Enclosed hereto is PhilHealth Circular No. 2019-0004, Re: Required Qualifying Contributions for Eligibility to PhilHealth Benefits, contents of which is self-explanatory.

Table of Contents

2019 Required Qualifying Contributions for Eligibility to PhilHealth Benefits

PhilHealth Circular No. 2019-0004

I. RATIONALE

Pursuant to Section 12 of Republic Act No. 7875 as amended by R.A. 10606 otherwise known as the National Health Insurance Act of 2013, to wit:

“A member whose premium contributions for at least three (3) months have been paid within six (6) months prior to the first day of availment, including those of the dependents, shall be entitled to the benefits of the Program: Provided, That such member can show that contributions have been made with sufficient regularity: Provided, further, That the member is not currently subject to legal penalties…”

Thus, the law admits specific conditions for availment purposes: 1) premium contribution paid must be at least three (3) months within six (6) months prior to the first day of availment; 2) sufficient regularity of payment of premium contribution; and 3) no legal penalties as defined in RA 7875, as amended. All these conditions must be present.

To define the parameters that would determine the sufficiency and regularity of premium payment in relation to the above provision of the law, PhilHealth Board Resolution No. 2097, s-2016 declares that “… to establish sufficient regularity of payment, members should have paid six (6) months contributions preceding the three (3) months qualifying contributions within the twelve (12) – month period prior to the first day of availment…”

Hence, this Circular is being issued for the standard application of sufficient regularity of payment of premium contributions to the existing policy on the required premium contributions for availment of PhilHealth benefits.

II. OBJECTIVES

This Circular is being issued with the following objectives:

1. To clarify the definition and application of sufficient regularity to benefit entitlement and availment;

2. To establish the required number of contributions for eligibility to PhilHealth benefits; and

3. To lay down some special provisions on benefit entitlement and availment of members and dependents shifting to the informal economy, new members, members granted with special privileges due to fortuitous events, Women About to Give Birth (WATGB) and members of the Informal Economy who have missed/unpaid premium contributions.

III. SCOPE

This Circular provides the policy guidelines on the required monthly contributions for eligibility or entitlement to PhilHealth benefits of employed members under the Formal Economy and individually paying members under the Informal Economy, which include workers in the informal sector, self-earning individuals, dual citizens and, foreign nationals.

Moreover, it defines the specific conditions under which concerned members can avail of PhilHealth benefits, particularly those shifting to the informal economy, granted with special privileges, WATGB, and informal economy members who have missed/unpaid premium contributions.

IV. DEFINITION OF TERMS

1. Sufficient regularity of payment of premium contributions – payment of at least six (6) months contributions preceding the required three (3) months contributions within the twelve (12)-month period prior to the first day of availment.

2. Unexpired portion of coverage – a period where a deceased member and all his/her qualified dependents remains covered/ entitled to PhilHealth benefits by virtue of the premiums remitted prior to the death of the former.

V. PREMIUM REQUIREMENTS TO AVAIL OF PHILHEALTH BENEFITS FOR MEMBERS WHOSE COVERAGE HAS NO VALIDITY PERIOD (Annex A)

To become eligible to PhilHealth benefits, the member should have established the following premium payments within the immediate twelve (12) – month period prior to the first day of availment:

1. At least three (3) months contributions within the immediate six (6) months prior to the first day of confinement. The six-month period shall include the month of confinement;

2. Sufficient regularity of payment of premium contributions as defined in Section IV; or

A total of nine (9) months premium contributions within the immediate twelve (12) months prior to the first day of availment shall be required to become eligible to PhilHealth benefits.

The counting of the twelve (12) month period prior to availment of benefits shall reckon from the month of availment.

VI. EXEMPTIONS ON THE REQUIRED SUFFICIENT REGULARITY OF PREMIUM CONTRIBUTIONS FOR BENEFIT ENTITLEMENT AND AVAILMENT

The following members are exempted from the rule on sufficient regularity:

1. Members with validity period

a. Indigent members

b. Overseas Filipino Program (OFP) members

c. iGroup members

d. Members tagged as Point of Service (POS), both Financially Incapable (FI) and Financially (Lapable (FC)

2. Members with automatic and continuous availment

a. Lifetime members

b. Senior citizens

3. Kasambahays in accordance with RA 10361 and PhilHealth Circular No. 016-2015

4. Group enrollment members as defined in PhilHealth Circular No. 2017-005 and directly hired job order workers, contract of service and project-based personnel in the government per PhilHealth Circular No. 2017-008

