Attached herewith is Annex A (Financial Education Core Messages for Integration) of DepEd Order No. 22, s. 2021 dated June 03, 2021, on the Financial Education Policy.

Financial Education in the Philippine K to 12 Basic Education Curriculum shall be integrated through the contextualization of Financial Education Concepts and Skills labeled as “Core Messages” within the K to 12 Learning Competencies labeled as “Entry Points”. The following principles shall be adopted in the integration process:

a. The Financial Education Concepts and Core Messages shall be integrated without changing existing learning competencies in the learning areas of the K to 12 Basic Education Curriculum. There shall be no changes in the content standards of each learning area during the integration process.

b. Financial Education Core Messages (Annex A) shall be integrated in identified Entry Points within learning areas across grade levels, whenever feasible, and with due consideration to degrees of difficulty. Integration shall be done through contextualization (localization and/ or indigenization) of the Financial Education Concepts and Core Messages during classroom instruction, discussions and/or activities.

c. Lesson Exemplars in each learning area shall be provided as resources and/or reference for lesson delivery. These exemplars, with relevant supplemental tools, shall be used by teachers to guide the integration of relevant Financial Education Concepts and Core Messages in the lessons. These exemplars may be contextualized whenever applicable. Sample exemplars are listed in DepEd Memorandum No. 32 s. 2019 (Annex B) and DepEd Memorandum No. 107 s. 2019 (Annex C).

d. Integration shall be operationalized through the contextualization, in particular through the conduct, implementation or use of any of the following items, in appropriate phase/s of lesson delivery:

- Drills, exercises, activities, and tools relevant to the Financial Education Concepts and Core Messages;

- Examples of finance-related concepts relevant to the actual experiences of the learners;

- Valuing process focusing on financial decisions;

- Contextualized financial situations and environment;

- Inclusion of Financial Education Concepts and financial capability indicators in different forms of learning assessments; and

- Performance outputs where Core Messages are deemed applicable.

e. Learning materials, tools and activities produced and donated by public and private sector partners of DepEd may be used; provided that these materials, tools activities, are aligned with the provisions of this Policy and do not present potential conflicts of interest. Teachers may adopt and/or improve these materials, tools and activities to contextualize the integration of Financial Education Concepts and Core Messages, consistent with this Policy.

f. The integration shall emphasize the main objectives of Financial Education to allow the learners to:

- understand the value of money and resources;

- understand how money and resources are acquired or generated;

- plan and manage the use of money and resources;

- save and share money and resources, and

- apply classroom lessons through financial inclusion mechanisms, (i.e., opening savings accounts, managing financial resources prudently, etc.)

READ MORE HERE: DepEd Financial Education Policy (DepEd Order No. 22, s. 2021)

