Attached herewith is the DepEd-DBM-DILG Joint Memorandum Circular No. 1, s. 2020 relative to the Addendum to DepEd-DBM-DILG Joint Memorandum Circular No. 1, s. 2017 entitled “Revised Guidelines on the Use of the Special Education Fund (SEF)”.

Item No. 1.1.2. of the said circular allows payment of expenses pertaining to the operation of schools, which may include, but not limited to utilities, communication expenses, scouting activities (jamboree, camping, hiking, outdoor activities, scout trainings and instructional drills/ exercises) of the Boy Scouts of the Philippines.

Kindly disseminate this information to all concerned under your respective areas of jurisdiction.

Table of Contents

ADDENDUM TO DepEd-DBM-DILG JC No. 1, s. 2017 DATED JANUARY 19, 2017, ENTITLED, “REVISED GUIDELINES ON THE USE OF THE SPECIAL EDUCATION FUND (SEF)”

In view of the passage of the Masustansyang Pagkain Para sa Batang Pitipmo Act (Republic Act [RA] No. 11037), and to amplify the policies on the use of the SEF to better support the supplementary budgetary needs of schools and learning centers, the following expenses shall likewise be allowed to be charged against the SEF, in addition to those already authorized under DepEd-DBM-DILG JC No. 1, s. 2017, as may be determined and approved by the Local School Board (LSB):

Funding for the implementation of the National Feeding Program for undernourished children in public day care, kindergarten and elementary schools, particularly for the following purposes:

- Supplemental Feeding Program for Day Care Children;

- School-Based Feeding Program;

- Milk Feeding Program;

- Micronutrient Supplements;

- Health Examination, Vaccination, and Deworming;

- Gulayan sa Paaralan

- Water, Sanitation, and Hygiene (WASH); and

- Integrated Nutrition Education, Behavioral Transformation, and Social Mobilization.

Operations and maintenance of public schools

- Payment of compensation/allowances of locally-hired dentists and/or dental aide positions to serve in public elementary and secondary schools; Provided, that the rates of compensation shall be determined by the LSB based on funds available, but not to exceed the salary schedule being implemented by the local government unit concerned; Provided further, that the grant of Magna Carta benefits to said personnel shall be subject to the provisions of DBM-Department of Health (DOH) JC No. 1, s. 2012, as amended by DBM-DOH JC No. 1, s. 2016; Provided finally, that for the purpose of hiring dentists and/or dental aides positions chargeable against the SEF, the LSB in each province, city and municipality shall strictly comply with the existing Civil Service laws, rules and regulations;

- Payment of expenses pertaining to the operation of schools, which may include, but not limited to, utilities, communication expenses, scouting activities (jamboree, camping, hiking, outdoor activities, scout trainings, and instructional drills/exercises) of the Boy Scouts of the Philippines and the Girl Scouts of the Philippines, programs to promote campus journalism, Parents-Teachers Association activities, Student Council Government Activities, and other extra-curricular activities that promote leadership and values as may be provided under the corresponding DepEd issuances. Such expenses may be included in the Maintenance and Other Operating Expenses allocation of schools;

- Payment of dental supplies and other related expenses pertaining to the operation of dental facilities in public elementary and secondary schools; and

- Establishment of dental facilities and acquisition of apparatus and/or equipment, subject to the prevailing requirements and specifications set by the DepEd, in consultation with the DOH.

Interpretation of the provisions of this JC shall be referred to the DepEd, DBM, and DILG for joint resolution.

All other provisions of DepEd-DBM-DILG JC No. 1, s. 2017 that are not inconsistent with this JC shall remain in full force and effect.

If, for any reason, any part or provision of this JC is declared invalid or unconstitutional, the other parts or provisions not affected thereby shall remain in full force and effect.

This JC shall take effect after fifteen (15) days from the completion of its publication in the Official Gazette or in a newspaper of general circulation.

DepEd-DBM-DILG Joint Memorandum Circular No. 1, s. 2020

REVISED GUIDELINES ON THE USE OF THE SPECIAL EDUCATION FUND (SEF)

Background

Under Republic Act (RA) No. 7160 (Local Government Code [LGC] of 1991), a province or city, or a municipality within the Metropolitan Manila Area, may levy and collect an annual tax of one percent (1%) on the assessed value of real property in addition to the basic real property tax. The additional 1% tax on real property collected in the province is shared equally by the province and the municipality within its territorial jurisdiction. On the other hand, cities keep all of their collection. The proceeds from this special levy accrue to the SEF and are automatically released to the LSBs.