5. Women About to Give Birth (WATGB) as stipulated in PhilHealth Circular No. 025, s. 2015

VII. SPECIFIC PROVISIONS

1. Change in Membership Category’

a. To ensure continuous entitlement to PhilHealth benefits of members and dependents shifting to the Informal Economy, the following conditions must be complied:

i. Sufficient regularity of payment of premium contributions;

ii. Shifting of membership status to the Informal Economy Program and payment of at least one (1) month premium contribution within the 3-month shifting period following the last month with payment for employed members or of expiration of validity period for indigent, sponsored, OFP, and iGroup members; and

iii. In case of confinement within the shifting period, payments made prior to hospital discharge shall be counted as qualifying contributions. (See Annex B)

b. To determine the number of qualifying contributions in relation to eligibility rules, the one year premium payments made for and in behalf of the sponsored members and Point of Care (POC)/Point of Service (POS) enrollees (premiumbased) for their coverage in the preceding year shall be counted as part of their qualifying contributions. Activation of their membership under the informal economy shall require payment of at least one (1) month premium contribution within the quarter following the expiration of validity period.

c. For the purpose of computing the total number of monthly premium contribution for those applying as lifetime member, premium payments shall be counted regardless of membership category.

d. For the purpose of computing the number of qualifying contributions in relation to eligibility rules, the premium payments made by any type of NHIP member extends to his/her dependents. Hence, a dependent who enrolls as a member may be conferred with eligibility and/or sufficient regularity of premium contribution ascertained from his/her previous coverage as a dependent. A Certificate of Premium Payment issued by PhilHealth and an updated PMRF and/or proof of dependency may be attached to the medical claims to facilitate availment of benefits.

e. Non-PhilHealth members and members without the required qualifying contributions may be declared as dependents. In case they decided to enroll/ shift as a member, the period in which they are covered as dependents may be counted as qualifying contributions. All qualified dependents of an eligible NHIP member are entitled to avail of the benefits, subject to existing pertinent policies.

2. Proof of Contributions for Benefit Availment of Various Membership Categories

a. In case the required contributions are not reflected in the PhilHealth online verification system, only those proof of contributions as specified below shall be required to be submitted to the concerned health care providers to facilitate availment of benefits by members and their qualified dependents:

| Member | Proof of Contributions |

| Formal Economy: | |

| Employed Members (including seafarers) | Claim Signature Form (CSF) or Claims Form 1 (CF1) duly signed by the employer |

| Kasambahays | Any one of the following: – PhilHealth Agent Receipt (PAR)/ – Other payment receipts issued by concerned ACAs/ – PhilHealth Official Receipt (POR)/ – Certificate of Premium Payment (CPP), issued by PhilHealth |

| Informal Economy: | |

| Individually Paying Members | |

| Migrant Workers (land-based OFWs) | MDR (with validity period) and/or Official Receipt of Contribution abroad, POR/CPP issued by PhilHealth and PAR/other valid payment receipts issued by concerned ACAs |

| Workers in the Informal Sector | POR and CPP issued by Phill Icalth and PAR or other valid payment receipts issued by concerned ACAs |

| Self-earning Individuals | |

| Dual Citizens | |

| Foreign Nationals | |

| Group Members | |

| iGroup Members | MDR (with validity period) |

| Job Order, Project-Based Contractors and Contract of Service | |

| Members under Group Enrollment (including Barangay-Based Group Enrollment) | |

| Indigent Program | |

| Sponsored Program | MDR (with validity period) |

b. Undeclared dependent of an active NHIP member may avail of PhilHealth benefits subject to compliance in the submission of proof of payment and proof of relationship and/or updated Phill Icalth Member Registration Form (PMRF).

3. Provisions on the 3/6 Qualifying Contributions for Benefit Availment

The following members shall only be required at least three (3) months contributions within the immediate six (6) months prior to the first day of availment:

a. Newly-enrolled members whose membership to NHIP cover less than twelve (12) months reckoned from the initial date of payment; and

b. First time employee with less than twelve (12) months of employment.

4. Entitlement of Dependents of a Deceased Member

The unexpired portion of coverage of a deceased member may be used by dependent spouse and children in the counting of qualifying contributions and availment of PhilHealth benefits.

5. Retroactive Payment of Premiums

Retroactive payment shall only be counted as qualifying contributions if paid prior to the first day of availment.

a. Formal Economy

Pursuant to PhilHealth Circular No. 32, s. 2003, employed members who arc on leave without pay may remit their premium contribution for the applicable period in the amount equivalent to the rate of an informal economy member. Should the said member fails to remit his/her premium contributions within the calendar quarter, he/she shall be given a grace period of one (1) calendar quarter immediately following the unpaid month (s) or quarter to pay retroactively the said premium.

b. Informal Economy

i. Members who have missed/unpaid premium contributions for a maximum period of three consecutive months but have established nine (9) consecutive months of premium payments prior to the unpaid period shall be allowed to retroactively pay within one (1) month following the unpaid period.

ii. Newly-enrolled informal economy members whose membership to NIIIP cover less than nine (9) months reckoned from the initial date of posting of premium payment may be allowed to retroactively settle their premium payments within one (1) month immediately following the unpaid period.