Table of Contents

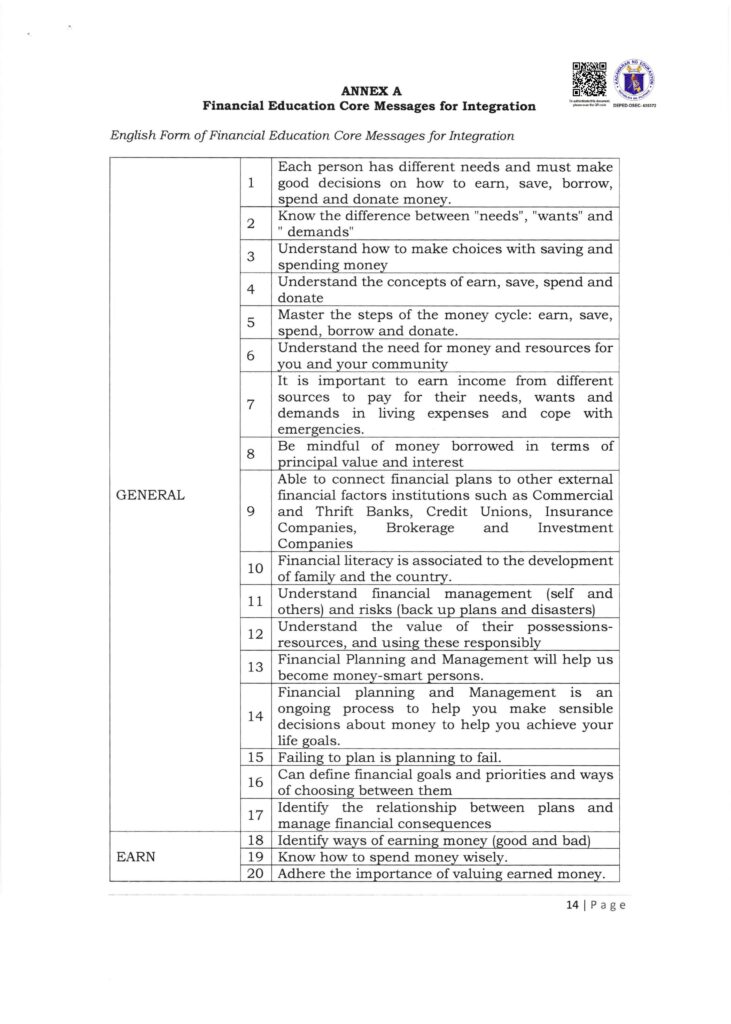

English Form of DepEd Financial Education Core Messages for Integration

GENERAL

- Each person has different needs and must make good decisions on how to earn, save, borrow, spend and donate money.

- Know the difference between “needs”, “wants” and ” demands”

- Understand how to make choices with saving and spending money

- Understand the concepts of earn, save, spend and donate

- Master the steps of the money cycle: earn, save, spend, borrow and donate.

- Understand the need for money and resources for you and your community

- It is important to earn income from different sources to pay for their needs, wants and demands in living expenses and cope with emergencies.

- Be mindful of money borrowed in terms of principal value and interest

- Able to connect financial plans to other external financial factors institutions such as Commercial and Thrift Banks, Credit Unions, Insurance Companies, Brokerage and Investment Companies

- Financial literacy is associated to the development of family and the country.

- Understand financial management (self and others) and risks (back up plans and disasters)

- Understand the value of their possessions-resources, and using these responsibly

- Financial Planning and Management will help us become money-smart persons.

- Financial planning and Management is an ongoing process to help you make sensible decisions about money to help you achieve your life goals.

- Failing to plan is planning to fail.

- Can define financial goals and priorities and ways of choosing between them

- Identify the relationship between plans and manage financial consequences

EARN

- Identify ways of earning money (good and bad)

- Know how to spend money wisely.

- Adhere the importance of valuing earned money.

- Money is hard-earned and easy to spend.

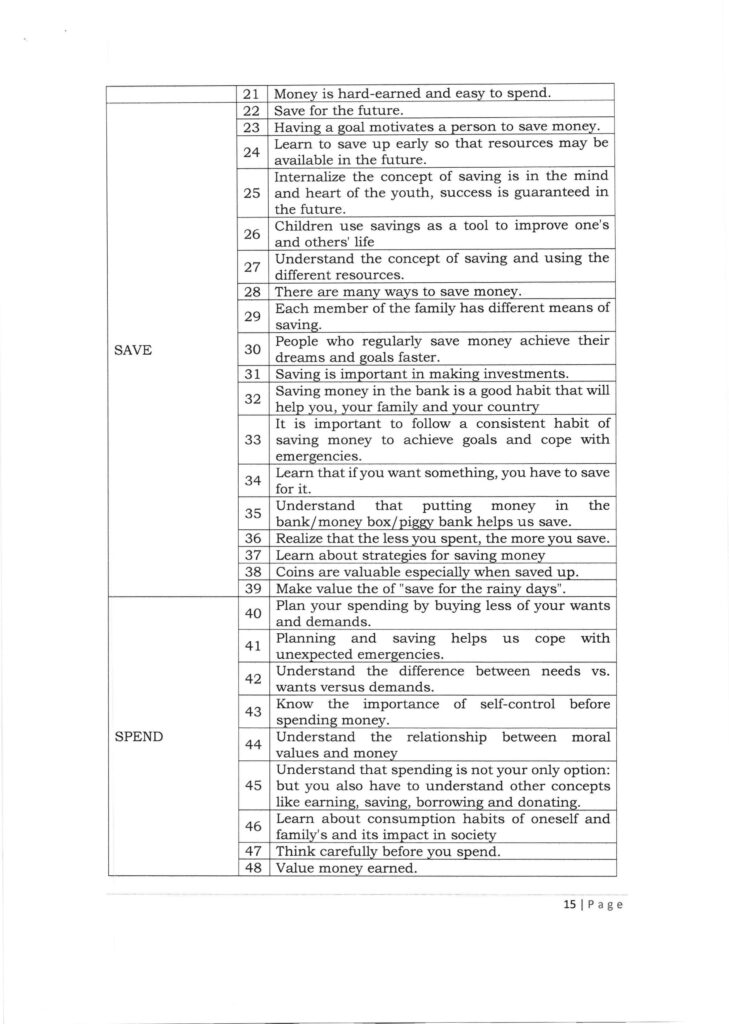

SAVE

- Save for the future.