The SEF provides the source of funds for the supplementary annual budgetary needs for the operation and maintenance of public schools within the province, city, or municipality through an annual SEF Budget. The formulation, approval, and utilization of the SEF Budget are the responsibility of the individual LSB in each province, city or municipality.

Previous circulars jointly issued by the DepEd, DBM, and DILG provide the general guidelines on the use of the SEF in implementation of RA No. 7160. Given the observed practices in the utilization of the SEF and current developments in the basic education sub-sector, particularly the K to 12 and early childhood care and development (ECCD) programs, there is a need to reiterate and refocus the policies on the use of the SEF to better support the supplementary budgetary needs of schools1 and learning centers.

Purpose

To update the policies and guidelines contained in previous JCs of the DepEd, DBM, and DILG (JC No. 1 s. 1998, JC No. 1-A s. 2000, JC No. 1-B s. 2001 and JC No. 4 s. 2001) on the use and purpose of the SEF as provided under RA No. 7160 and its Implementing Rules and Regulations (IRR); and

To ensure a more strategic and efficient utilization of resources for priority programs and projects which would complement, as well as reinforce, the budgeting priorities at the different levels of decisionmaking.

Legal Bases on the Use of the SEF

Section 272 of RA No. 7160 provides that the SEF shall be allocated to the following:

- Operation and maintenance of public schools;

- Construction and repair of school buildings;

- Facilities and equipment;

- Educational research;

- Purchase of books and periodicals; and

- Sports development.

Further, Section 100 (c) of the same law provides that the annual school board budget shall give priority to the following:

- Construction, repair, and maintenance of school buildings and other facilities of public elementary and secondary schools;

- Establishment and maintenance of extension classes where necessary; and

- Sports activities at the division, district, municipal, and barangay levels.

Section 7 (b) of RA No. 10410, otherwise known as the “Early Years Act of 2013”, provides that LGUs shall include allocations from their SEF for the ECCD Program.

Allowable Expenses Chargeable Against the SEF

In all instances, the allocation for the following expenditure items chargeable against the SEF shall be net of the budgetary provision for the same or related item(s) in the budget for the DepEd and the ECCD Council, and that which may be funded out of the Special Purpose Funds :

Operation and maintenance of public schools:

- Payment of compensation/allowances of teachers locally-hired in elementary and secondary schools identified to have shortages per the teacher deployment analysis of DepEd; the rates of compensation/allowances shall be determined by the LSB based on funds available, but not to exceed the salary schedule being implemented by the local government unit (LGU) concerned: Provided, that for the purpose of hiring teachers chargeable against the SEF, the LSB in each province, city or municipality shall utilize the list found in the Registry of Qualified Applicants (RQA);

- Payment of salaries/wages of utility workers and security guards hired in public elementary and secondary schools which have not been provided such position in the DepEd budget; and

- Payment of expenses pertaining to the operation of schools, which may include utilities and communication expenses.

Construction and repair of school buildings:

- Construction, repair and maintenance of school buildings and other facilities for public elementary and secondary schools, which are deemed to have shortage of classrooms or of other facilities, as the case may be, per DepEd classroom deployment analysis, subject to existing standards/specifications set by DepEd and/or Department of Public Works and Highways; furthermore, this item shall be given priority in the SEF Budget; and

- Acquisition and titling of school sites.

Facilities and equipment:

- Acquisition of laboratory, technical and similar apparatus, and information technology equipment and corollary supporting services (e.g. internet connection, maintenance, etc.), subject to the prevailing requirements and specifications set by the DepEd.

Educational research:

- Educational research other than the research subject areas funded in the DepEd budget, subject to the prevailing policies and guidelines of the DepEd.

Purchase of books and periodicals:

- Purchase of library books and periodicals for the libraries of the different elementary and secondary schools in the province, city, and municipality, and purchase of instructional materials, workbooks and textbooks needed by public elementary and secondary schools, subject to the prevailing policies and guidelines of the DepEd.

Sports development:

- Expenses for school sports activities at the national, regional, division, district, municipal and barangay levels, as well as for other DepEd related activities, subject to the prevailing requirements and specifications set by the DepEd.