6. Members Covered by Fortuitous Events

Members granted with special privileges due to fortuitous events as per PhilHealth Circular No. 0034, s.2013 shall be allowed to pay their premiums within the extension period of premium payment. In case their confinement occurs within the extension period, they may pay for the applicable period prior to hospital discharge. Hence, such payments shall be counted as qualifying contributions.

VIII. REPEALING CLAUSE

This Circular shall repeal all provisions of PhilHealth Circular No. 201-0021 (Application of Sufficient Regularity of Payment of Premium Contributions to the Required Qualifying Contributions for Eligibility to PhilHealth Benefits), PhilHealth Circular No. 0032, s.2014 (Clarifications in the Application of Qualifying Contributions to Ensure Entitlement to PhilHealth Benefits), and PhilHealth Circular No. 24, s.2003 (Omnibus Guidelines on Entitlement to Benefits).

IX. EFFECTIVITY

This Circular shall take effect fifteen (15) days after its publication in at least two (2) newspapers of general circulation. It shall be deposited thereafter with the National Administrative Register at the University of the Philippines Law Center.

PhilHealth Circular No. 2019-0004

Illustrations of Premium Requirements to Avail of Benefits for PhilHealth Members With No Validity Periods

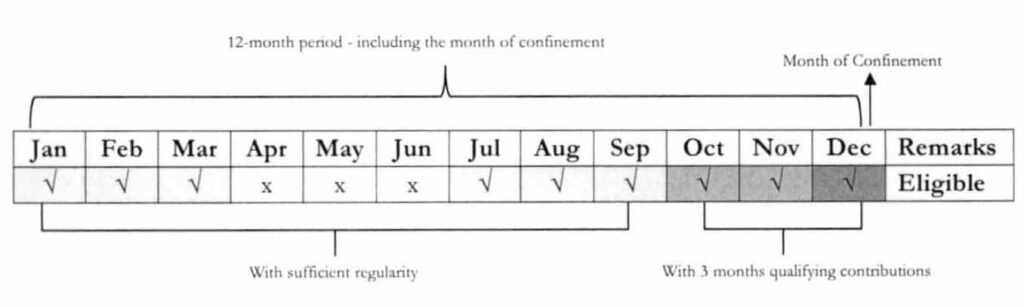

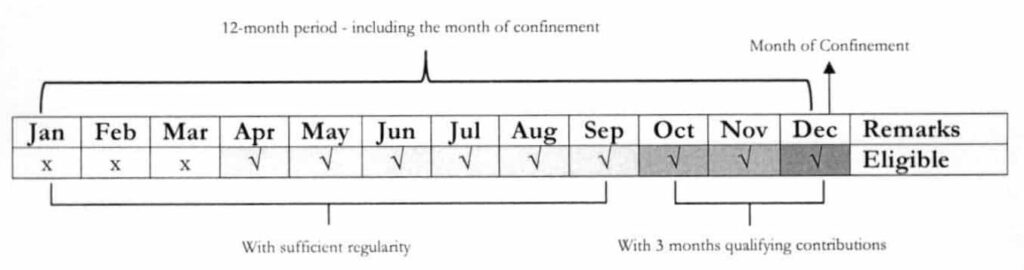

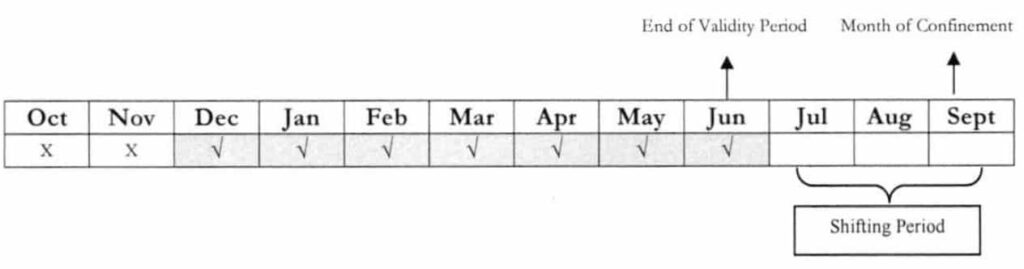

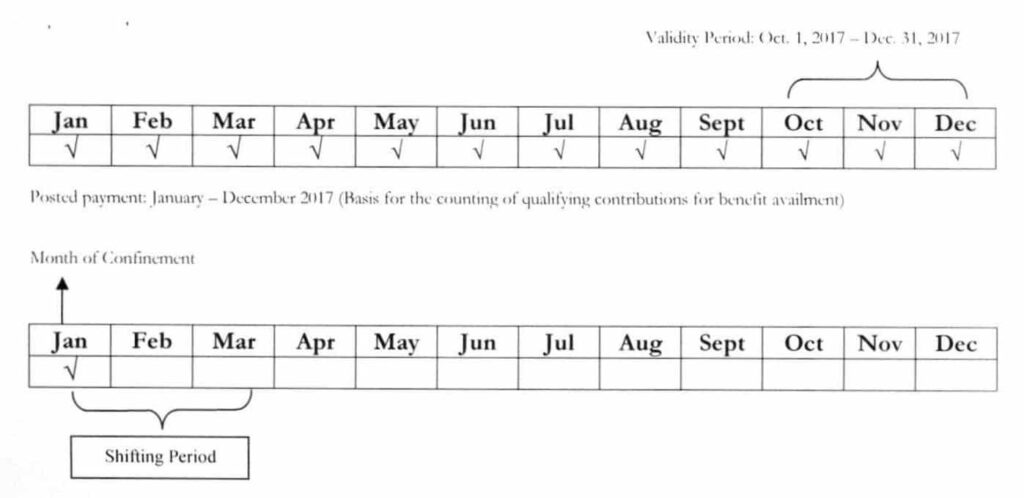

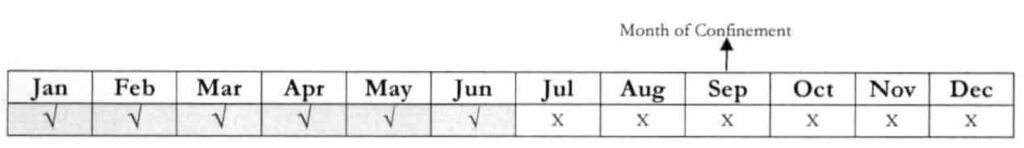

For illustrations 1 and 2, patient is to be confined on December 15. Premium Payment for OctDecember was made prior to the first day of confinement.

Illustration 1

Illustration 2

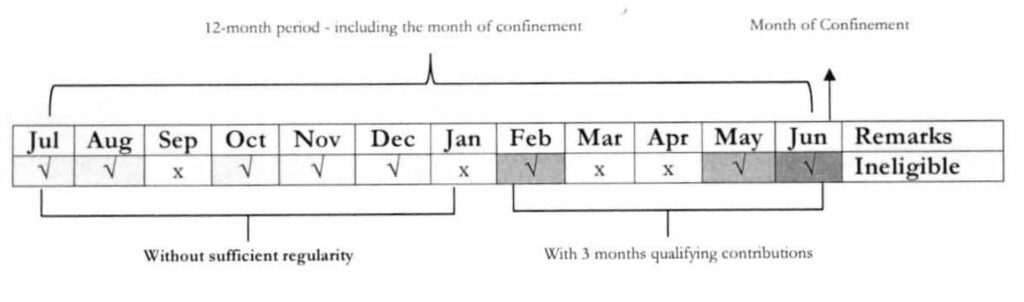

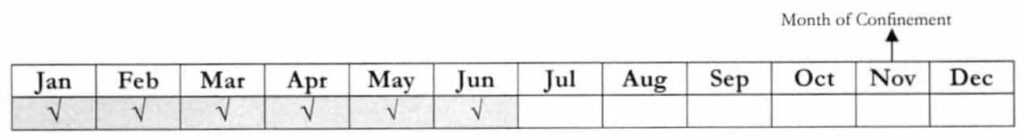

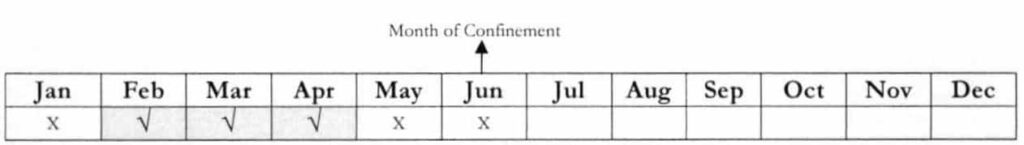

For illustration 3, patient is to be confined on June 20. Premium Payment for Feb, May and June was made prior to the first day of confinement. However, with no sufficient regularity of premium contribution, patient is ineligible to avail of benefits.