- Having a goal motivates a person to save money.

- Learn to save up early so that resources may be available in the future.

- Internalize the concept of saving is in the mind and heart of the youth, success is guaranteed in the future.

- Children use savings as a tool to improve one’s and others’ life

- Understand the concept of saving and using the different resources.

- There are many ways to save money.

- Each member of the family has different means of saving.

- People who regularly save money achieve their dreams and goals faster.

- Saving is important in making investments.

- Saving money in the bank is a good habit that will help you, your family and your country

- It is important to follow a consistent habit of saving money to achieve goals and cope with emergencies.

- Learn that if you want something, you have to save for it.

- Understand that putting money in the bank/money box/piggy bank helps us save.

- Realize that the less you spent, the more you save.

- Learn about strategies for saving money

- Coins are valuable especially when saved up.

- Make value the of “save for the rainy days”.

SPEND

- Plan your spending by buying less of your wants and demands.

- Planning and saving helps us cope with unexpected emergencies.

- Understand the difference between needs vs. wants versus demands.

- Know the importance of self-control before spending money.

- Understand the relationship between moral values and money

- Understand that spending is not your only option: but you also have to understand other concepts like earning, saving, borrowing and donating.

- Learn about consumption habits of oneself and family’s and its impact in society

- Think carefully before you spend.

- Value money earned.

- Money is a limited resource that must be spent wisely.

- Learn that sometimes you have to wait to get what you want.

- Credit is a sum of money that a person or a bank lends to you. Normally you are required to pay an additional amount called interest when you return or pay the loan back. The borrowed sum plus interest must be paid on time and, if possible, in full, to avoid additional interest charges and penalties.

- Debt should be used for beneficial goals and investments.

- Debt is sometimes unavoidable

- Debts MUST be paid so borrow only what you can afford to pay

- Have a clear plan on how to pay a debt

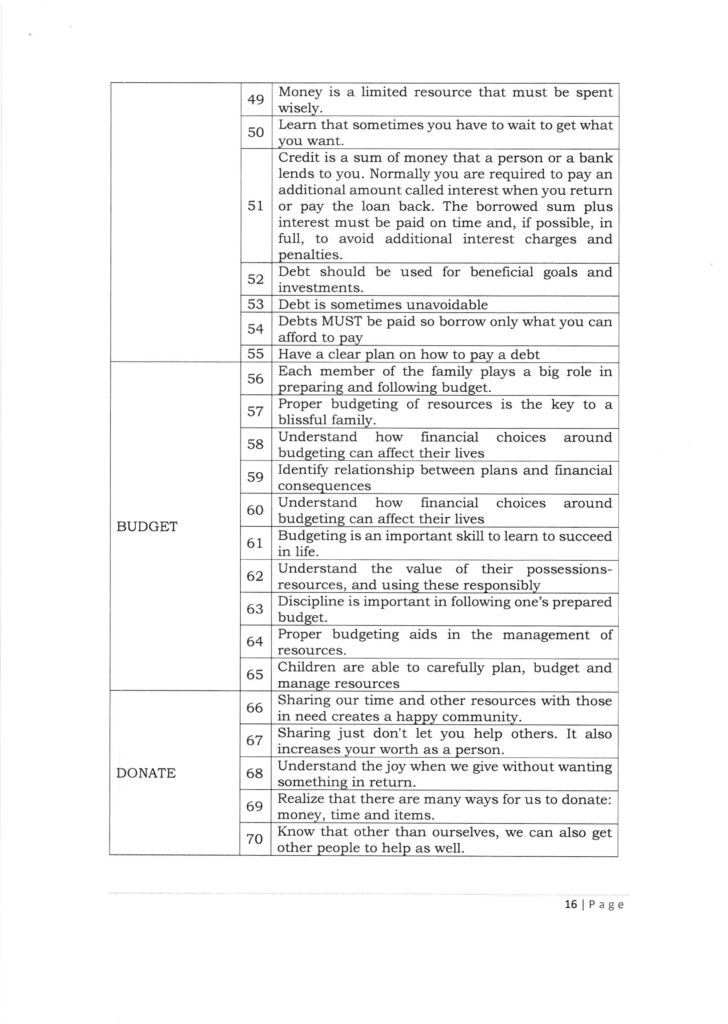

BUDGET

- Each member of the family plays a big role in preparing and following budget.

