GFAL is the “GSIS Financial Assistance Loan to DepEd Personnel” that allows eligible borrowers (DepEd teaching and non-teaching personnel) to refinance their outstanding loans with private lending institutions (PLIs) duly accredited under DepEd’s Automatic Payroll Deduction System (APDS).

Supported by a budget of up to P50 billion, GFAL offers a competitive rate at 6% per annum on a longer loan term of up to six years. This will enable eligible DepEd borrowers with existing loans with PLIs to have reduced monthly loan amortizations.

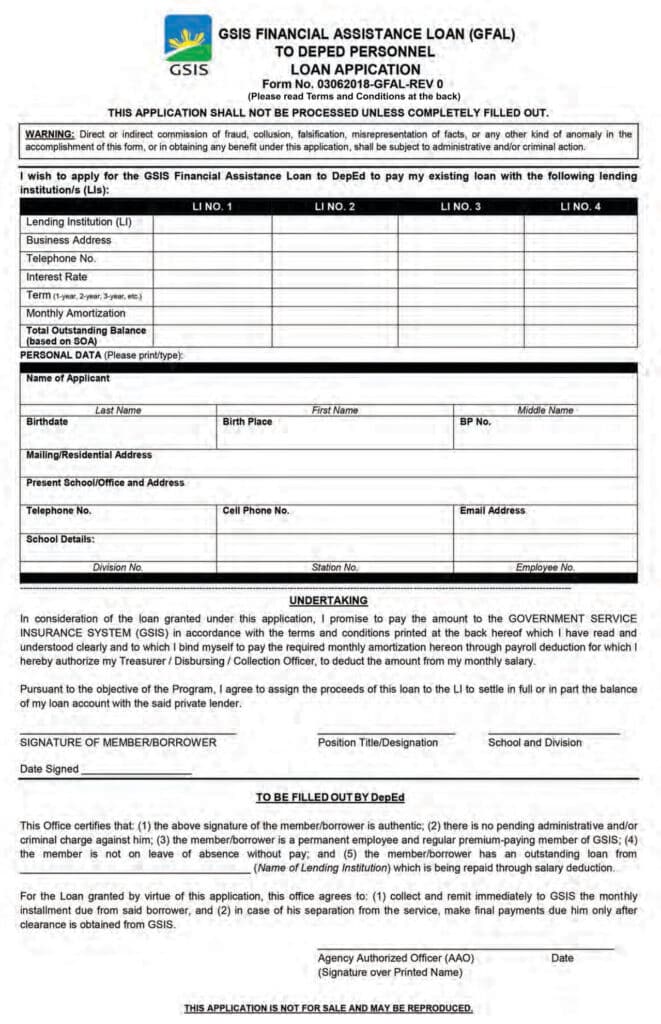

Download: https://drive.google.com/file/d/1DlfU-z6vaYzSn0mo8G31Vj2eKF6CW1j7/view?usp=sharing

