Attached herewith is DepEd Order No. 22, s. 2021 dated June 03, 2021, on the Financial Education Policy.

The Department of Education (DepEd) issues the enclosed Financial Education Policy. This is pursuant to pertinent provisions of Republic Act (RA) No. 10922 or the Economic and Financial Literacy Act of 2016 and RA 10679 or the Youth Entrepreneurship Act of 2015.

This policy aims to intensify the integration of Financial Education in the K to 12 Basic Education Curriculum in various disciplines across grade levels.

It targets to enhance the financial literacy and financial capability of all learners, public school teachers, and DepEd personnel to make sound financial decisions that lead to financial health and financial inclusion.

These guidelines shall be effective immediately and shall remain in force and in effect for the duration of the program.

For more information, please contact the Office of the Director IV, Bureau of Curriculum Development, Bonifacio Building, Department of Education Central Office, DepEd Complex, Meralco Avenue, Pasig City, at telephone numbers: (02) 8636 5096; (02) 8633-7267; or (02) 8636-5172.

Immediate dissemination of and strict compliance with this Order is directed.

READ MORE: Financial Education Core Messages for Integration on the DepEd Financial Education Policy

Enclosure to DepEd Order No. 022 , s. 2021

Table of Contents

DEPED FINANCIAL EDUCATION POLICY

I. RATIONALE

Financial Education is vital in developing financially literate citizenry, empowering them to make wise financial decisions, take advantage of economic opportunities, and achieve financial health. Financially literate citizens can contribute more productively to inclusive growth and be more effective agents of nation-building, thereby supporting the vision of Ambisyon Natin 2040: Matatag, Magirihawa, at Panatag na Buhay and that of the Sustainable Development Goals (SDGs), particularly the promotion of quality education that ensures an increasing number of youth and adults with relevant skills and competencies for productive lives and poverty reduction.

Financial Education alongside financial consumer protection is also among the key pillars of the National Strategy for Financial Inclusion (NSFI), which was institutionalized on 02 June 2016 through Executive Order No. 208, naming the Department of Education (DepEd) as one of the members of the interagency Financial Inclusion Steering Committee (FISC) tasked to implement the NSFI in line with its own mandates and authorities. The NSFI provides a platform for the collaboration of public and private sectors, and ensures synergy of actions to achieve shared objectives of financial education, consumer protection, and financial inclusion.

The role of Financial Education in economic development is mandated by the following laws:

a. Republic Act No. 10922 or the “Economic and Financial Literacy (EFL) Act”:

“All public and private elementary and secondary schools under the Department of Education (DepEd), and state and private colleges and universities under the Commission on Higher Education (CHED) and the National Youth Commission (NYC) are mandated to conduct consciousness-raising and knowledge-expanding activities on economic and financial literacy, including the setting up of literature comers, organizing fora, trainings and conducting basic economic and financial management classes. ” (Sec. 4)

b. Republic Act No. 10679 or the “Youth Entrepreneurship Act”:

“The promotion of youth entrepreneurship and financial literacy program shall be inculcated in all levels of education nationwide. Consistent with RA No. 10533 or the “Enhanced Basic Education Act”, the DepEd shall ensure that the K-12 Curriculum shall be supported by programs on entrepreneurship and financial literacy…” (Sec. 4)

Consistent with Ambisyon Natin 2040, SDGs, the NSFI, and the aforementioned laws, and the DepEd mission, vision and core values, the DepEd thus responds to the urgent need to improve the financial literacy and financial capability in the Philippines. Such urgency has also been amplified in surveys that indicate low levels of financial literacy in the Philippines. A survey by the Bangko Sentral ng Pilipinas (BSP) has shown that forty one percent (41%) of Filipinos can only answer 1 of 3 financial literacy questions correctly, and a meager eight percent (8%) can answer all three. There are also studies which show segments of the population appearing to struggle the most in understanding basic financial concepts which include adults who did not save as a child because those who develop the habit of saving at a young age outperform their peers in choosing financial products and services, monitoring expenses, managing debt and planning for retirement1.

Hence, DepEd recognizes the importance of enhancing the competencies of learners and teachers alike and its contribution to the overall improvement of level of financial literacy and financial capability of Filipinos. It is through this Policy that DepEd intends to provide comprehensive content and pedagogy on financial literacy such as earning, saving, spending, budgeting, donating, investing, and protecting consumers.