- Proper budgeting of resources is the key to a blissful family.

- Understand how financial choices around budgeting can affect their lives

- Identify relationship between plans and financial consequences

- Understand how financial choices around budgeting can affect their lives

- Budgeting is an important skill to learn to succeed in life.

- Understand the value of their possessions-resources, and using these responsibly

- Discipline is important in following one’s prepared budget.

- Proper budgeting aids in the management of resources.

- Children are able to carefully plan, budget and manage resources

DONATE

- Sharing our time and other resources with those in need creates a happy community.

- Sharing just don’t let you help others. It also increases your worth as a person.

- Understand the joy when we give without wanting something in return.

- Realize that there are many ways for us to donate: money, time and items.

- Know that other than ourselves, we can also get other people to help as well.

- Learn that helping people in need will make this world a better place.

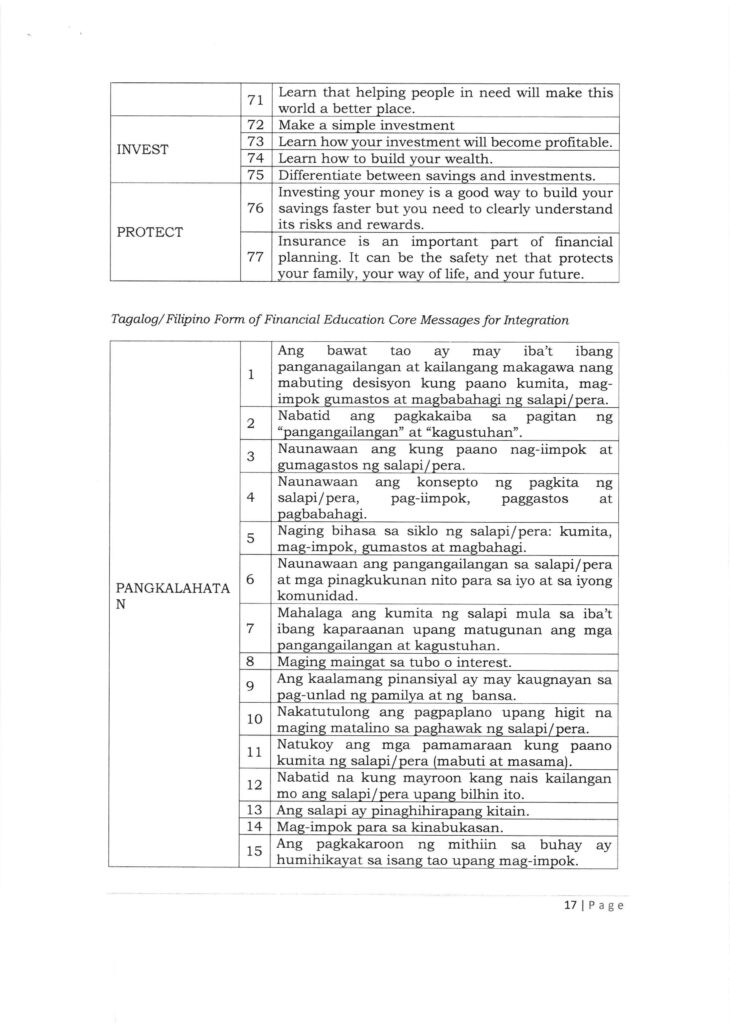

INVEST

- Make a simple investment

- Learn how your investment will become profitable.

- Learn how to build your wealth.

- Differentiate between savings and investments.

PROTECT

- Investing your money is a good way to build your savings faster but you need to clearly understand its risks and rewards.

- Insurance is an important part of financial planning. It can be the safety net that protects your family, your way of life, and your future.

Tagalog/Filipino Form of DepEd Financial Education Core Messages for Integration

PANGKALAHATAN

- Ang bawat tao ay may iba’t ibang panganagailangan at kailangang makagawa nang mabuting desisyon kung paano kumita, mag-impok gumastos at magbabahagi ng salapi/pera.

- Nabatid ang pagkakaiba sa pagitan ng “pangangailangan” at “kagustuhan”.

- Naunawaan ang kung paano nag-iimpok at gumagastos ng salapi/pera.

- Naunawaan ang konsepto ng pagkita ng salapi/pera, pag-iimpok, paggastos at pagbabahagi.

- Naging bihasa sa siklo ng salapi/pera: kumita, mag-impok, gumastos at magbahagi.