Table of Contents

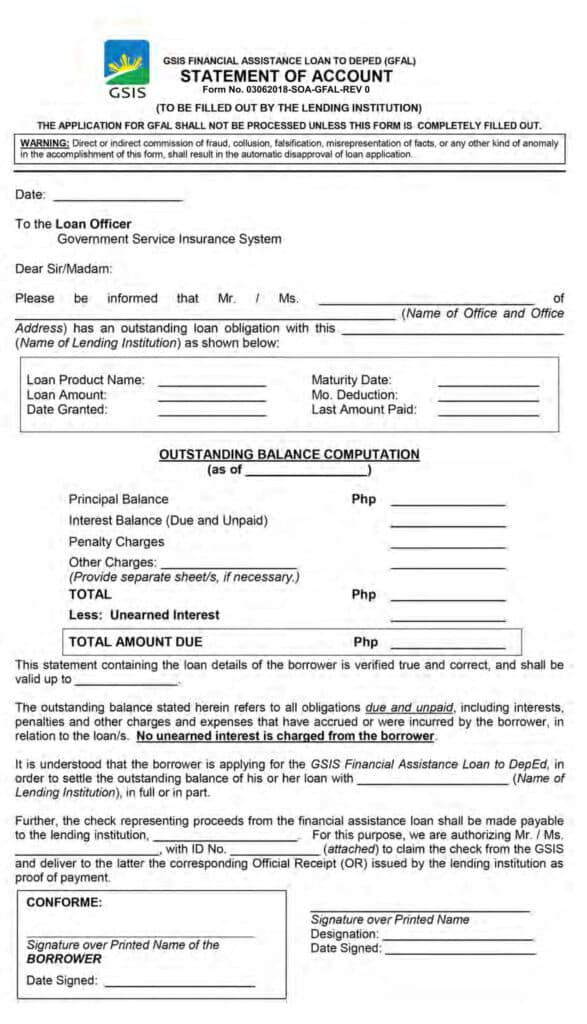

GSIS Financial Assistance Loan (GFAL) Statement of Account

Download: https://drive.google.com/file/d/18kS4hfVm8BiztQqsM59Ej8S0siuZtaJv/view?usp=sharing

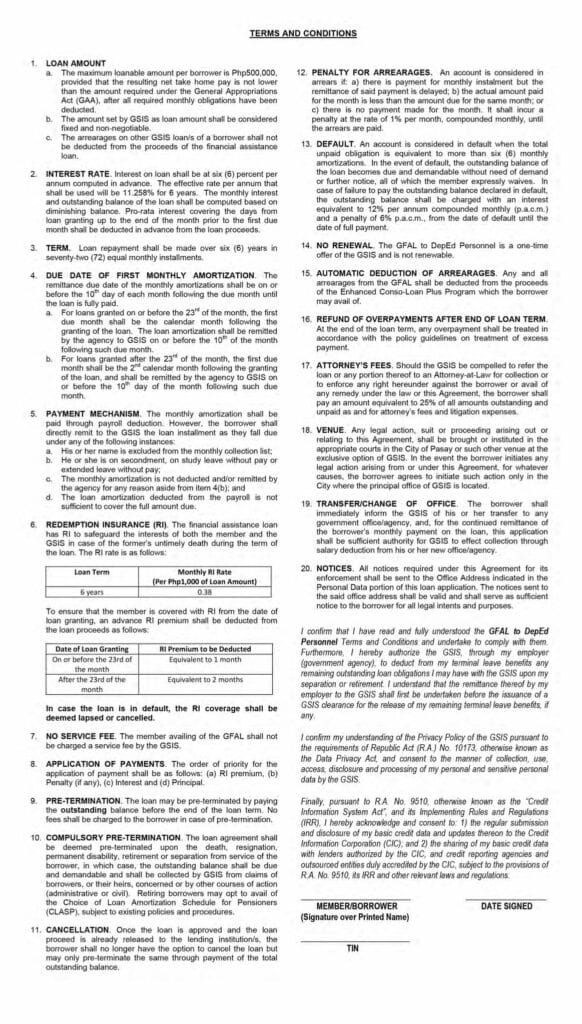

GSIS Financial Assistance Loan (GFAL) Terms and Conditions

1. LOAN AMOUNT

a. The maximum loanable amount per borrower is Php500,000, provided that the resulting net take home pay is not lower than the amount required under the General Appropriations Act (GAA), after all required monthly obligations have been deducted.

b. The amount set by GSIS as loan amount shall be considered fixed and non-negotiable.

c. The arrearages on other GSIS loan/s of a borrower shall not be deducted from the proceeds of the financial assistance loan.

2. INTEREST RATE. Interest on loan shall be at six (6) percent per annum computed in advance. The effective rate per annum that shall be used will be 11.258% for 6 years. The monthly interest and outstanding balance of the loan shall be computed based on diminishing balance. Pro-rata interest covering the days from loan granting up to the end of the month prior to the first due month shall be deducted in advance from the loan proceeds.

