The DepEd Borrower (hereinafter referred to as the “Borrower”) shall present his/her latest available original pay slip to the Automatic Payroll Deduction System (APDS) Program accredited lending entity (hereinafter referred to as the “Lender”) as part of his/her loan application.

The Lender shall evaluate the Borrower’s loan application using its own criteria, including the Borrower’s capacity to pay based on the presented original pay slip. The presence of “Undeducted Obligations” in the Borrower’s pay slip indicates his/her lack of capacity to pay the loan through the Automatic Payroll Deduction System (APDS) Program, hence, such borrower is ineligible to borrow under the APDS.

If the loan application passes the Lender’s evaluation, the Lender shall stamp the following on the face of the pay slip without obscuring the pertinent details therein:

a. Corporate name of the Lender and APDS Code for lending;

b. Principal amount of the loan;

c. Term of the loan (first and final months of deduction);

d. Amount of monthly amortization;

e. Date of loan evaluation; and

f. Name signature of Lender’s Loan Officer.

Continue reading..

Table of Contents

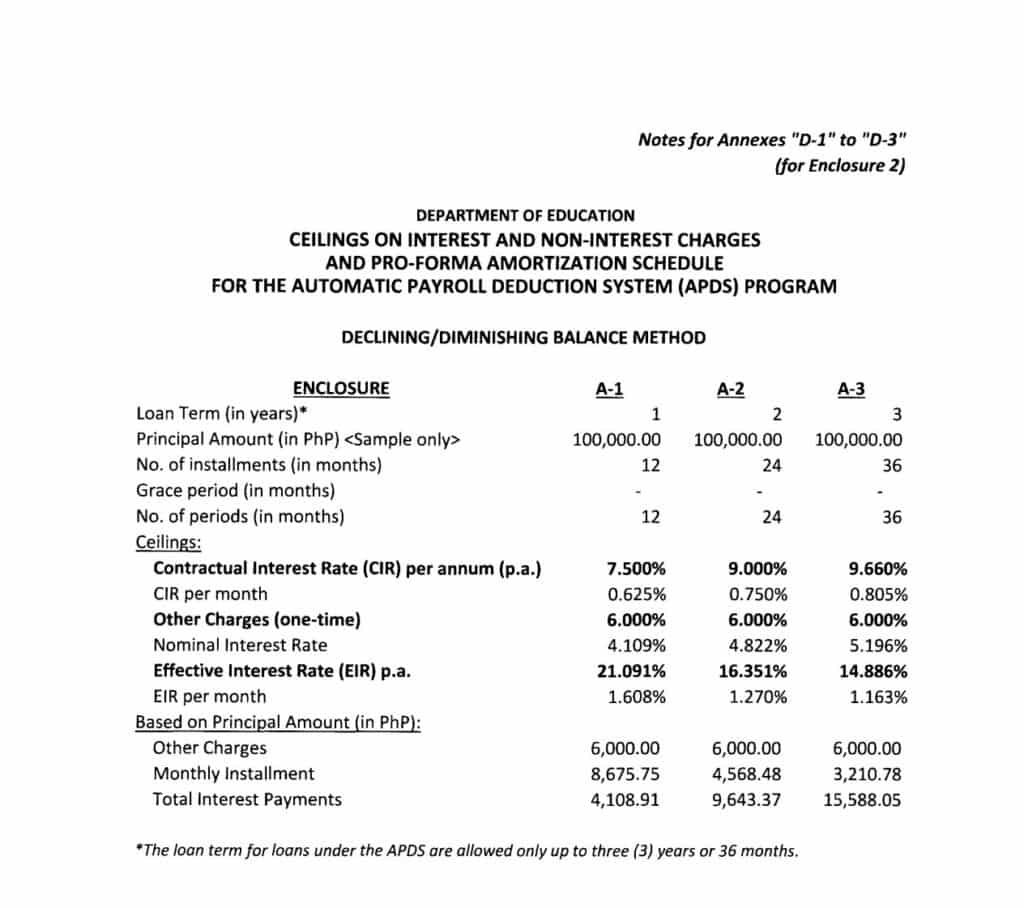

Sample Loan Computation/Monthly Amortization for DepEd Employees

CEILINGS ON INTEREST AND NON-INTEREST CHARGES AND PRO-FORMA AMORTIZATION SCHEDULE FOR THE AUTOMATIC PAYROLL DEDUCTION SYSTEM (APDS) PROGRAM