Funding for the ECCD Program, particularly for the following purposes:

- Direct services related to the implementation of the ECCD program, such as salaries/allowances of locally-hired Child Development Teachers and/or Day Care Workers, etc.;

- Organization and support of parent cooperatives to establish community-based ECCD programs;

- Provision of counterpart funds for the continuing professional development of ECCD public service providers;

- Provision of facilities for the conduct of the ECCD Program; and

- Payment of expenses pertaining to the operations of National Child Development Centers, including, but not limited to, utilities (/.e. electricity and water expenses) and communication (/.e. telephone expenses).

Planning and Budgeting for the SEF

The LSB shall formulate a three-year program indicating strategic prioritization policies in the allocation of the SEF to schools taking into consideration equitable sharing, priority needs and such factors as enrollment ratio, distance of the schools, performance, drop-out rate, and location of schools, as well as the goals and objectives of the LGU’s Comprehensive Development Plan (CDP), and the expenditures, programs, projects and activities in the LGU’s Local Development Investment Program (LDIP) prior to the formulation and preparation of its Annual Budget for the incoming year. It is understood that the DepEd representative to the LSB shall be responsible for coordinating municipal/city school plans with that of the province and ensuring that the School Improvement Plan (SIP) and the Division Education Development Plan (DEDP) are formulated collaboratively with the stakeholders in the community.

The LSB in each province, city, or municipality shall be responsible for the preparation and approval of the annual budgetary requirements of the public schools based on the DepEd-approved SIP and DEDP in the implementation of ECCD Program, kindergarten, elementary and secondary, formal and non-formal education programs, chargeable to their respective SEFs.

All expenditure items to be included in the SEF Budget shall be among those provided under Section 4.0 hereof and contained in the approved SIP and DEDP.

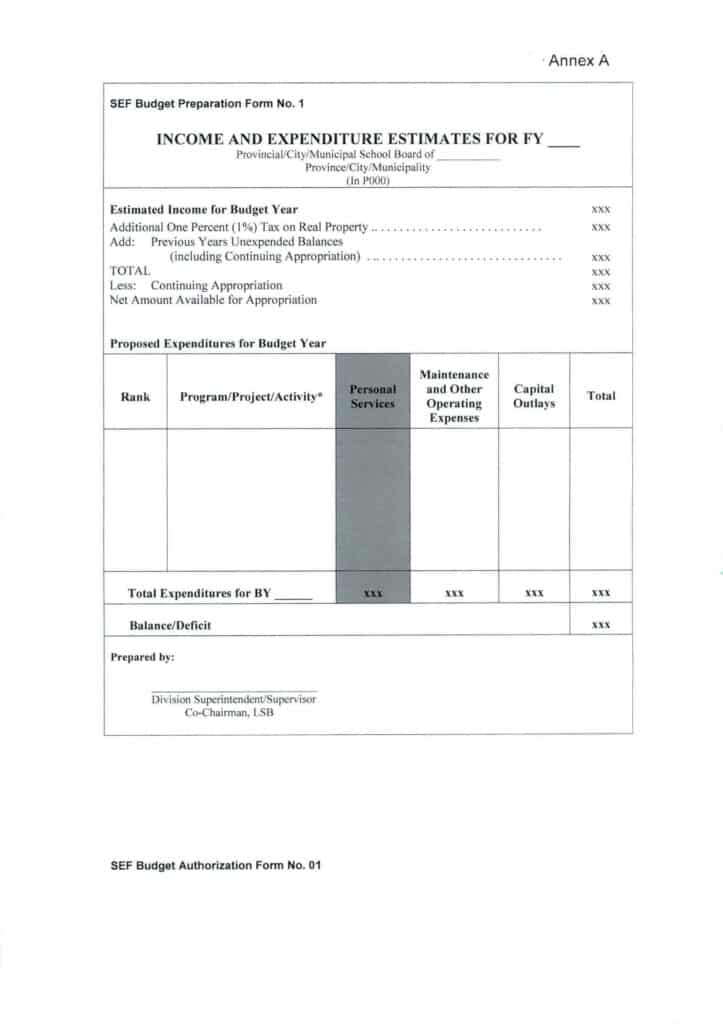

The SEF Budget shall be presented by program, activity and project (P/A/P), by allotment class and per school using SEF Budget Preparation Form No. 1 (Annex A).

The provincial SEF Budget shall, as much as possible, fill the funding gap in the needs of all the public schools covered by the province.

The corollary budget allocation shall be complementary to the budget of the national programs.