Illustration 3

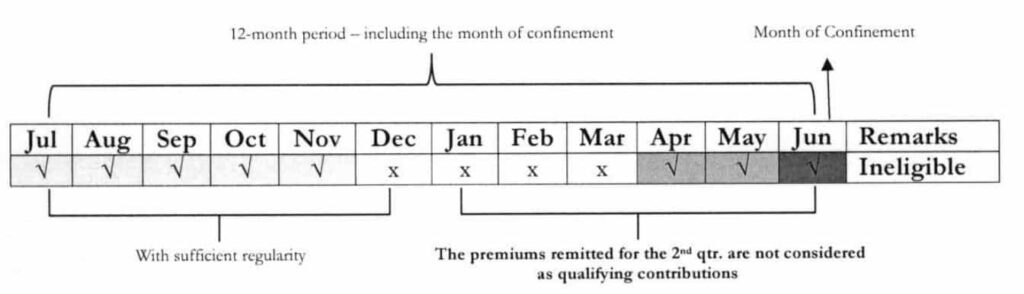

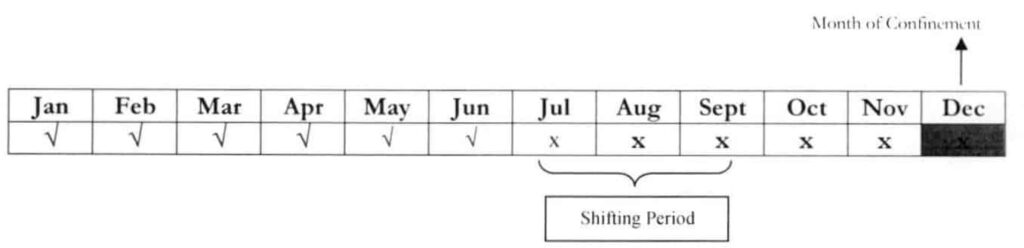

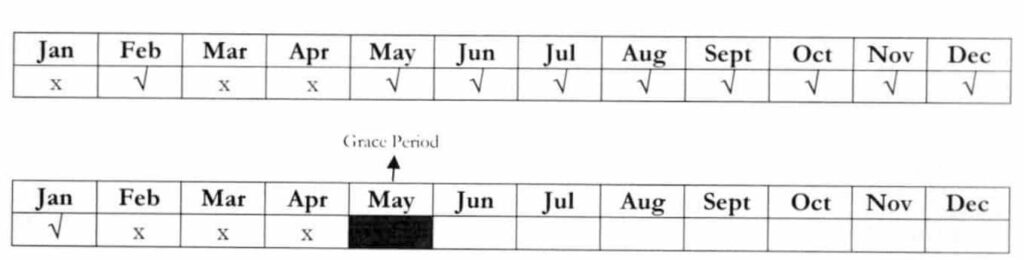

For illustration 4, payment for the 2nd Qtr. was made after discharge. While the patient has sufficient regularity of premium contribution, non-compliance to payment of 3 months within 6 months prior to the first day of confinement has resulted to suspension of benefit entitlement for this particular admission.

Illustration 4

Illustrations of the Specific Provisions of this Circular

1. Change in Membership Category: Members from other categories shifting to the Informal Economy Program (Individually Paying Program)

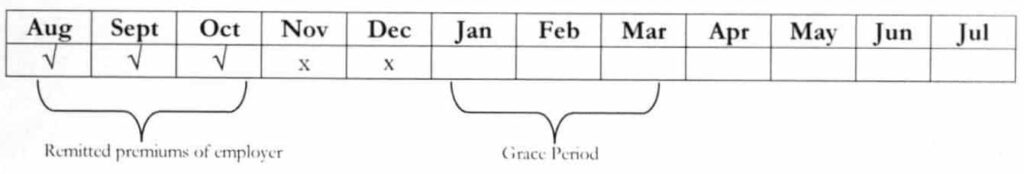

Shifting of membership status to the Informal Economy Program and payment of at least one (1) month premium contribution within the 3-month shifting period following the last month with payment for employed members or of expiration of validity periodfor indigent, sponsored, OFP, and iGroup member.

Example 1: A member has been employed for 6 months, from December 2017 – June 2018. Last September 15, 2018, the said member was admitted to the hospital.

Question: If the member would pay the following day for July to September 2018, can he avail of the Phill Iealth benefits?

Answer: Yes. Considering that the month of confinement falls within the shifting period, the months of July-September 2018 shall be counted as qualifying contributions if paid prior to hospital discharge. Hence, the member can be able to satisfy the required qualifying contributions of at least 9/12.

Example 2: A member, who was separated from employment. He has posted premium contributions from January-June 2018. By November 5, 2018, he was admitted to the hospital.

Question: If he would shift to the informal economy during admission, can he pay her premiums for July-September 2018? Will it be considered as qualifying contributions for the said admission?

Answer: No. Since the deadline for the 3rd quarter payment has already lapsed, if is no longer allowed to pay for the said period. Retroactive payment is allowed only if the member has established nine (9) consecutive months of premiums prior to the unpaid period. If the said condition has been complied, a member shall be given a grace period of one (1) month following the missed period. In this case, the member has no required number of contributions for retroactive payment. Moreover, retroactive payment shall only be counted as qualifying contributions if paid prior to the first day of availment or hospital admission.

