Table of Contents

GSIS Retirements Programs

The GSIS offers various retirement programs depending on the qualifications of the member. GSIS has retirement packages generally acknowledged to be one of the most generous in the country-ensuring financial freedom for its members, especially after they leave the service.

I. ELIGIBILITY REQUIREMENTS:

Member shall be entitled to the retirement benefit on condition that:

Retirement under Republic Act 660

Also called “Magic 87”, this option provides both annuity and lifetime pension.

Retiring under RA 660 requires the following:

- He/she should have entered government service on or before May 31, 1977

- The retiree’s last three years of service prior to retirement should have been continuous, except in cases of death, disability, abolition, and phase- out of position due to reorganization.

- His/her appointment status should be permanent

- He/she should meet the age and service requirements under the “Magic 87” formula. Based on the formula, a retiree’s age and years in service should be added up and should total at least 87.

- The “Magic 87” formula is shown below:

| Age | 52 | 53 | 54 | 55 | 56 | 57 | 58 | 59 | 60 | 61 | 62 | 63 | 64 | 65 |

| YCS | 35 | 34 | 33 | 32 | 31 | 30 | 28 | 26 | 24 | 22 | 20 | 18 | 16 | 15 |

The maximum monthly pension for those above 57 years old shall be 80% of the Average Monthly Salary (AMS) received during the last 3 years immediately preceding retirement. The Maximum pension for those aged 57 and below shall be 75% of the AMS.

Packages in store for you

RA 660 lets you choose among the following options to let you enjoy a new beginning:

Option 1: Automatic Pension – Under this option, pensioners below 60 years old may choose to receive either an automatic monthly pension for life or an option to avail of a lump sum. The lump sum, which can be requested every six months, means they can receive their one-year worth of monthly pension in advance for a period of five years. On the sixth year, they will start receiving their lifetime monthly pension.

Option 2: Initial three-year lump sum – For those who are at least 60 years old but less than 63 years on date of retirement, the benefit is a 3-year lump sum. The subsequent two -year lump-sum shall be paid to the retiree on his 63rd birthday. If the retiree is still living after the 5-year guaranteed period, he shall be entitled to a monthly pension for life.

Option 3: 5-Year Lumpsum – For those who are 63-65 years old, they can avail of a five-year lump sum then after five years, they will receive a monthly pension for life.

Retirement under Presidential Decree 1146

Retirement under PD 1146 can only be availed by those who were in service after May 31,1977 but prior to June 24, 1997. A retiring member under PD 1146 is entitled to either Old Age Pension or Cash Payment, depending on his age and years in service.

Packages in store for you

Option 1: Basic Monthly Pension (BMP)

This option is available for retirees who are at least 60 years old and have rendered 15 years of service. Those qualified under this option will receive a Basic Monthly Pension (BMP) guaranteed for five (5) years. After the 5-year guaranteed period, he/she will receive a basic monthly pension for life. A retiree may also request to convert his/her five-year guaranteed BMP into a lump sum subject to a six (6) percent discount rate.

The BMP is computed as follows:

a) If period with premium payments is less than 15 years: BMP= .375 x RAMC

b) If period with premium payments is 15 years or more: BMP= .025 x RAMC x Length of service

RAMC stands for Revalued Average Monthly Compensation. It is computed as follows: RAMC = AMC+ P140.00 The maximum RAMC is P3,140.00

In either case, the BMP shall not exceed 90% of the Average Monthly Compensation (AMC).

The AMC is computed as follows:

| AMC = | Total compensation received during the last 3 years |

| Total number of months during which compensation was received |

Option 2: Cash Payment (CP)

This option is available to retirees who are at least 60 years old and have rendered at least 3 years but less than 15 years of service. Qualified under this mode option will receive a cash payment that is equal to 100% of the Average Monthly Compensation (AMC) for every year of service.

The Cash Payment is computed as follows:

CP = Total monthly contributions paid x AMC

Retirement Under R.A. 8291

Five-year lump sum or cash payment with instant pension-choose your personal reward.

When availing of the retirement program under RA 8291, two things should be considered: age and the length of service.

To qualify for this retirement mode:

- The retiree must have rendered at least 15 years of service and must be at least 60 years of age upon retirement.

- He /she must not be a permanent total disability pensioner.

- Unlike other retirement modes, the last three years of service of a retiree need not to be continuous under RA 8291

Packages in store for you

Retiring members who will opt to retire under RA 8291 are entitled to either of the following:

Option 1: 5-Year Lump Sum and Old Age Pension

Under this option, the retiree can get his/her five-year worth of pension in advance. The lump sum is equivalent to 60 months of the Basic Monthly Pension (BMP) payable at the time of retirement. After five years, the retiree will start receiving his/her monthly pension.

Option 2: Cash payment and Basic Monthly

In option 2, the retiree will receive a Cash Payment equivalent to 18 times the Basic Monthly Pension (BMP) payable upon retirement and then a monthly pension for life payable immediately after his retirement date.