Overall, this Policy provides direction, guiding principles and procedures on the implementation and monitoring of the integration of Financial Education, including the measurement of effectiveness and impact of the same.

II. SCOPE AND COVERAGE

The Financial Education Policy covers all learners from all public and private elementary, junior and senior high schools, learning centers for Special Education (SPEd) and Alternative Learning Systems (ALS), Indigenous Learning Systems and Madrasah Education Program.

This shall guide the teachers (both from public and private) on the process of intensified integration of financial education in various discipline across grade levels (Kindergarten to Senior High School).

This will also bridge the necessity for teachers and personnel to be better equipped in financial literacy through reinforcement of existing measures such as the Teacher Induction Program (TIP), and partnership programs with BSP (i.e Financial Empowerment Seminars, Financial Education Expo, and Financial Literacy Program with Schools).

This policy shall also guide concerned offices in the Central Office (CO), Regional Offices (ROs), Schools Division Offices (SDOs), and schools in the program implementation.

The Laboratoiy Schools of State Colleges and Universities (SUCs) and Local Colleges and Universities (LUCs) are encouraged to adopt this policy.

This proposed policy shall govern performance management of public schools only. DepEd regulation over private school does not cover performance management of teachers and staff.

III. DEFINITION OF TERMS

the educational process of relating the curriculum to a particular setting, situation or area of application to make the competencies relevant, meaningful, and useful to all learners.

The degree of contextualization may be described and distinguished into the following:

a. 1. Localization – the process of relating learning content as specified in the curriculum to local information and materials in the learners’ community.3

a.2. Indigenization – the process of enhancing curriculum competencies, education resources and teaching-learning processes in relation to the bio-geographical, historical, and socio-cultural contexts of the learners’ community. Indigenization may also involve the enhancement of the curriculum framework, curriculum design and learning standards of subject areas, guided by the standards and principles adhered to in the national curriculum.

the activity of setting up a business or businesses, taking on financial risks in the hope of profit.

the systematic process of teaching and learning to acquire financial literacy and improve financial capability.

the ability of consumers to use the acquired financial literacy to make better-informed decisions about managing their finances.

a condition in which a learner/consumer can balance income and expenses, build and maintain reserves, manage existing debts, plan and prioritize, manage and recover from financial shocks, and use an effective range of financial tools.

the effective use by financial consumers of suitable financial services that are safely delivered through digital and traditional channels that can empower them to achieve their financial goals.

the level of knowledge of a learner about financial concepts and principles.

(as contextually used in this policy) This refers to students that will undertake Financial Education.

(as contextually used in this policy) This refers to students, teachers, and other school stakeholders that would benefit from the study of Financial Education.

IV. POLICY STATEMENT

DepEd hereby institutionalizes and intensifies the integration of Financial Education in the K to 12 Basic Education Curriculum, in line with the provisions of RA No. 10922 and RA No. 10679, and in support of national and international development goals.

This policy thus targets to enhance the financial literacy and financial capability of all learners, teachers, and DepEd personnel to make sound financial decisions that lead to financial health and financial inclusion.

This Policy likewise sets the principles and guidelines for efficient and effective teaching and learning of Financial Education Concepts and Core Messages aligned with appropriate learning competencies in various learning areas across all grade levels, which are anchored on the use of pedagogical approaches that are constructivist, inquiry-based, reflective, collaborative and integrative. This Policy also encourages educators to be reflective, flexible, creative, and innovative in their facilitation of the teaching and learning process, making Financial Education an integral part of lesson planning, instructional design, classroom and school activities, and professional development as well.

For learners, in particular, this Policy aims to:

- help them understand the value of money and resources with integrity and honesty through undertaking examinations pertinent to financial scenarios; and

- develop their knowledge and capability to apply Financial Education Concepts and Core Messages in practical situations through simulated real-life financial settings.

For private schools’ teachers, administrators, and school heads in particular, this Policy aims to:

- guide them in integrating Financial Education Concepts and Core Messages in appropriate Learning Competencies in various learning areas across all grade levels based on identified and approved entry points in the K to 12 Basic Education Curriculum; and

- capacitate them in Financial Education through the provision of resource materials.