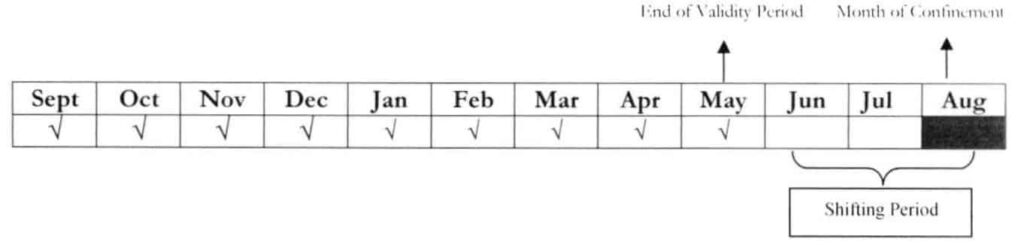

Example 3: An OFP member is no longer working abroad. His membership validity has expired last May 18, 2018. The said member was confined on Aug 7, 2018.

Question: Considering that the member has already established the 9/12 qualifying contributions at the time of confinement, is he entitled to avail of the PhilHealth benefits even without shifting to the informal economy?

Answer: The member may have the required qualifying contributions but he has no membership category since his membership validity under the OFP has already expired. Hence, he should shift to the informal economy and pay at least one month to activate his membership under the said program.

Example 4: An employed member was separated from employment. The last posted payment of the said member was June 2018. He was admitted to the hospital on Dec 5, 2018.

Question: Can the member pay for July – December to avail of the PhilHealth benefits?

Answer: The member can only pay for October-December 2018 because the deadline of payment for the 4th quarter has not yet lapsed. However, such payment can no longer be counted as qualifying contributions because the member is already admitted by the time the payment was remitted. Per policy, only payments made prior to the F’ day of availment shall be counted as qualifying contributions.

2. Determining the number of monthly qualifying contributions of sponsored members, who have shifted to the informal economy, in relation to eligibility rule

To determine the number o f qualifying contributions in relation to eligibility rules, the one year premium payments made for and in behalf of the sponsored members and Point of Care (POC)/ Point of Service (POS) enrollees (premium-based) for their coverage in the preceding year shall be counted as part of their qualifying contributions. Activation oj their membership under the informal economy shall require payment of at least one (1) month premium contribution within the quarter following the expiration of validity period.

Example: A member was enrolled by the LGL under the sponsored program, with validity period of October – December 2017. The enrolment of the said member under SP was not renewed on the following year. By January 8, 2018, she was admitted to the hospital

Question: Is the member entitled to avail of the PhilHealth benefits?

Answer: Yes. The number of months paid rather than the validity period shall be considered as basis for the counting of qualifying contributions. Likewise, the member is required to shift under the informal economy and pay at least one month prior to hospital discharge to activate her membership under the said program. Hence, the qualifying contributions shall cover the months of May 2017 up to January 2018.

3. Computation of total monthly premium contributions of members applying for lifetime membership

For the purpose of computing the total number of monthly premium contribution for those applying as lifetime member premium payments shall be counted regardless of membership category.

Example: A senior citizen member is now applying as lifetime member. Below is the record of membership and contributions of the said member:

| YEAR | MEMBERSHIP CATEGORY | NUMBER OF YEARS WITH PAYMENTS |

| 2005-2012 | Employed Member | 7 |

| 2013-2014 | Individually Paying Member | 1 |

| 2015-2016 | Sponsored Program | 1 |

| 2017- 2018 | Senior Citizen | 1 |

| Total | 10 |

Question: Based on the above membership and payment history of the member, is he qualified under the Lifetime Membership Program of PhilHealth?

Answer: Yes, the senior citizen member has satisfied the required contributions of at least 120 months or 10 years.

4. Granting of eligibility to dependents that enroll as member

For the purpose of computing the number of qualifying contributions in relation to eligibility rules, the premium payments made by any type of NHIP member extends to his/her dependents. Hence, a dependent that enrolls as a member may be conferred with eligibility and/or sufficient regularity of premium contribution ascertained from his/her previous coverage as a dependent. A Certificate of Premium Payment issued by PhilHealth and an updated PMRF and/ or proof of dependency may be attached to the medical claims to facilitate availment of benefits.

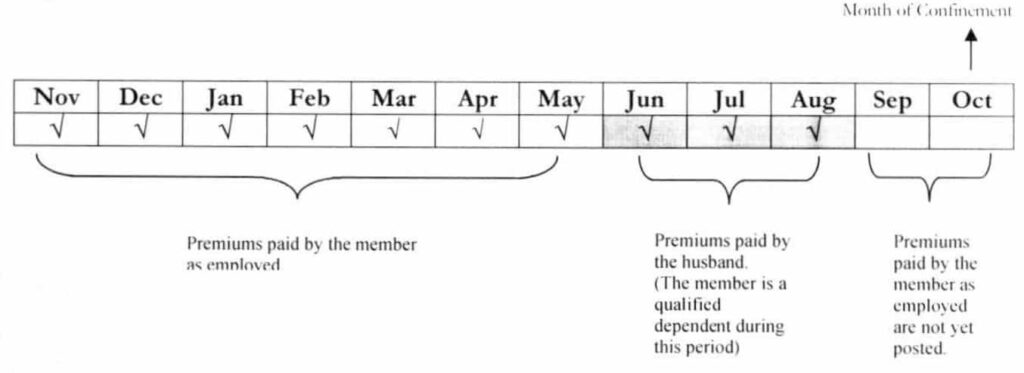

Example 1: A three-year old son of an employed member has been admitted due to Upper Respiratory Tract Infection. The said member has been employed since 2009 bur was separated from work last June 2018. She becomes employed again starting Sept. 2018. During the three months that she was unemployed, she was a qualified dependent of her employed husband.