The BMP is computed as follows:

a) If period with premium payments is less than 15 years:

BMP = .375 x RAMC (Revalued Average Monthly Compensation)

b) If period with premium payments is 15 years and more : BMP = .025 x RAMC x period with premium payments

The BMP, however, shall NOT exceed 90% of the Average Monthly Compensation (AMC).

RAMC stands for Revalued Average Monthly Compensation and is computed as follows :

RAMC= P700 + AMC (Average Monthly Compensation)

AMC

= Average Monthly Compensation

= Total Monthly Compensation received during the

last 36 months of service divided by 36

Application of the AMC Limit

The maximum amount of the Average Monthly Compensation (AMC) to be used as the base for computing pensions and other benefits of a member shall be the AMC limit prevailing at the time the contingency/ies occurred. Thus, pursuant to the lifting of the AMC limit, the monthly pension of a member with at least 15 years of creditable service who is in the service on or after January 1, 2003 shall be computed on the basis of his/her AMCs without limit.

Retirement under Republic Act 1616

Refund your GSIS premiums with this “take-all” option at the same time get gratuity payment from your employer.

RA 1616 provides for a gratuity benefit for retiring members who will qualify under this retirement mode. The gratuity is payable by the last employer. The employee shall also be entitled to a Refund of Retirement Premiums paid, personal share with interest and government share without interest.

To qualify under the mode, a retiree must:

- be in government service on or before May 31, 1977

- has rendered at least 20 years of service regardless of age and employment status

- His/her last 3 years of service prior to retirement must be continuous, except in cases of death, disability, abolition or phase out of position due to reorganization.

What is in store for you

Since RA 1616 is considered as the “Take All Retirement” mode, it provides the following benefits:

1. Gratuity payable by the last employer based on the total creditable service converted into gratuity months multiplied by the highest compensation received. The gratuity months shall be computed as follows:

Years of Service Gratuity Months

First 20 years one (1) month salary

20 years to 30 years 1.5 months salary

Over 30 years two (2) months salary

(There is no limit to the amount of gratuity benefit.) and

2. Refund of retirement premiums consisting of personal contributions of the employee plus interest, and government share without interest, payable by the GSIS.

Portability Law (RA 7699)

Combine your GSIS and SSS creditable years of service to qualify for retirement program offered by both pension funds.

Admittedly most of us move from one job to another in a move to find a higher pay and better career. Many government retirees have had a history in the private sector. In certain cases, they don’t have enough years of service in the government to qualify to any GSIS retirement program.

With the help of RA 7699, otherwise known as the Portability Law, government retirees who do not meet the required number of years provided under PD 1146 and RA 8291 can still avail of retirement and other benefits.

Under the scheme, you may combine your years of service in the private sector represented by your contributions to the Social Security System (SSS) with your government service and contributions to the GSIS to satisfy the required years of service under PD 1146 and RA 8291.

However, if you have satisfied the required years of service under the GSIS retirement option you have chosen, you would not be allowed to incorporate your contributions to the SSS anymore for availment of additional benefits.

In case of death, disability and old age, the periods of creditable services or contributions to the SSS and GSIS shall be summed up to entitle you to receive the benefits under either PD 1146 or RA 8291.

If qualified under RA 8291, all the benefits shall apply EXCEPT the cash payment. The reason for this is that the Portability Law or RA 7699 provides that only benefits common to both Systems (GSIS and SSS) shall be paid. Cash payment is NOT included in the benefits provided by the SSS.

II. CONDITIONS FOR RETIREMENT

1. A member can only avail of one retirement mode. His election of a mode of retirement precludes him from retiring under other retirement laws.

2. The retirement proceeds received by the retiree shall at all times be subject to deduction for any outstanding indebtedness he/she may have incurred with the GSIS. (Section 39, RA 8291 Otherwise known as the GSIS Retirement Law)

3. In the event the retiree has an existing life endowment policy providing for option to convert the policy into an optional life policy in case of separation or retirement, the retiree is deemed to have terminated the policy if he/she fails to signify his/her intention to convert the policy upon his/her separation or retirement from the service. In the event , however, the member concerned decides to convert his/her compulsory policy into an optional policy, the following shall be observed:

a. The optional policy shall be under the terms and conditions of the optional life policy program of GSIS which may not necessarily be the same terms and conditions of the member’s original compulsory life policy.

b. The premium rates to be paid by the member concerned shall be in accordance with the scheduled premium rates under the optional life policy program of GSIS and the age of the said member at the time he/she elected to convert.

4. The retiree-pensioner is required to report personally to the GSIS nearest his/her place of residence at least once a year and at such time as may be determined by GSIS as a condition for continued remittance of his/her monthly pension.