The LSB shall consider the following in the preparation of the SEF Budget:

Recommendation of the DepEd PSDS and SDS as well as the priorities indicated in the SIPs and DEDPs vis-a-vis the information from the DepEd Regional Office (RO) on the allocation of each school from the National Budget for the current year and the ensuing year as contained in the National Expenditure Program;

The report of the school heads on the state of education at the start of every school year, which will provide an annual progress report on the SIP and cover, among others, the basic education performance indicators and audited financial reports of his/her school, including funds it received during the previous school year from national, local, and community-based sources, as well as the disposition of these funds; and

The relevant expenditures, P/A/Ps of the current LDIP and Annual Investment Program of the LGU.

The approval of the SEF Budget shall be through an LSB Resolution, signed by the Chair and Co-Chair and majority of all its members, pursuant to Section 100 (b) of RA No. 7160.

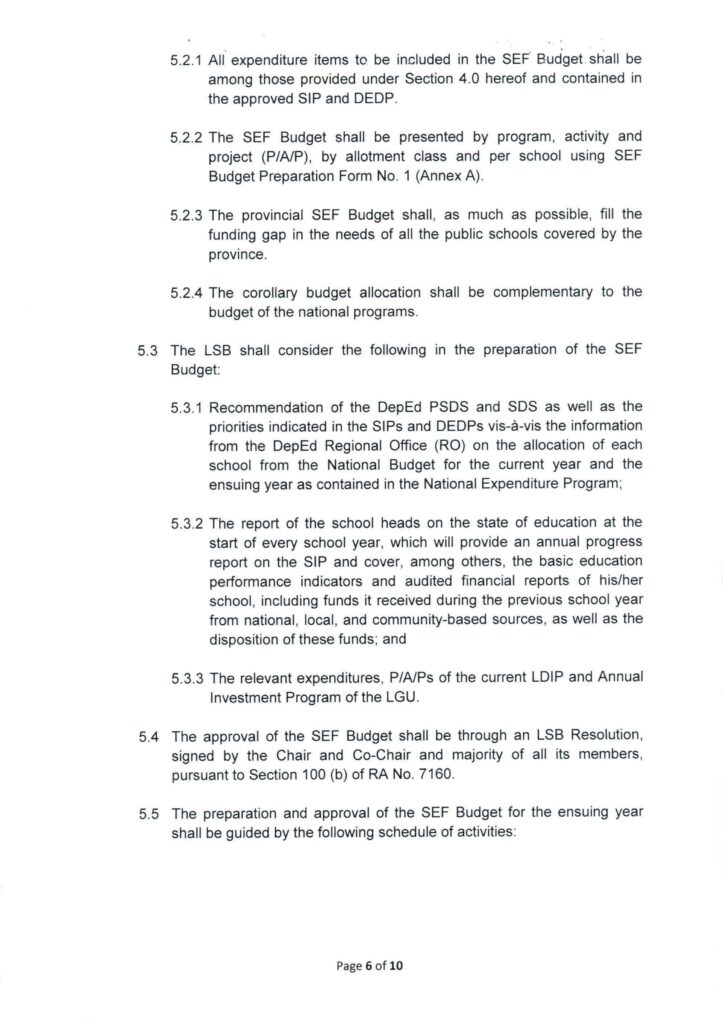

The preparation and approval of the SEF Budget for the ensuing year shall be guided by the following schedule of activities:

| Activities | Person/s Responsible | Indicative Timelines |

|---|---|---|

| Submit a report covering the period January 1 to December 31 of the preceding year to the LSB and DepEd Central Office (CO) containing the following information: 1. Amount of resources allocated to the individual schools from the annual appropriations of the national government (DepEd budget, allocation from the SPFs, and from other items); 2. Results of analysis of teacher shortage or teacher : student ratio by school; 3. Schedule of construction of classroom by school from all sources / funds; and Indicators of school performance including 4. National Achievement Test (NAT) results and drop-out rates. | DepEd SDS | Not later than March 31 of the current year |

| Submission to the LSB of the certified statement containing the following: 1. actual SEF Income for the immediately preceding fiscal year; 2. actual SEF income for the first two quarters of the current year; 3. the estimated SEF income for the last two quarters of the current year; and 4. the annual estimates for the ensuing year. | Local Treasurer and Local Accountant | Not later than July 15 of the current year |

| Formulate and issue budget prioritization policies and tentative budget ceilings per municipality/city/province thru a Budget Call | LSB | Not later than July 31 of the current year |