Question: Is the dependent of the said member entitled to avail of the PhilHealth benefits?

Answer: Yes. The payment of the husband for Jun — Aug 2018, a period in which the member is a qualified dependent, may be counted as her qualifying contributions. With a total of ten (10) months contributions within the immediate twelve (12) month period or 10/12, the said member is eligible to avail of PhilHealth benefits. Since she is an eligible PhilHealth member, all her qualified dependents arc entitled to avail of the PhilHealth benefits.

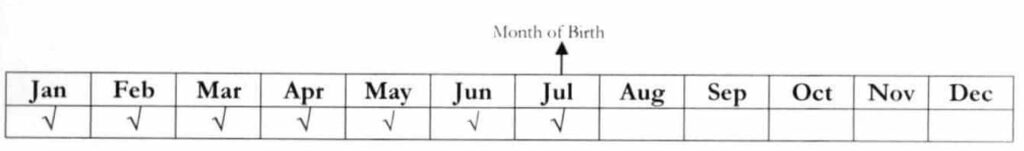

Example 2: Dependent-child turned 21 years old on July 1, 2018. The principal member (parent) is an active PhilHealth member with posted premium payments from January 2015 -July 2018.

Question: If the dependent-child enrolls on October 1, 2018 and will be admitted to the hospital on the same day, is he eligible to avail of PhilHealth benefits?

Answer: Yes. Payment was made during confinement and within the 3-month shifting period. Hence, premiums paid for such period shall be counted as qualifying contributions.

Question: If the dependent-child will be admitted to the hospital on November 1, 2018 and enrolls on November 5, 2018, is lie eligible to avail of PhilHealth benefits?

Answer: No. Payment was made beyond the shifting period. As such, only those payments made prior to the first day of availment shall be counted as qualifying contributions.

Example 3: A lifetime member has paid his premiums for Jan – Jul 2018. He died on July 3, 2018.

Question: If the surviving spouse will be admitted to the hospital on Dec. 5, 2018 and enrolls as principal member on Dec. 6, 2018, is she eligible to avail of PhilHealth benefits?

Answer: Yes. Since she has shifted from being a dependent to a principal member, her payments prior to hospital discharge shall be counted as qualifying contributions.

Question: If the surviving spouse will be admitted to the hospital on Mar. 16, 2018 and enrolls on Mar. 17, 2018, is she eligible to avail of PhilHealth benefits?

Answer: No, because the payment was made beyond the shifting period. Hence, the applicable policy requires that qualified contributions are only those remitted prior to the first day of availment or hospital confinement.

5. Declaration of dependents

Non-PhilHealth members and members without the required qualifying contributions may be declared as dependents. In case they decided to enroll/ shift as a member, the period in which they are covered as dependents may be counted as qualifying contributions. All qualified dependents of an eligible NHIP member are entitled to avail of the benefits, subject to existing pertinent policies.

Example: An informal economy member was admitted on August 28, 2018. I pon verification using the portal, she only has 6 months contributions within the immediate twelve (12) month period prior to the first day of her hospitalization. Her husband is an employed member for more than three years and with updated premium contributions.

Question: Considering that the informal economy member lacks the required qualifying contributions, is there a way that she can avail of the PhilHealth benefits?

Answer: To avail of the PhilHealth benefits, the member must write to PhilHealth requesting to change her membership category from member to dependent and attach an updated PhilHealth Member Registration f orm (PM RF) duly signed by her husband.

6. Application of 3/6 rule on benefit availment

The following members shall only be required at least three (3) months contributions within the immediate six (6) months prior to the first day of availment:

a. Newly-enrolled member whose membership to NHIP cover less than twelve (12) months reckoned from the initial date with posted payment; and

Example: A member has enrolled on Feb 28, 2018 under the informal economy. He paid for 1st Qtr. and 2nd Qtr. of 2018.

Question: If his admission falls on Sep. 20, 2018, can he avail of the benefits?

Answer: Yes. Since his membership to NHIP is less than 12 months starting from the month with first posted payment (Jan), he is only required 3/6 qualifying contributions prior to the first day of availment.

Question: If his admission has been moved to Dec. 2018, can he avail of the benefits?