For public schools’ teachers, school heads and concerned supervisors from ROs and SDOs, in particular, this Policy aims to:

- guide them in integrating Financial Education Concepts and Core Messages in appropriate Learning Competencies in various learning areas across all grade levels based on identified and approved entry points in the K to 12 Basic Education Curriculum

- capacitate them in Financial Education through the provision of resource materials and capability building opportunities to enable them to effectively facilitate the integration of Financial Education Concepts and Core Messages in the conduct and delivery of lessons and classes; and

- produce financially literate and debt-free teaching force.

For DepEd non-teaching personnel in particular, this Policy further provides guidance to:

- ensure that Financial Education is integrated in the regular training programs and professional development courses for the non-teaching personnel which would make them financially literate and debt-free;

- identify the strategic roles and responsibilities and ensure communication and collaboration among concerned DepEd offices from the Central Office to the Division Offices;

- monitor progress and measure impact of Financial Education integration in the personal finance management skills of the non-teaching personnel; and

- provide general guidance to existing and potential DepEd partners from the public and private sectors to ensure that their support, projects, and programs are in accordance with the objectives of this Policy, the design of the integration process, and the identified Financial Education Concepts and Core Messages.

V. PROCEDURES

A. General Guidelines for Teachers and Concerned DepEd Offices in the Integration of Financial Education in the K to 12 Basic Education Curriculum