DECLINING/DIMINISHING BALANCE METHOD

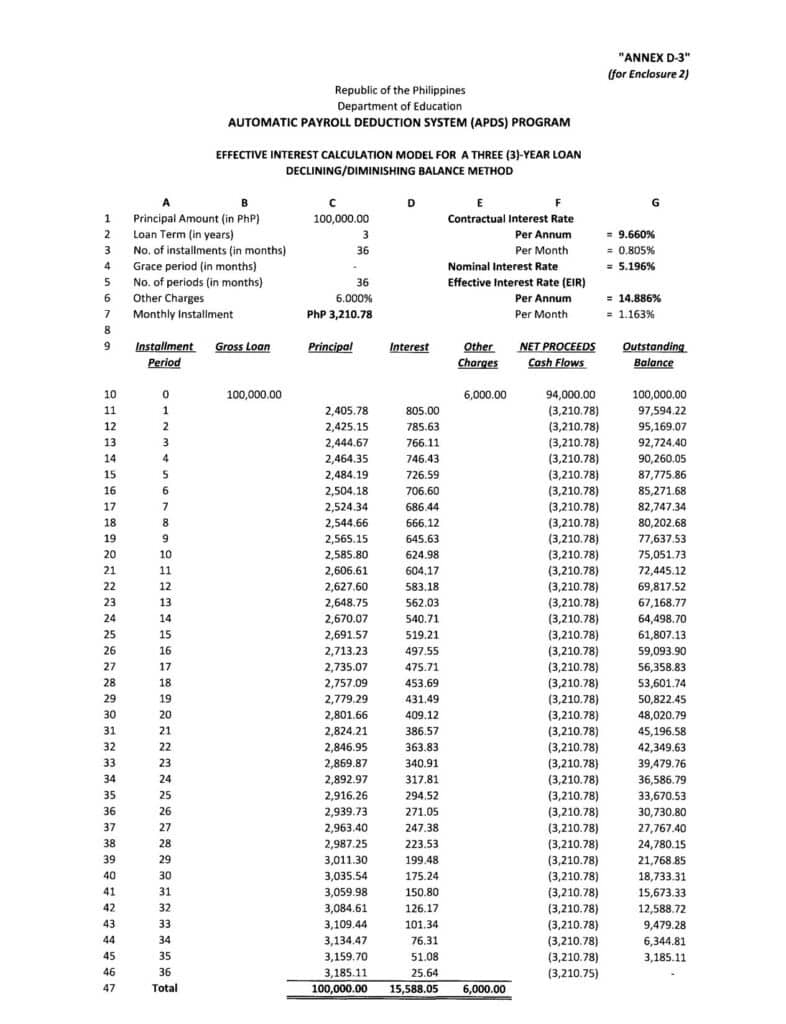

EFFECTIVE INTEREST CALCULATION MODEL FOR A THREE (3) YEAR LOAN

DECLINING/DIMINISHING BALANCE METHOD

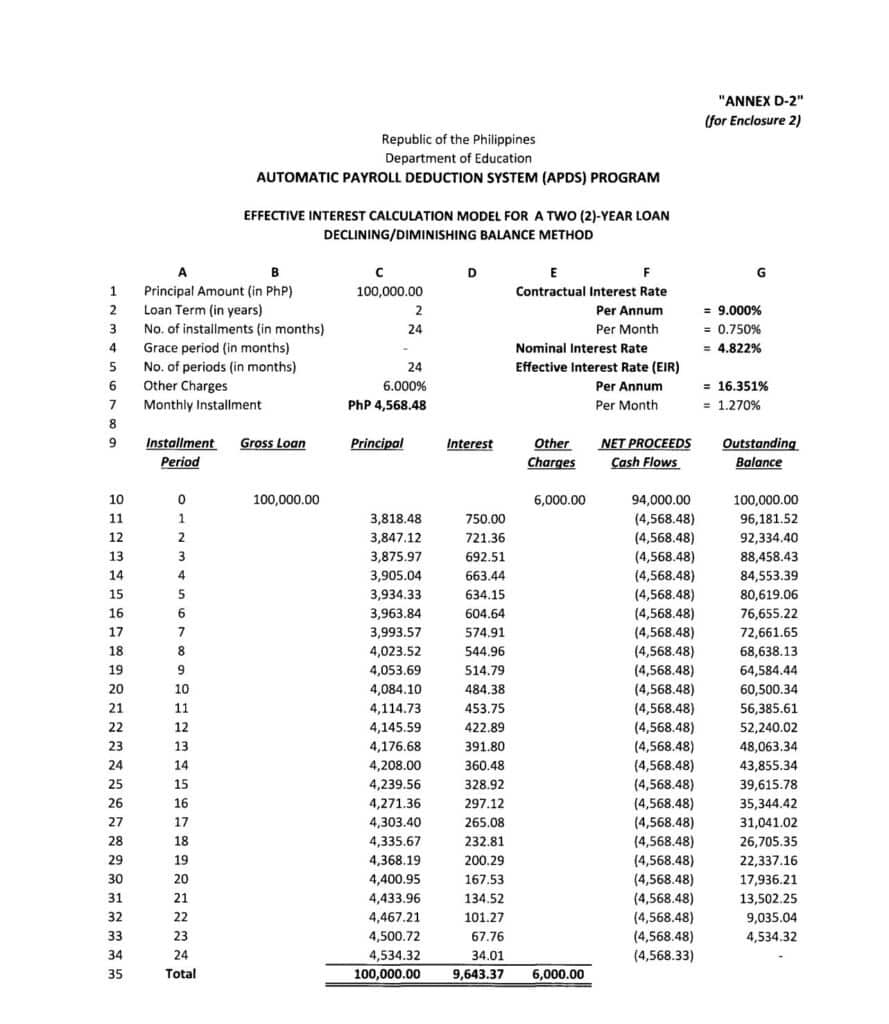