Answer: No. Since the month of availment is already on the 12th month, the 3/6 rule is no longer applicable. Hence, the member lacks the required qualifying contributions of 9/12

b. First- time employees with less than twelve (12) months of employment

Question: Since she is a newly hired employee with less than 12 months of employment, the 3/6 rule shall apply. Unfortunately, the portal failed to establish her eligibility. How can she avail of the benefits?

Answer: The member may go to the nearest LHIO and request for a certificate of premium payments with note stating that she is a new member with less than 12 months of employment and has the required 3/6 qualifying contributions.

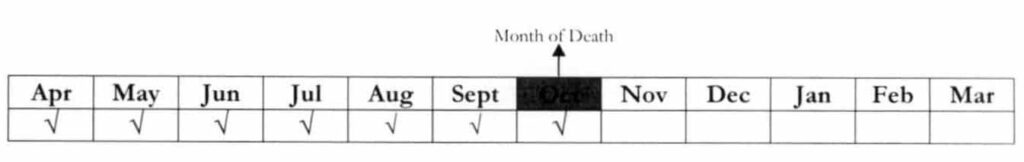

7. Entitlement of Dependents of a Deceased Member

The unexpired portion of coverage oj a deceased member may be used by dependent spouse and children in the counting of qualifying contributions and availment of PhilHealth benefits.

Example: An informal economy member has paid his premiums for 3 years (CY2017-CY2019). The member has expired on Nov. 25, 2017. One of his minor children is hospitalized on March 16, 2018.

Question: If the surviving spouse has not yet shifted from being a dependent to principal member, is there a way for the minor child to become eligible to PhilHealth benefits?

Answer: The minor child can avail of the benefits by using the unutilized portion of the benefits paid by the deceased member. Flence, all qualified dependents of the deceased member can avail of the benefits until December 31, 2019.

8. Retroactive Payment

Retroactive payment shall only be counted as qualifying contributions if paid prior to the first day of availment.

a. Formal Economy

Pursuant to PhilHealth Circular No. 32, s. 2003, employed members who are on leave without pay may remit their premium contribution for the applicable period in the amount equivalent to the rale of an informal economy member. Should the said member fails to remit bis/ her premium contributions within the calendar quarter, be/ she shall be given a grace period of one (1) calendar quarter immediately following the unpaid month(s) or quarter to pay retroactively the said premium.

Example: An employed member is on sick leave without pay from November to December 2018. Hence, he has no remitted premiums for the said period. Nevertheless, he can still pay the missed period based on the prescribed premium rate for the members of the informal economy. His membership tagging in the PhilHealth database shall remain as employed or member of the formal sector.

b. Informal Economy

i. Members who have missed/unpaid premium contributions for a maximum period of three consecutive months but have established nine (9) consecutive months of premium payments prior to the unpaid period shall be allowed to retroactively pay within one (1) month following the unpaid period.

Example: A member has missed the payment for Feb – Apr. 2018. Since she was able to establish 9 consecutive months of premium contributions (May 2017 – Jan. 2018), she was given until the last working day of May 2018 to pay for the missed period.

ii. Newly-enrolled informal economy members whose membership to NHIP cover less than nine (9) months reckoned from the initial date of posting of premium payment may be allowed to retroactively settle their premium payments within one (1) month immediately following the unpaid period.

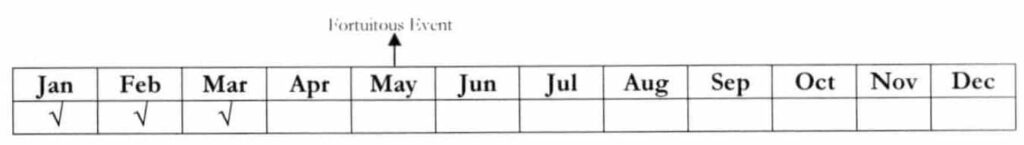

9. Members Covered by Fortuitous Events

Members granted with special privileges due to fortuitous events as per PhilHealth Circular No. 0034, s.2013 shall be allowed to pay their premiums within the extension period of premium payment. In case their confinement occurs within the extension period, they may pay for the applicable period prior to hospital discharge. Hence, such payments shall be counted as qualifying contributions.

Example: On May 5, 2018, Tarlac City was placed under the state of calamity. Granted with special privileges due to fortuitous event, the deadline of payment of premium contributions for 2nd quarter for the informal economy members has been extended until September 30, 2018. A resident will be admitted to the hospital on September 15, 2018.

Question: Is he/she eligible to avail of PhilHealth benefits?

Answer: If the member will remit his/her premiums (2nd & 3rd Quarter 2018) prior to hospital discharge and within the extension period, it shall be counted as qualifying contributions. Hence, the said member is eligible to avail of PhilHealth benefits.

Question: What if the deadline of payment will be extended until December 31, 2018?

Answer: With the privilege granted to members due to fortuitous event, all retroactive payments during the extension period if paid prior to hospital discharge shall be counted as qualifying contributions.