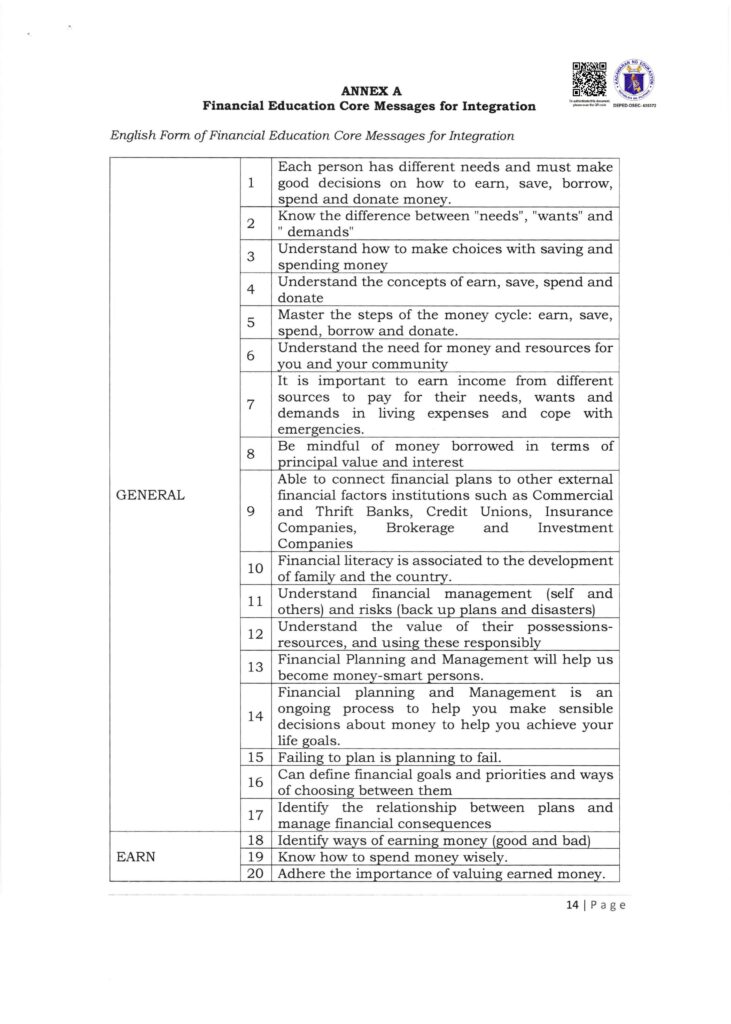

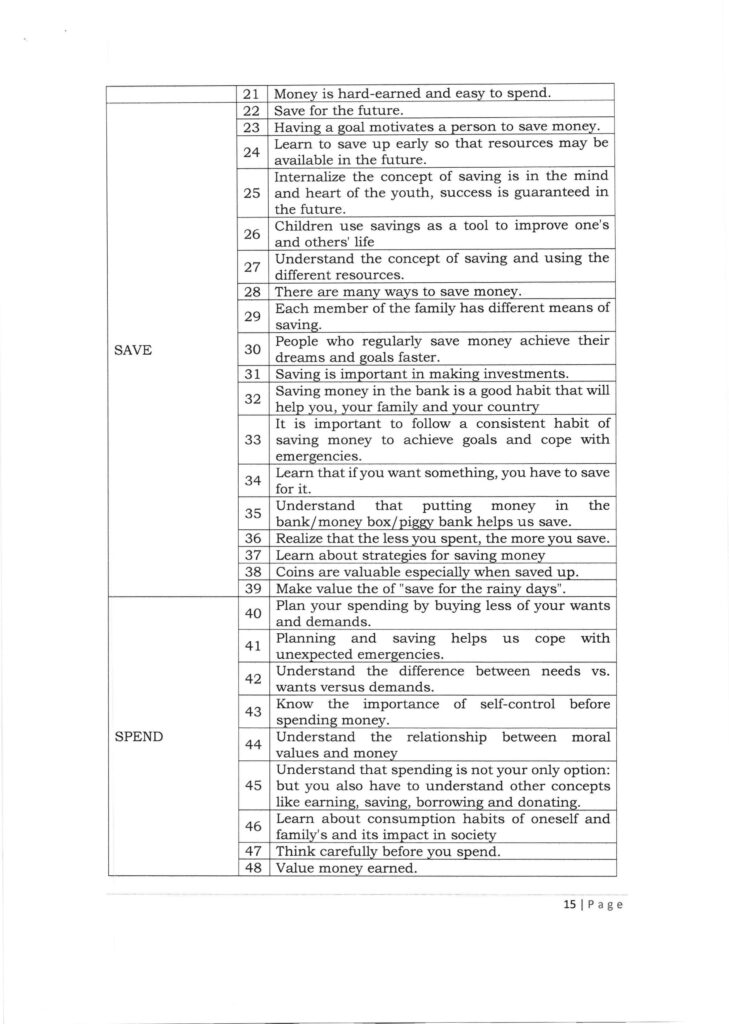

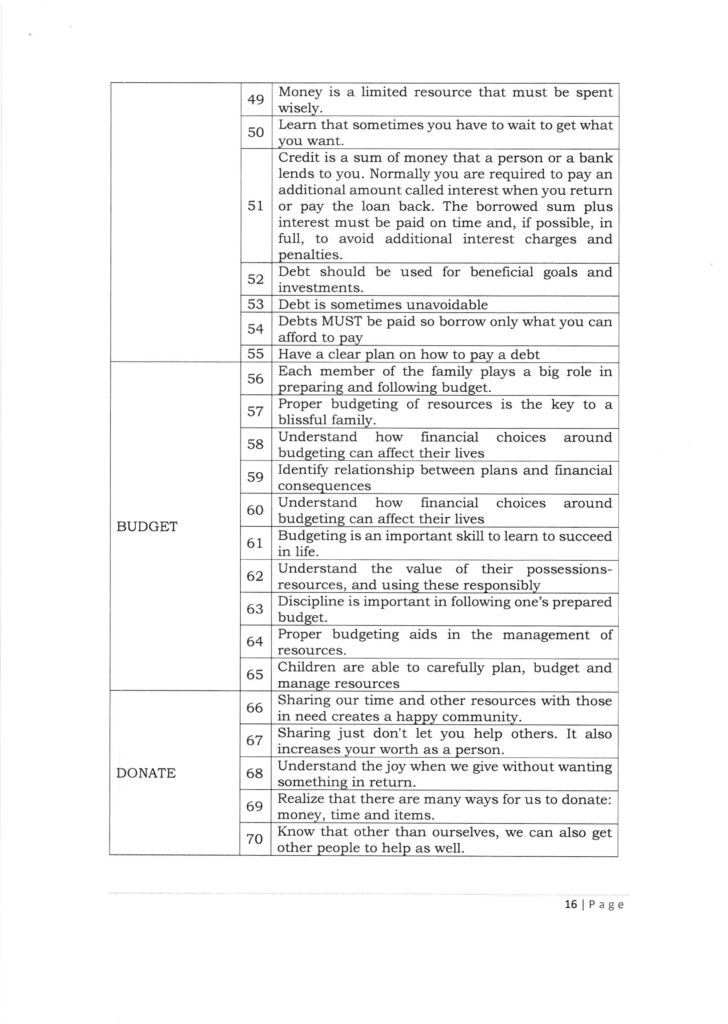

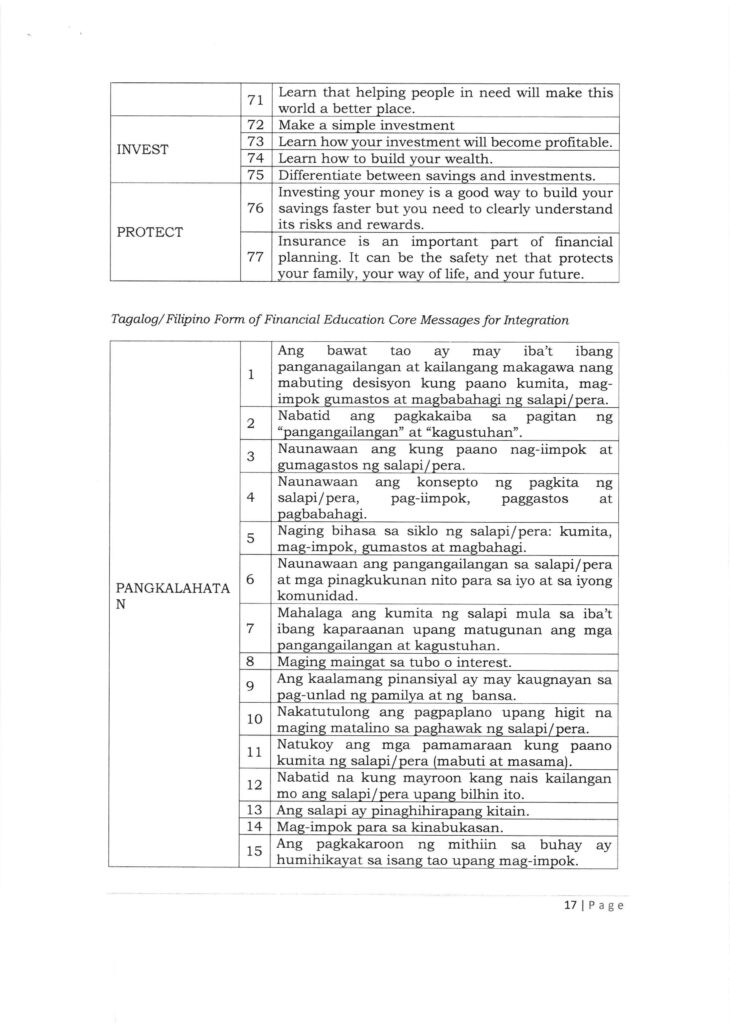

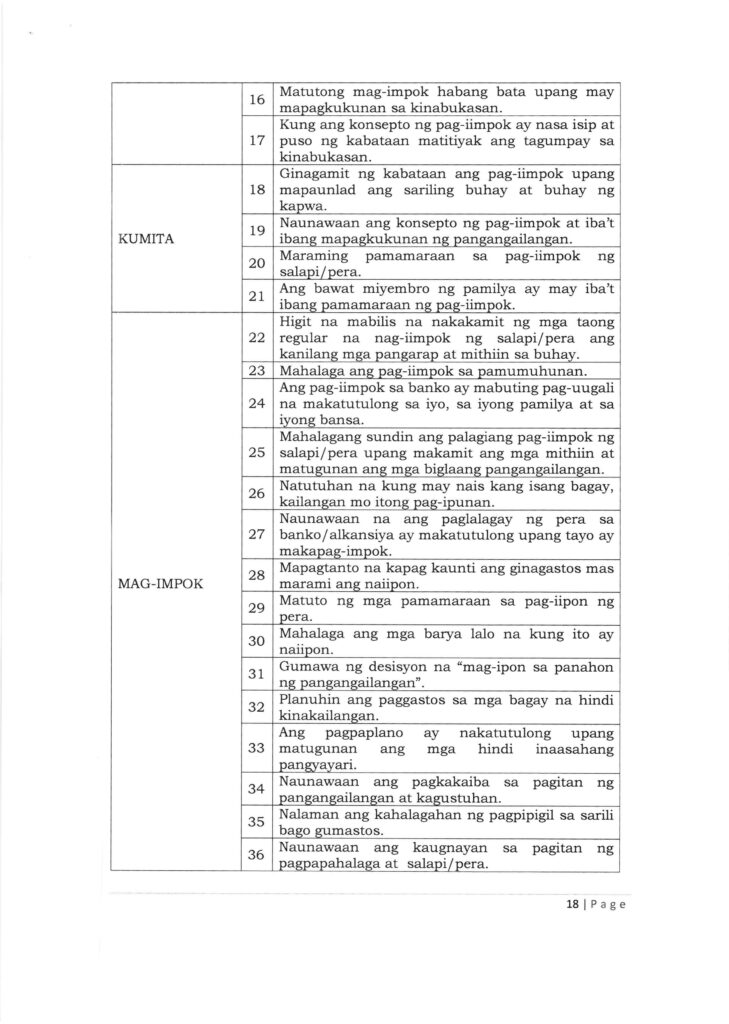

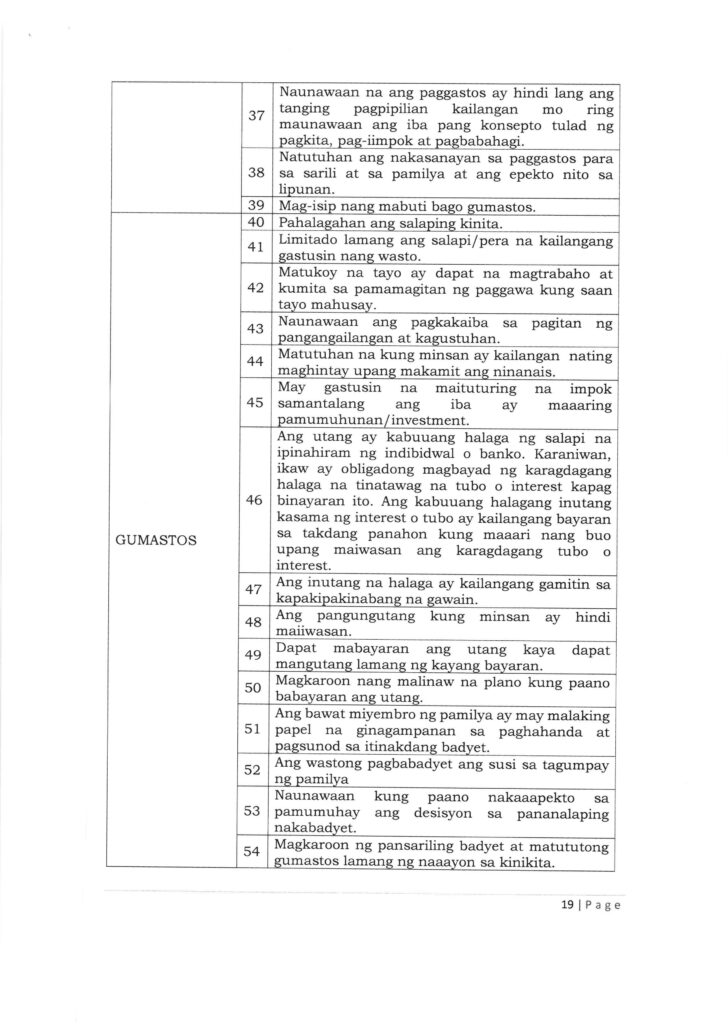

Financial Education in the Philippine K to 12 Basic Education Curriculum shall be integrated through the contextualization of Financial Education Concepts and Skills labeled as “Core Messages” within the K to 12 Learning Competencies labeled as “Entry Points”. The following principles shall be adopted in the integration process:

a. The Financial Education Concepts and Core Messages shall be integrated

without changing existing learning competencies in the learning areas of the K to 12 Basic Education Curriculum. There shall be no changes in the content standards of each learning area during the integration process.