- Naunawaan ang pangangailangan sa salapi/pera at mga pinagkukunan nito para sa iyo at sa iyong komunidad.

- Mahalaga ang kumita ng salapi mula sa iba’t ibang kaparaanan upang matugunan ang mga pangangailangan at kagustuhan.

- Maging maingat sa tubo o interest.

- Ang kaalamang pinansiyal ay may kaugnayan sa pag-unlad ng pamilya at ng bansa.

- Nakatutulong ang pagpaplano upang higit na maging matalino sa paghawak ng salapi/pera.

- Natukoy ang mga pamamaraan kung paano kumita ng salapi/pera (mabuti at masama).

- Nabatid na kung mayroon kang nais kailangan mo ang salapi/pera upang bilhin ito.

- Ang salapi ay pinaghihirapang kitain.

- Mag-impok para sa kinabukasan.

- Ang pagkakaroon ng mithiin sa buhay ay humihikayat sa isang tao upang mag-impok.

- Matutong mag-impok habang bata upang may mapagkukunan sa kinabukasan.

- Kung ang konsepto ng pag-iimpok ay nasa isip at puso ng kabataan matitiyak ang tagumpay sa kinabukasan.

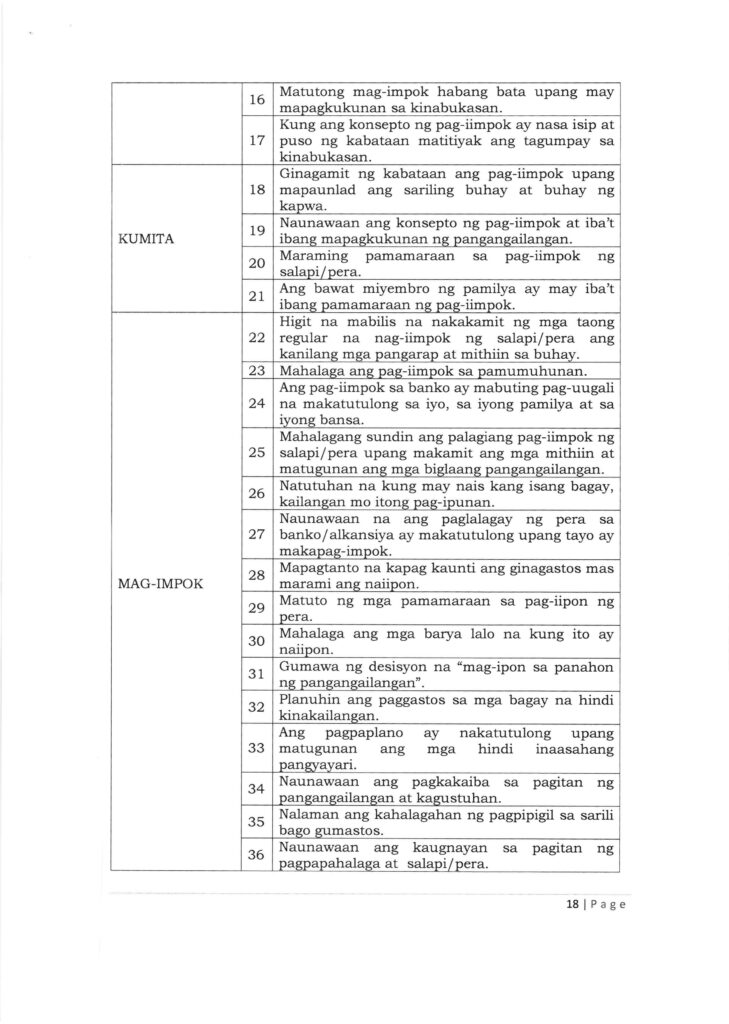

KUMITA

- Ginagamit ng kabataan ang pag-iimpok upang mapaunlad ang sariling buhay at buhay ng kapwa.

- Naunawaan ang konsepto ng pag-iimpok at iba’t ibang mapagkukunan ng pangangailangan.

- Maraming pamamaraan sa pag-iimpok ng salapi/pera.

- Ang bawat miyembro ng pamilya ay may iba’t ibang pamamaraan ng pag-iimpok.

MAG-IMPOK

- Higit na mabilis na nakakamit ng mga taong regular na nag-iimpok ng salapi/pera ang kanilang mga pangarap at mithiin sa buhay.

- Mahalaga ang pag-iimpok sa pamumuhunan.

- Ang pag-iimpok sa banko ay mabuting pag-uugali na makatutulong sa iyo, sa iyong pamilya at sa iyong bansa.