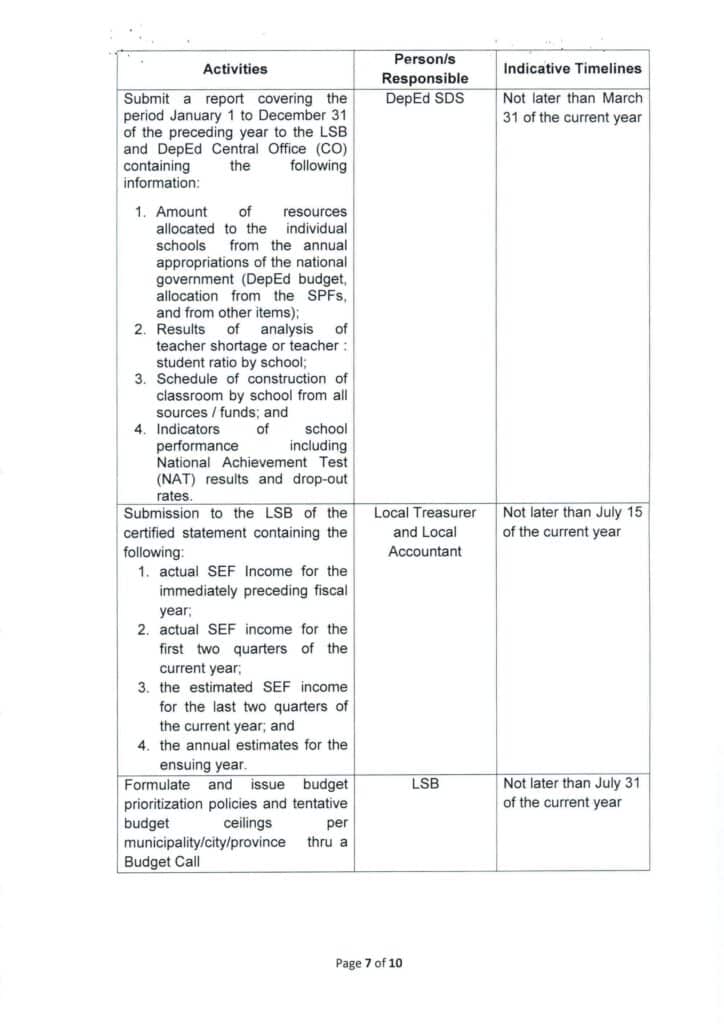

| Submission by elementary and secondary schools of requests for funding for the ensuing budget year to the DepEd PSDS (for municipal school boards) or the SDS concerned (for city school boards). | Heads of elementary (including kindergarten) and secondary schools | Not later than August 31 of the current year |

| Consultation / Discussion / Hearing with schools concerned and other stakeholders; | DepEd PSDS and SDS | September 1 to September 30 of the current year |

| Consolidation of budget requests from all schools in the LGU (city / municipality) for the ensuing budget year. | ||

| Review and approval of the SEF Budget by for the ensuing year through an LSB Resolution approved by the majority of all LSB members. | Municipal/City LSB | Not later than October 31 of the current year (Earlier approval of SEF Budget for municipalities will allow Provincial LSBs to consider augmentation to municipalities in the review of the provincial SEF Budget) |

| Submission of the following to the Provincial LSB: 1. Consolidated approved municipal/city SEF Budgets; and 2. List of proposals not funded in the municipal/city SEF Budgets | DepEd SDS | Not later than seven (7) days after the approval of the SEF Budget |

| Review of proposals not funded in the approved SEF Budget of the City/Municipality taking into consideration the priorities contained in the DEDP. | Provincial LSB | Not later than November 30 of the current year |

| Approval of the Provincial SEF Budget by Province through an LSB Resolution approved by the majority of all LSB members. | ||