3. TERM. Loan repayment shall be made over six (6) years in seventy-two (72) equal monthly installments.

4. DUE DATE OF FIRST MONTHLY AMORTIZATION. The remittance due date of the monthly amortizations shall be on or before the 10tn day of each month following the due month until the loan is fully paid.

a. For loans granted on or before the 23rd of the month, the first due month shall be the calendar month following the granting of the loan. The loan amortization shall be remitted by the agency to GSIS on or before the 10th of the month following such due month.

b. For loans granted after the 23rd of the month, the first due month shall be the 2nd calendar month following the granting of the loan, and shall be remitted by the agency to GSIS on or before the 10th day of the month following such due month.

5. PAYMENT MECHANISM. The monthly amortization shall be paid through payroll deduction. However, the borrower shall directly remit to the GSIS the loan installment as they fall due under any of the following instances:

a. His or her name is excluded from the monthly collection list;

b. He or she is on secondment, on study leave without pay or extended leave without pay;

c. The monthly amortization is not deducted and/or remitted by the agency for any reason aside from item 4(b); and

d. The loan amortization deducted from the payroll is not sufficient to cover the full amount due.

6. REDEMPTION INSURANCE (Rl). The financial assistance loan has Rl to safeguard the interests of both the member and the GSIS in case of the former’s untimely death during the term of loan. The RI rate is as follows:

| Loan Term | Monthly Rl Rate (Per Php1,000 of Loan Amount) |

|---|---|

| 6 years | 0.38 |

To ensure that the member is covered with Rl from the date of loan granting, an advance Rl premium shall be deducted from the loan proceeds as follows:

| Date of Loan Granting | Rl Premium to be Deducted |

|---|---|

| On or before the 23rd of the month | Equivalent to 1 month |

| After the 23rd of the month | Equivalent to 2 months |

In case the loan is in default, the Rl coverage shall be deemed lapsed or cancelled.

7. NO SERVICE FEE. The member availing of the GFAL shall not be charged a service fee by the GSIS.

8. APPLICATION OF PAYMENTS. The order of priority for the application of payment shall be as follows: (a) Rl premium, (b) Penalty (if any), (c) Interest and (d) Principal.

9. PRE-TERMINATION. The loan may be pre-terminated by paying the outstanding balance before the end of the loan term. No fees shall be charged to the borrower in case of pre-termination.

10. COMPULSORY PRE-TERMINATION. The loan agreement shall be deemed pre-terminated upon the death, resignation, permanent disability, retirement or separation from service of the borrower, in which case, the outstanding balance shall be due and demandable and shall be collected by GSIS from claims of borrowers, or their heirs, concerned or by other courses of action (administrative or civil). Retiring borrowers may opt to avail of the Choice of Loan Amortization Schedule for Pensioners (CLASP), subject to existing policies and procedures.

11. CANCELLATION. Once the loan is approved and the loan proceed is already released to the lending institution/s, the borrower shall no longer have the option to cancel the loan but may only pre-terminate the same through payment of the total outstanding balance.

12. PENALTY FOR ARREARAGES. An account is considered in arrears if: a) there is payment for monthly instalment but the remittance of said payment is delayed; b) the actual amount paid for the month is less than the amount due for the same month; or c) there is no payment made for the month. It shall incur a penalty at the rate of 1% per month, compounded monthly, until the arrears are paid.

13. DEFAULT. An account is considered in default when the total unpaid obligation is equivalent to more than six (6) monthly amortizations. In the event of default, the outstanding balance of the loan becomes due and demandable without need of demand or further notice, all of which the member expressly waives. In case of failure to pay the outstanding balance declared in default, the outstanding balance shall be charged with an interest equivalent to 12% per annum compounded monthly (p.a.c.m.) and a penalty of 6% p.a.c.m., from the date of default until the date of full payment.

14. NO RENEWAL. The GFAL to DepEd Personnel is a one-time offer of the GSIS and is not renewable.

15. AUTOMATIC DEDUCTION OF ARREARAGES. Any and all arrearages from the GFAL shall be deducted from the proceeds of the Enhanced Conso-Loan Plus Program which the borrower may avail of.

16. REFUND OF OVERPAYMENTS AFTER END OF LOAN TERM. At the end of the loan term, any overpayment shall be treated in accordance with the policy guidelines on treatment of excess payment.