- Mahalagang sundin ang palagiang pag-iimpok ng salapi/pera upang makamit ang mga mithiin at matugunan ang mga biglaang pangangailangan.

- Natutuhan na kung may nais kang isang bagay, kailangan mo itong pag-ipunan.

- Naunawaan na ang paglalagay ng pera sa banko/alkansiya ay makatutulong upang tayo ay makapag-impok.

- Mapagtanto na kapag kaunti ang ginagastos mas marami ang naiipon.

- Matuto ng mga pamamaraan sa pag-iipon ng pera.

- Mahalaga ang mga barya lalo na kung ito ay naiipon.

- Gumawa ng desisyon na “mag-ipon sa panahon ng pangangailangan”.

- Planuhin ang paggastos sa mga bagay na hindi kinakailangan.

- Ang pagpaplano ay nakatutulong upang matugunan ang mga hindi inaasahang pangyayari.

- Naunawaan ang pagkakaiba sa pagitan ng pangangailangan at kagustuhan.

- Nalaman ang kahalagahan ng pagpipigil sa sarili bago gumastos.

- Naunawaan ang kaugnayan sa pagitan ng pagpapahalaga at salapi/pera.

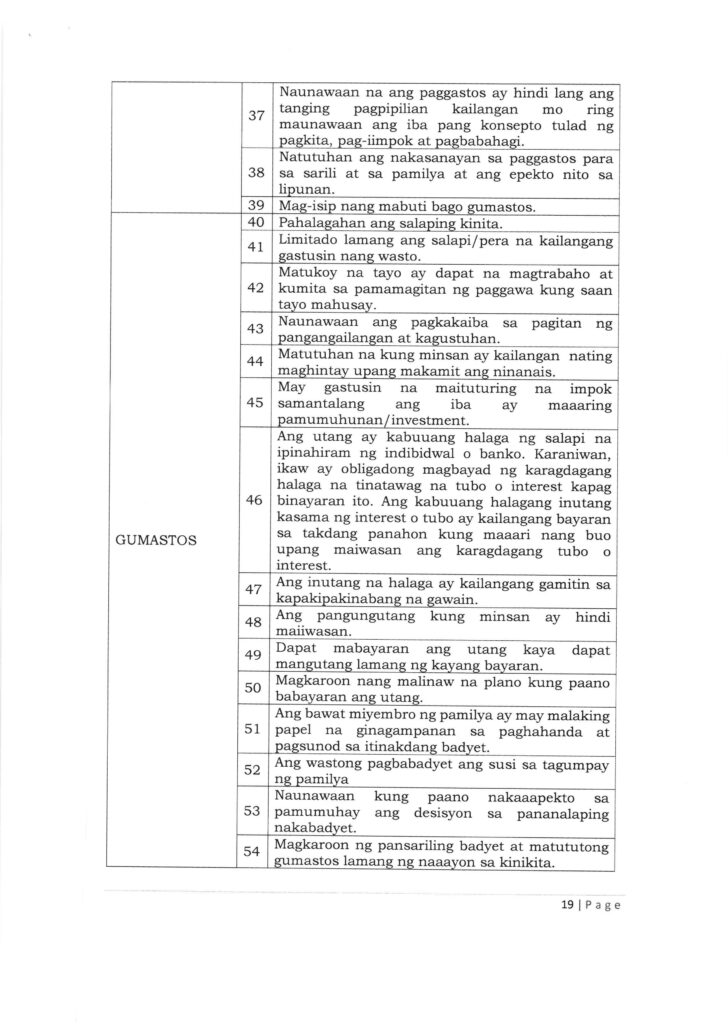

- Naunawaan na ang paggastos ay hindi lang ang tanging pagpipilian kailangan mo ring maunawaan ang iba pang konsepto tulad ng pagkita, pag-iimpok at pagbabahagi.

- Natutuhan ang nakasanayan sa paggastos para sa sarili at sa pamilya at ang epekto nito sa lipunan.

- Mag-isip nang mabuti bago gumastos.

GUMASTOS

- Pahalagahan ang salaping kinita.

- Limitado lamang ang salapi/pera na kailangang gastusin nang wasto.

- Matukoy na tayo ay dapat na magtrabaho at kumita sa pamamagitan ng paggawa kung saan tayo mahusay.

- Naunawaan ang pagkakaiba sa pagitan ng pangangailangan at kagustuhan.