Read: Requirements Checklist for Various Positions

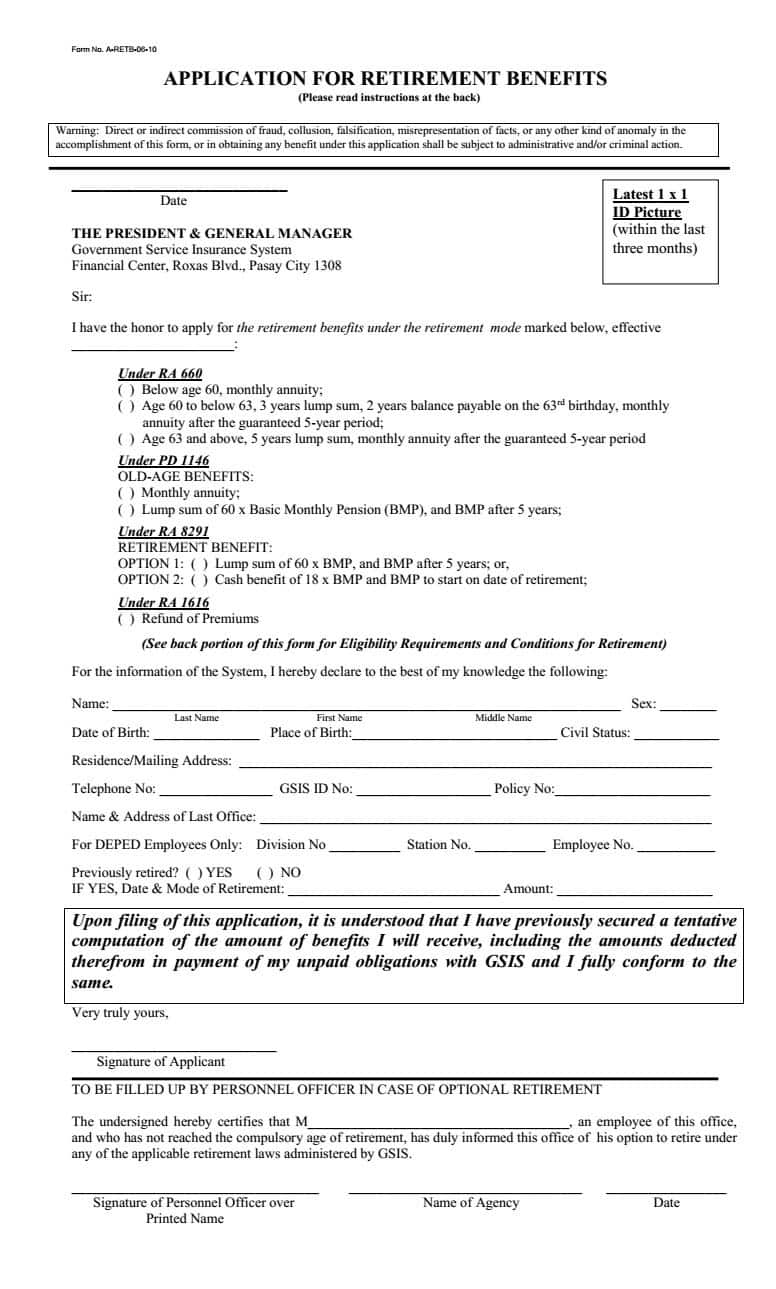

Download: GSIS_Application – Retirement Benefits

What if a member who is only 58 years old applies for retirement and whose retirement is duly approved by his/her employer, what retirement benefits shall he/she may receive upon retirement at age 58?

My mother retired in 1988 and opted for a lump sum option – not sure which one. She is a now 89. Is she entitled to a monthly pension? Her name is Manolita Lourdes G. Tolentino and she taught at the Batangas City East Elementary School. Thank you.

Good afternoon I am currently teaching at Department of Education Division of Imus City.I am 41 years old and rendered 16 years in service.Can I apply for early retirement and have pension when I reach at the age of 60?

How is the disability retirement application of mr felipe rayco .pls we submitted all the requirements even the additional requirements.as the letter send to us by gsis as soon as the additional requirements was submitted the claim will be process .how manny mnths it will be process.thank you

Good afternoon I am currently teaching at Department of Education Division of Lanao Del Norte.I am 46 years old and rendered 23 years in service.Can I apply for early retirement and have pension when I reach at the age of 60?

Sir, I would like to know what are the requirements for early retirement at age 54 and 34 year in the service?

T whom it may concern,

I was a teacher for nine years. After graduation in 1968, got a teaching position with the DIVISON of RIZAL. Five years service BPS DIVISION OF RIZAL and four years BPS DIVISION OF MANILA until I resigned in 1977. I wanted to apply for a retirement benefit under GSIS but not sure which one to complete. is it too late to apply?

I appreciate if someone is able to assist me in the completion of a correct application form?

Thank you so much in advance.

LETICIA ROS SMITH

I have a question. Sir, my mom was a special ed teaccher in cebu… she was a teacher for 15 plus years.. she passed away suddenly a couple of years ago… would she be entitled to any government benefits??

Great information and very usefull, thank you.