of the beneficiary school, with the DOD containing the actual peso worth of the support packages.

5. The DepEd (or school) receives the support and executes a deed of acceptance as a way of acknowledging the donation provided by the Private Sector partner.

APPLICATION FOR TAX INCENTIVES

6. The Private Sector partner applies for the availment of tax incentives arising from its expenses incurred in the program, by submitting proper and complete requirements to the DepEd Adopt-a-School Program Secretariat which is under the External Partnerships Service.

7. The DepEd Adopt-a-School Program Secretariat reviews application papers of partners and endorses them to the Revenue District Office of BIR for approval.

Flow Chart

VI. Qualifications of Private Sector Partners Entitled to Apply

These private donating entities must possess the following qualifications at any time during the term of the Agreement:

- It must have a credible track record as an organization.

- It must be paying its required taxes on time or within the concerned fiscal year.

- It must have been in existence for at least one year as shown in its Articles of Incorporation from the Security and Exchange Commision, Certificate of Registration at the Cooperative Development Authority, or business permit from the local government.

- It must not have been prosecuted and found guilty of engaging in any illegal activities.

- It must not be affiliated or connected to any group in the tobacco industry.

- It must possess the thrust and image aligned with the values which the DepEd promotes.

VII. Valuation of the Assistance/Contribution or Donation

a. Funding assistance/contribution or donation. The amount of assistance/contribution or donation shall be based on the actual amount contributed/donated appearing on the official receipt or acknowledgement receipt issued by the donee.

b. Use of Facilities. If the assistance is in the form of access of teachers and students to facilities operated by the Private Sector partner such as buildings, offices, laboratories, shops, machine and equipment, among others, the amount shall be based on the rental value agreed upon by the concerned office of the DepEd and/ or the school and the Private Sector partner, as stated in the Memorandum of Agreement.

Formula for computation:

Rental rate (per hour) at the time of program implementation* X Number of hours the facilities was used = Total value of the assistance / donation provided

Example:

Php 1,000.00 (rate per hour) x 80 hours = Php 80,000.00

* Rental rate will be based on prevailing rate in the area.

Documentation requirement: Canvass report showing rental rates from at least three establishments.

c. Services and Professional Expertise. If the assistance is in the form of resource persons for lectures, workshops, hands-on training, orientation, supervisory work and the like, the amount of the contribution or donation shall be based on the value of services rendered as agreed upon by the Private Sector partner, the concerned office of the DepEd and the public school, as stated in the Memorandum of Agreement or the actual expenses incurred by the Private Sector partner, whichever is lower.

Formula for computation:

Compensation rate (per hour) based on the last declared income from the same nature of work or service rendered X Number of hours rendered = Total value of the assistance/ service provided

Example:

Php 300.00 per hour X 80 hours rendered = Php 24,000.00

Documentation requirement: Payroll or certification of Salary Rate from the Personnel Division, and copy of the Income Tax Return.

d. Equipment, machines, and other materials. If the assistance is in the form of brand new equipment and machines, the amount of the contribution or donation shall be based on the acquisition cost by the Private Sector partner or the actual cost at the time of the donation. However, if said items had already been used, then such valuation take into consideration the depreciated booked value of the donation.

Formula for computation:

Acquisition cost of donated equipment or item X Number of units or pieces = Total value of the donation given

Example A:

Php 40,000.00 (brand new oven) X 2 units = Php 80,000.00

Documentation Requirement : Official receipt/invoice

Example B:

Php 10,000 (depreciated value of a second-hand-oven) x 2 units = Php 20,000.00

Documentation requirement: Any official document showing the acquisition cost and computation of equipment with depreciated value.

e. Land/Real Estate Property. If the assistance is in the form of real property, the amount of the contribution or donation shall be the zonal value or assessed value of the property at the time of the contribution/donation, as determined pursuant to Section 6(E) of the Tax Code or the book value/depreciated value of the property, whichever is lower. Appraisal increase or appreciation in the value of the asset recorded in the books of account should not be considered in computing the book value of the asset.

Formula for computation:

Lot area X Zonal value at the time the lot was given or assessed value of the property per sq. meter, whichever is lower = Total value of the land or real estate property donated

Example:

1,000 sq. meters X Php 5,000 per sq. meter = Php 5,000,000 Documentation requirement: Zonal value certification obtained from the BIR

NOTE: Value of donations being applied for tax incentive claim will still be subject to BIR’s approval.