- Matutuhan na kung minsan ay kailangan nating maghintay upang makamit ang ninanais.

- May gastusin na maituturing na impok samantalang ang iba ay maaaring pamumuhunan / investment.

- Ang utang ay kabuuang halaga ng salapi na ipinahiram ng indibidwal o banko. Karaniwan, ikaw ay obligadong magbayad ng karagdagang halaga na tinatawag na tubo o interest kapag binayaran ito. Ang kabuuang halagang inutang kasama ng interest o tubo ay kailangang bayaran sa takdang panahon kung maaari nang buo upang maiwasan ang karagdagang tubo o interest.

- Ang inutang na halaga ay kailangang gamitin sa kapakipakinabang na gawain.

- Ang pangungutang kung minsan ay hindi maiiwasan.

- Dapat mabayaran ang utang kaya dapat mangutang lamang ng kayang bayaran.

- Magkaroon nang malinaw na piano kung paano babayaran ang utang.

- Ang bawat miyembro ng pamilya ay may malaking papel na ginagampanan sa paghahanda at pagsunod sa itinakdang badyet.

- Ang was tong pagbabadyet ang susi sa tagumpay ng pamilya

- Naunawaan kung paano nakaaapekto sa pamumuhay ang desisyon sa pananalaping nakabadyet.

- Magkaroon ng pansariling badyet at matututong gumastos lamang ng naaayon sa kinikita.

- Matukoy ang relasyon sa pagitan ng pagpaplano at kinahinatnang pinansiyal.

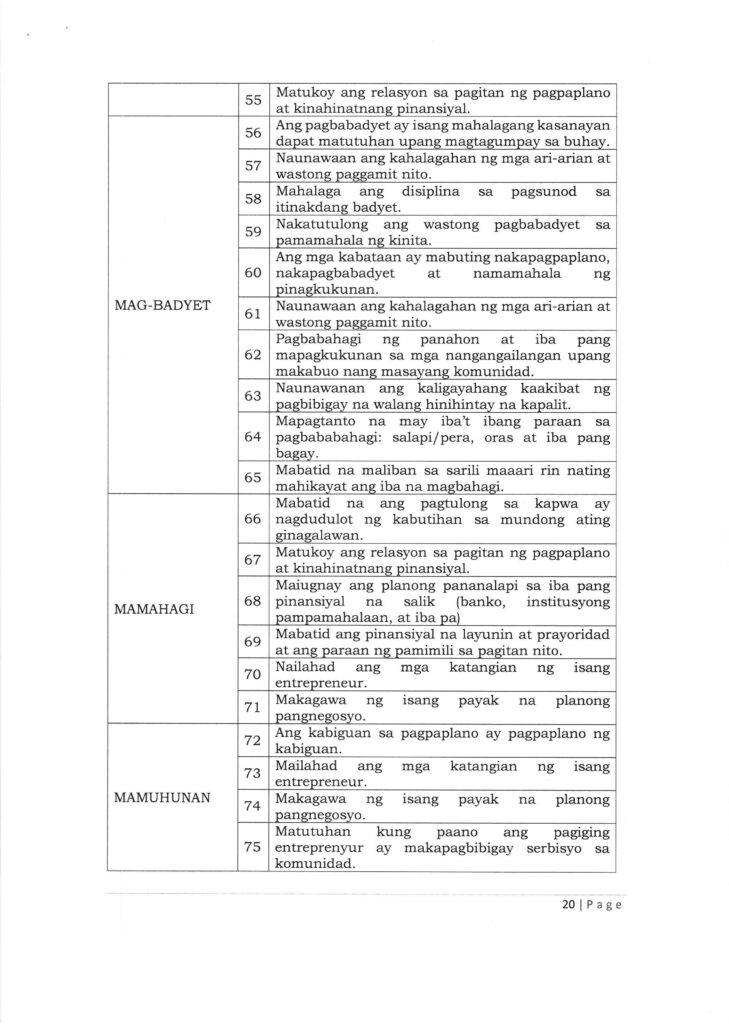

MAG-BADYET

- Ang pagbabadyet ay isang mahalagang kasanayan dapat matutuhan upang magtagumpay sa buhay.

- Naunawaan ang kahalagahan ng mga ari-arian at wastong paggamit nito.

- Mahalaga ang disiplina sa pagsunod sa itinakdang badyet.

- Nakatutulong ang wastong pagbabadyet sa pamamahala ng kinita.

- Ang mga kabataan ay mabuting nakapagpaplano, nakapagbabadyet at namamahala ng pinagkukunan.