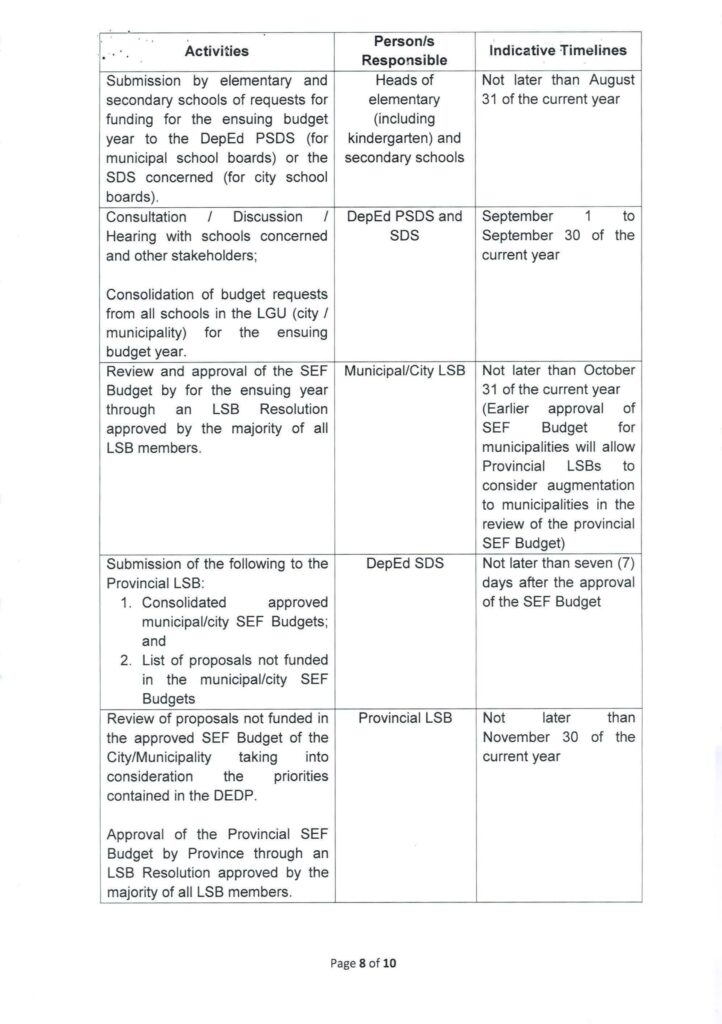

| Submission of approved SEF Budgets to DepEd Central Office | DepEd SDS | Not later than December 31 of the current year |

Monitoring, Transparency and Accountability in the Allocation and Utilization of the SEF

To promote and enhance transparency and accountability in the allocation and utilization of the SEF, the parties concerned shall comply with the following:

| Activities and Documents | Person/s Responsible | Indicative Timelines |

|---|---|---|

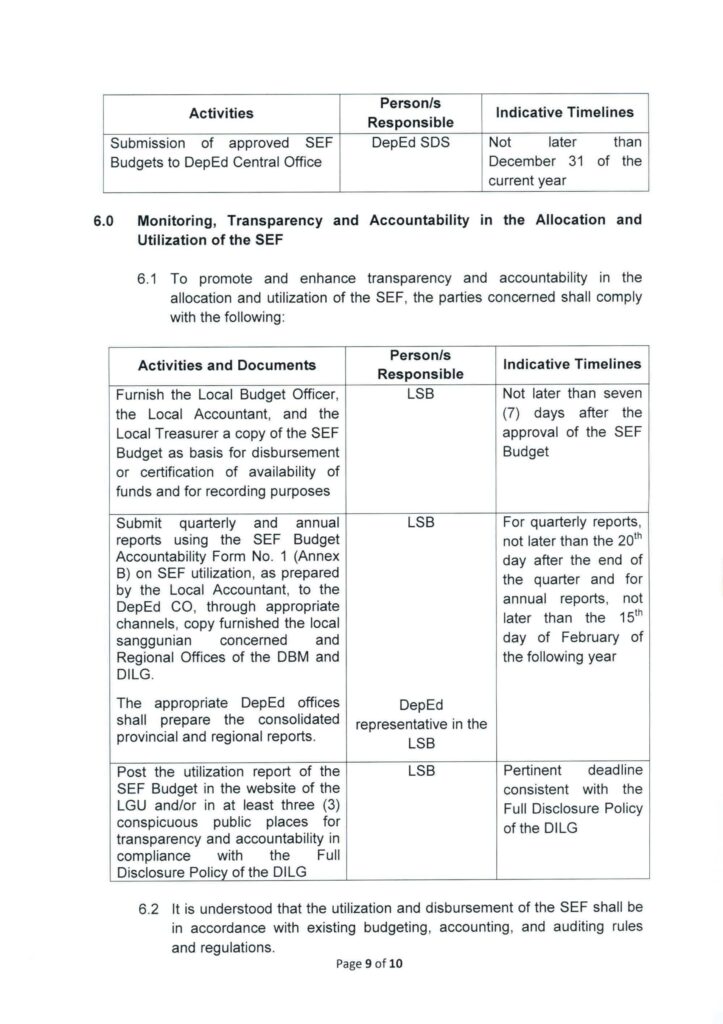

| Furnish the Local Budget Officer, the Local Accountant, and the Local Treasurer a copy of the SEF Budget as basis for disbursement or certification of availability of funds and for recording purposes | LSB | Not later than seven (7) days after the approval of the SEF Budget |