VIII. Requirements for Submission of Private Sector Partner for Tax Incentives Availment

a. Letter of intent addressed to the Secretary of Education;

b. Duly notarized Memorandum of Agreement;

c. Duly notarized Deed of Donation and Deed of Acceptance;

d. Official receipts or any document showing the actual value of the contribution/donation;

e. Certificate of Title and Tax Declaration, if the donation is in the form of real property; and tax clearance certificate and tax declaration issued by the Office of the Assessor. Aside from this, donors should also submit their recent real estate tax receipts;

f. Other adequate records showing the direct connection or relation of the expenses being claimed as deduction/donation to the adopting private entity’s participation in the program, as well as showing or proving receipt of the donated property.

g. Documents related to in-kind donations such as time, use of space, professional service or skills, and the like.

IX. Monitoring and Evaluation

To ensure that the applications for the availment of tax incentives shall be processed expeditiously and efficiently, all concerned parties shall adhere to timelines.

The External Partnerships Service – Adopt-a-School Program (EPS-ASP) Secretariat shall continuously gather feedback on the implementation of the guidelines from all concerned parties, the result of which shall be the basis in enhancing further the policy’s provisions and effectiveness.

| Activity | Period of Action | Indicative Period/Date | Responsible Party/Office |

|---|---|---|---|

| Preparation, approval and signing of MOA | Two weeks | Weeks before the implementation of the work immersion program | DepEd (or school) and the adopting private entity |

| Implementation of the program and delivery of the support to schools | One month | After the signing of the MOA, period of which is within a specified school year | Private Sector Partner |

| Filing of requirements for the tax incentive application | One day | Upon completion of the work immersion program | Private Sector Partner |

| Review of application and supporting documents | One week | As soon as the documents have been received | DepEd External Partne ships Service - Adopt-a-School Program (EPS-ASP) Secretariat |

| Preparation of the endorsement paper to the concerned Revenue District Office of BIR | One day | After the review of documents , resulting to the approval of the application | EPS-ASP Secretariat |

| Release of the BIR endorsement to the Private Sector Partner | One day | As soon as the tax incentive endorsement is approved by the DepEd Secretary. | EPS-ASP Secretariat |

X. References:

a. Republic Act No. 8525 (the Adopt-a-School Act of 1998)

b. DepEd Order No. 2, s. 2013 entitled Revised Implementing Rules and Regulations of RA 8525 Otherwise Known as the Adopt-a-School Act of 1998

c. Revenue Regulations No. 10-2013 entitled Implementing the Tax Incentives Provisions of RA 8525 Otherwise Known as the Adopt-a-School Act of 1998

d. Revenue Memorandum Circular No. 86-2014 entitled Clarifying the Valuation of Contributions or Gifts Actually Paid or Made in Computing Taxable Income

e. DepEd Order No. 40, s. 2015 entitled Guidelines on K to 12 Partnerships

f. CSC-DOH Joint Memorandum Circular No. 2010-01 on Protection of the Bureaucracy Against Tobacco Industry Interference

XI. Effectivity:

Starting School Year 2016-2017, this policy shall remain in force and in effect, unless sooner repealed, amended or rescinced.

Procedure in Accommodating and Utilizing Financial Assistance as Donation

A. On Receiving the Fund

- The DepEd schools division office or school receives the financial assistance as donation from the Private Sector partner.

- The DepEd schools division office or school deposits the fund as donation to the Bureau of Treasury (BTr).

- The DepEd schools division office or school secures the Certification of Deposit from the BTr.

B. On Utilizing the Fund

- The DepEd schools division office or school requests the Department of Budget and Management (DBM) for the issuance of Notice of Cash Allocation and for the release of funds.

- The DepEd schools division office or school implements the program as planned using the released funds from DBM. 1

- The DepEd schools division office or school provides the Private Sector partner and DBM report on expenditures arising from the implementation of the program.

1. Purchase of goods, items, including services should adhere to the provisions of Republic Act No. 9184 otherwise known as the Government Procurement Reform Act and its revised Implementing Rules and Regulations. Likewise, payment of goods, commodities and services shall be in accordance with pertinent accounting and auditing rules, and regulations.

[scribd id=310447378 key=key-ByqbWybvcHrc7jduJKKj mode=scroll]