- Naunawaan ang kahalagahan ng mga ari-arian at wastong paggamit nito.

- Pagbabahagi ng panahon at iba pang mapagkukunan sa mga nangangailangan upang makabuo nang masayang komunidad.

- Naunawanan ang kaligayahang kaakibat ng pagbibigay na walang hinihintay na kapalit.

- Mapagtanto na may iba’t ibang paraan sa pagbababahagi: salapi/pera, oras at iba pang bagay.

- Mabatid na maliban sa sarili maaari rin nating mahikayat ang iba na magbahagi.

MAMAHAGI

- Mabatid na ang pagtulong sa kapwa ay nagdudulot ng kabutihan sa mundong ating ginagalawan.

- Matukoy ang relasyon sa pagitan ng pagpaplano at kinahinatnang pinansiyal.

- Maiugnay ang planong pananalapi sa iba pang pinansiyal na salik (banko, institusyong pampamahalaan, at iba pa)

- Mabatid ang pinansiyal na layunin at prayoridad at ang paraan ng pamimili sa pagitan nito.

- Nailahad ang mga katangian ng isang entrepreneur.

- Makagawa ng isang payak na planong pangnegosyo.

MAMUHUNAN

- Ang kabiguan sa pagpaplano ay pagpaplano ng kabiguan.

- Mailahad ang mga katangian ng isang entrepreneur.

- Makagawa ng isang payak na planong pangnegosyo.

- Matutuhan kung paano ang pagiging entreprenyur ay makapagbibigay serbisyo sa komunidad.

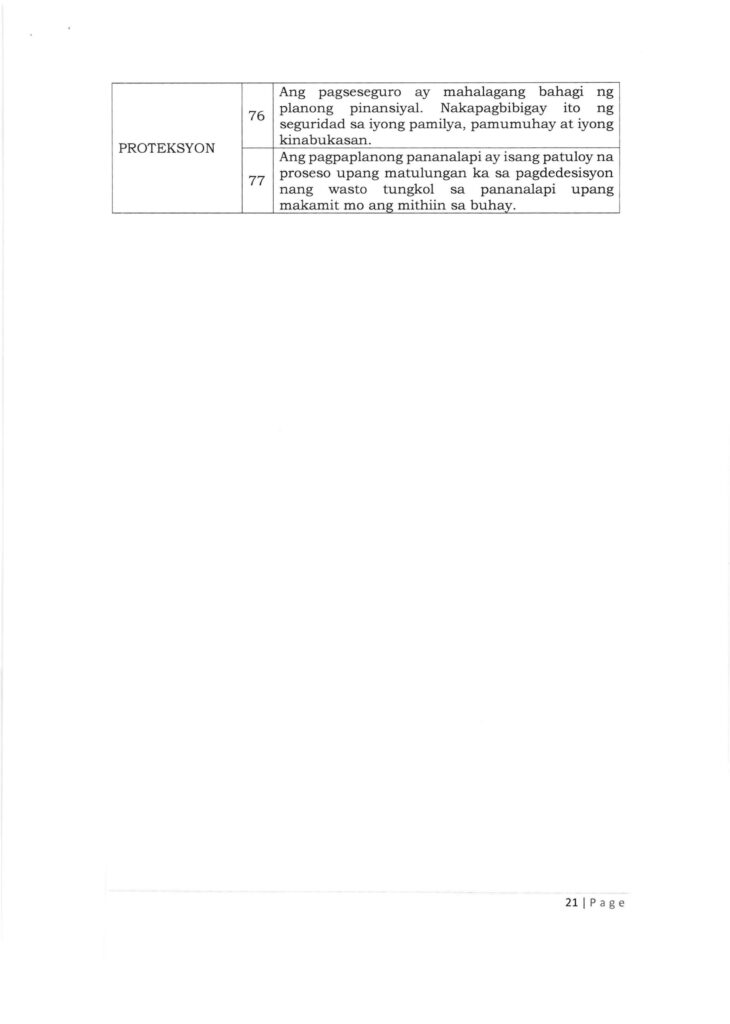

PROTEKSYON

- Ang pagseseguro ay mahalagang bahagi ng planong pinansiyal. Nakapagbibigay ito ng seguridad sa iyong pamilya, pamumuhay at iyong kinabukasan.

- Ang pagpaplanong pananalapi ay isang patuloy na proseso upang matulungan ka sa pagdedesisyon nang wasto tungkol sa pananalapi upang makamit mo ang mithiin sa buhay.