EFFECTIVE INTEREST CALCULATION MODEL FOR A THREE (2) YEAR LOAN

DECLINING/DIMINISHING BALANCE METHOD

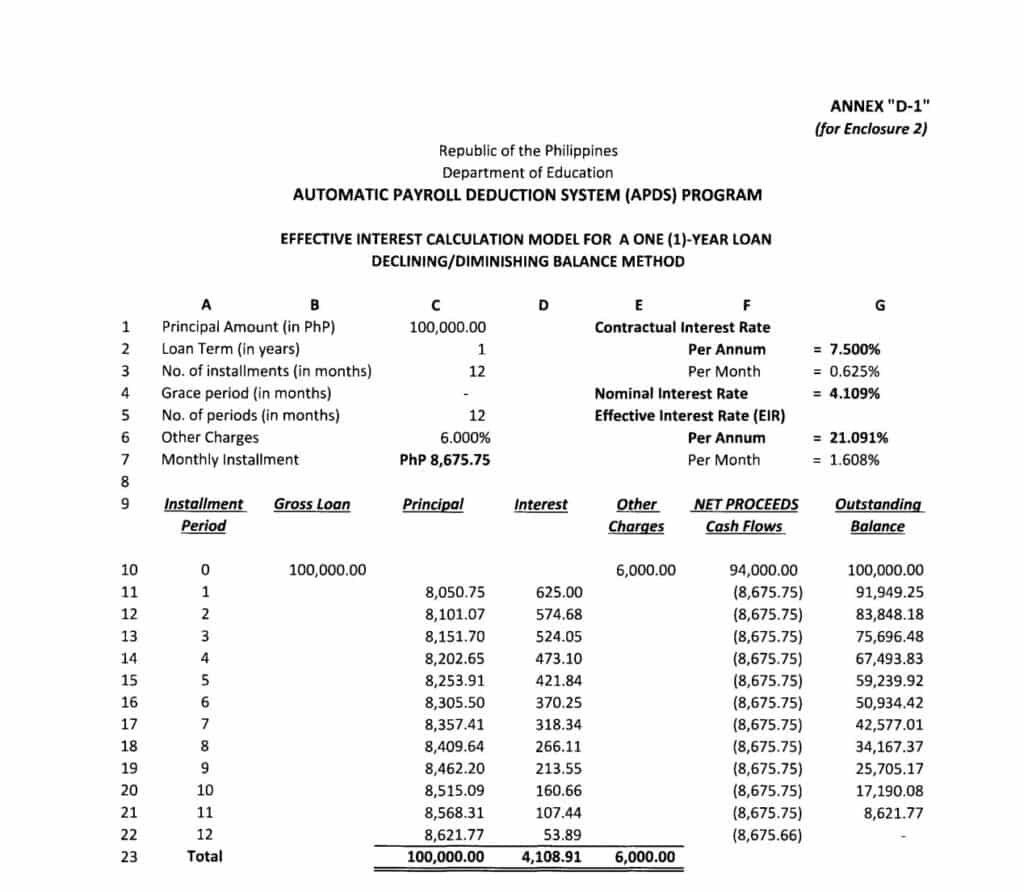

EFFECTIVE INTEREST CALCULATION MODEL FOR A THREE (1) YEAR LOAN

DECLINING/DIMINISHING BALANCE METHOD

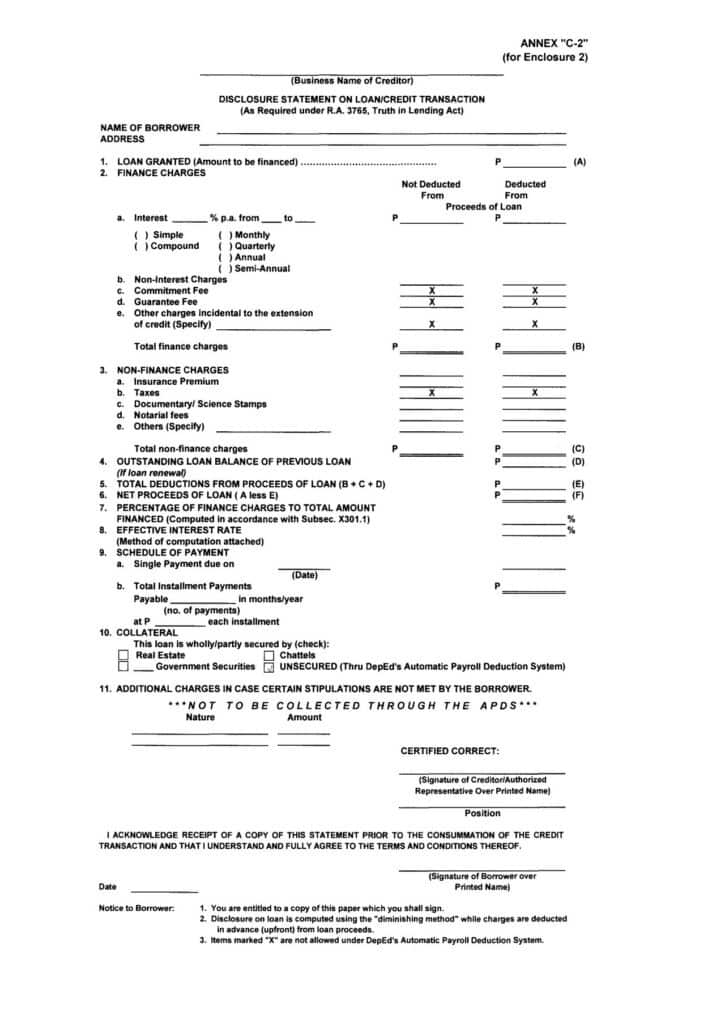

DISCLOSURE STATEMENT ON LOAN/CREDIT TRANSACTION

(As Required under R.A. 3765, Truth in Lending Act)

makaapply ba tayo ng 500k kahit ang utang ko sa PLI ay 300k lang. makakuha ba ako ng sobra na 200k

para magamit ko naman sa tuition fee sa college?