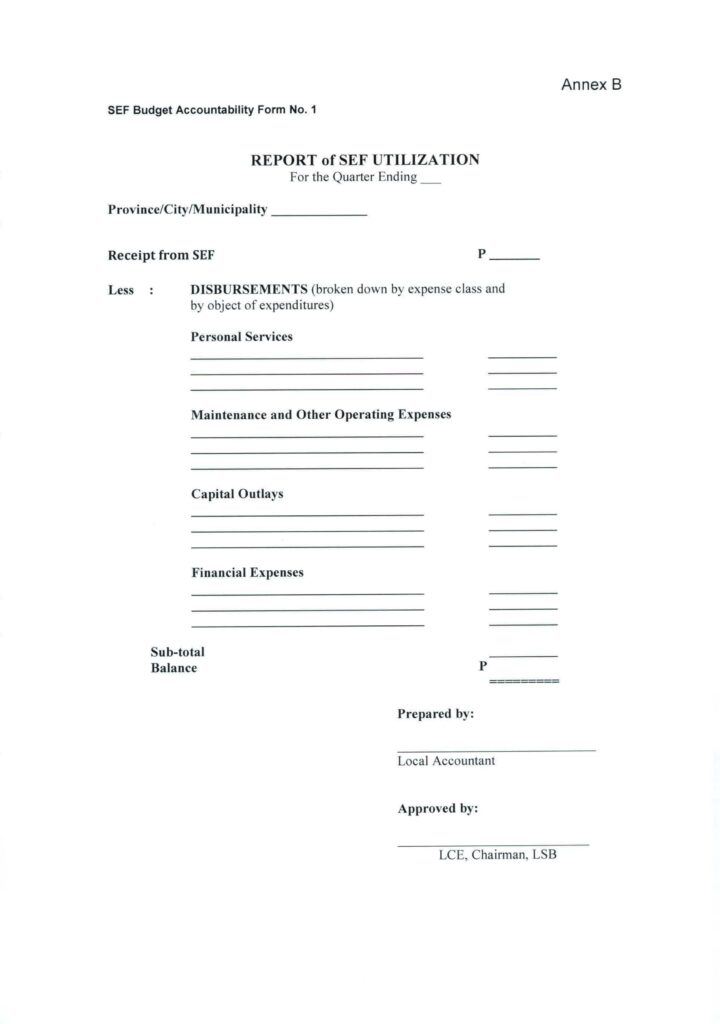

| Submit quarterly and annual reports using the SEF Budget Accountability Form No. 1 (Annex B) on SEF utilization, as prepared by the Local Accountant, to the DepEd CO, through appropriate channels, copy furnished the local sanggunian concerned and Regional Offices of the DBM and DILG. | LSB | For quarterly reports, not later than the 20th day after the end of the quarter and for annual reports, not later than the 15th day of February of the following year |

| The appropriate DepEd offices shall prepare the consolidated provincial and regional reports. | DepEd representative in the LSB | |

| Post the utilization report of the SEF Budget in the website of the LGU and/or in at least three (3) conspicuous public places for transparency and accountability in compliance with the Full Disclosure Policy of the DILG | LSB | Pertinent deadline consistent with the Full Disclosure Policy of the DILG |

It is understood that the utilization and disbursement of the SEF shall be in accordance with existing budgeting, accounting, and auditing rules and regulations.

Procurement charged to SEF shall follow the rules and procedures under RA No. 9184 (Government Procurement Reform Act), its IRR and Government Procurement Policy Board guidelines.

Issues for Resolution

Interpretation of the provisions in this JC, including cases not covered herein shall be referred to the DepEd – Central Office for final resolution by the DepEd, DBM and DILG.

Repealing Clause

All circulars on SEF that are not consistent with this JC are hereby repealed or amended accordingly.

Effectivity

This JC shall take effect immediately upon publication.