17. ATTORNEY’S FEES. Should the GSIS be compelled to refer the loan or any portion thereof to an Attorney-at-Law for collection or to enforce any right hereunder against the borrower or avail of any remedy under the law or this Agreement, the borrower shall pay an amount equivalent to 25% of all amounts outstanding and unpaid as and for attorney’s fees and litigation expenses.

18. VENUE. Any legal action, suit or proceeding arising out or relating to this Agreement, shall be brought or instituted in the appropriate courts in the City of Pasay or such other venue at the exclusive option of GSIS. In the event the borrower initiates any legal action arising from or under this Agreement, for whatever causes, the borrower agrees to initiate such action only in the City where the principal office of GSIS is located.

19. TRANSFER/CHANGE OF OFFICE. The borrower shall immediately inform the GSIS of his or her transfer to any government office/agency, and, for the continued remittance of the borrower’s monthly payment on the loan, this application shall be sufficient authority for GSIS to effect collection through salary deduction from his or her new office/agency.

20. NOTICES. All notices required under this Agreement for its enforcement shall be sent to the Office Address indicated in the Personal Data portion of this loan application. The notices sent to the said office address shall be valid and shall serve as sufficient notice to the borrower for all legal intents and purposes / confirm that I have read and fully understood the GFAL to DepEd Personnel Terms and Conditions and undertake to comply with them. Furthermore. I hereby authorize the GSIS, through my employer (government agency), to deduct from my terminal leave benefits any remaining outstanding loan obligations I may have with the GSIS upon my separation or retirement. I understand that the remittance thereof by my employer to the GSIS shall first be undertaken before the issuance of a GSIS clearance for the release of my remaining terminal leave benefits, if any.

I confirm my understanding of the Privacy Policy of the GSIS pursuant to the requirements of Republic Act (R.A.) No. 10173, otherwise known as the Data Privacy Act, and consent to the manner of collection, use. access, disclosure and processing of my personal and sensitive personal data by the GSIS.

Finally, pursuant to R.A No. 9510. otherwise known as the “Credit Information System Act”, and its Implementing Rules and Regulations (IRR). I hereby acknowledge and consent to: 1) the regular submission and disclosure of my basic credit data and updates thereon to the Credit Information Corporation (CIC); and 2) the sharing of my basic credit data with lenders authorized by the CIC, and credit reporting agencies and outsourced entities duly accredited by the CIC, subject to the provisions of R.A. No. 9510, its IRR and other relevant laws and regulations.

Where or what are the contact numbers that we can coordinate for Follow-up of my approved GFAL Application last year December 2021?

Good day sir, I want to apply for a GFAL , what are the requirements for it.

Good Day, Maam Rosita!

You may view the GFAL requirements here: http://www.teacherph.com/application-gfal/

Sir/Ma’am

Good Day’

I am applying for a top up loan and I already sent my application form just last week , In connection with this I would like to follow up the status of my loan.

Thank you so much and stay safe.

i want to gfal loan

Open na po ba ngayun ang loan ng top up gfal for teachers?

please send me the list of private lending institutions that are possible to be redeemed by GSIS..thank you..

In my case i have settled my arrears through conso loan last week of september 2018 , my problem is it appeared that i am not qualified for the GFAL because i leave without pay last october 2016 and so i have no contribution for that same month, my suggestion if i will pay that personally in order to complete my contribution good for 1 month can this idea be granted so that i could continue my GFAL, i have all the requirements already signed by our DEp ed laison officer. kindly help me with favorable solution on this matter. you can reach me to my name below and email add. Thanks.

Kpag my arrears s kanila hindi nmn magagrant gfal application.hindi nmn pla cla makatutulong s ating mga guro n baon s utang s PLI.

More than 10 days n pinaprocess gfal application ko till now d p rin n ggrant! What went wrong kya? D p ata hnda gsis s srili nilang programa.

Can you provide me the list of accredited PLIs as provided by deped? Thanks.

ANG LANDBANK at PPSTA PO BA AY ISA S MGA PLI’s ?