b. Financial Education Core Messages (Annex A) shall be integrated in identified Entry Points within learning areas across grade levels, whenever feasible, and with due consideration to degrees of difficulty. Integration shall be done through contextualization (localization and/ or indigenization) of the Financial Education Concepts and Core Messages during classroom instruction, discussions and/or activities.

c. Lesson Exemplars in each learning area shall be provided as resources and/or reference for lesson delivery. These exemplars, with relevant supplemental tools, shall be used by teachers to guide the integration of relevant Financial Education Concepts and Core Messages in the lessons. These exemplars may be contextualized whenever applicable. Sample exemplars are listed in DepEd Memorandum No. 32 s. 2019 (Annex B) and DepEd Memorandum No. 107 s. 2019 (Annex C).

d. Integration shall be operationalized through the contextualization, in particular through the conduct, implementation or use of any of the following items, in appropriate phase/s of lesson delivery:

- Drills, exercises, activities, and tools relevant to the Financial Education Concepts and Core Messages;

- Examples of finance-related concepts relevant to the actual experiences of the learners;

- Valuing process focusing on financial decisions;

- Contextualized financial situations and environment;

- Inclusion of Financial Education Concepts and financial capability indicators in different forms of learning assessments; and

- Performance outputs where Core Messages are deemed applicable.

e. Learning materials, tools and activities produced and donated by public and

private sector partners of DepEd may be used; provided that these materials, tools activities, are aligned with the provisions of this Policy and do not present potential conflicts of interest. Teachers may adopt and/or improve these materials, tools and activities to contextualize the integration of Financial Education Concepts and Core Messages, consistent with this Policy.

f. The integration shall emphasize the main objectives of Financial Education

to allow the learners to:

- understand the value of money and resources;

- understand how money and resources are acquired or generated;

- plan and manage the use of money and resources;

- save and share money and resources, and

- apply classroom lessons through financial inclusion

mechanisms, (i.e., opening savings accounts, managing financial resources prudently, etc.)

B. Building Competency and Capability for Teaching and Non-Teaching Personnel

To ensure the effective implementation of this Policy, relevant and appropriate training support and competency building activities for public schools shall be implemented by the National Educators Academy of the Philippines (NEAP) for teachers and leaders, the Teacher Education Council (TEC)- Secretariat for teachers-in-training, and Bureau of Human Resource, and Organizational Development (BHROD) for non-teaching personnel.

The capacity building activities relevant to Financial Education for DepEd personnel shall address their professional development needs (e.g., efficient financial integration in the curriculum) and personal training needs (e.g., personal financial management), in line with the professional standards in the Philippines. Such capacity building activities shall either be stand-alone and/or integrated into existing trainings such as Teacher Induction Program (TIP), In-Service Training for Teachers (INSET), Learning Action Cells (LAC), and other regular seminar-workshops for DepEd personnel.

Further, the capacity building activities shall enable teaching and nonteaching personnel of public schools to understand Financial Education Concepts and Core Messages, and enhance their financial literacy and capability as well. DepEd shall implement these activities with existing and/or potential partners from the public and private sectors, provided that the partners are in congruence with DepEd’s vision of a financially literate nation, aligned with the objectives of this Policy, and devoid of conflicts of interest and commercial gains.

C. Partnership and Linkages with External Organizations

To ensure the effective implementation of this Policy and achieve DepEd’s vision of a financially literate nation, all DepEd offices (i.e., central, regional, division, and school) may enter into partnership with external organizations from the public and private sectors, in coordination with the Office of External Partnerships and subject to a Financial Education Partnerships Framework.

All concerned DepEd offices shall collaborate in the development of the Financial Education Partnerships Framework indicating, at the minimum, the criteria for selection of partner organizations, the key areas where DepEd requires external support, as well as the usual procedures for entering into partnerships as defined in existing policies. The framework shall be anchored on the principles of shared objectives and responsibilities, and devoid of conflicts of interest and commercial gains. DepEd partnerships with external organizations may cover the provision of technical and/or logistical support in the development of financial education learning tools and materials, implementation of capacity building initiatives, and deployment of measurement and evaluation mechanisms, as envisioned under this Policy.

VI. ROLES AND RESPONSIBILITIES

DepEd Central Office (CO)

A. The Bureau of Curriculum Development (BCD) shall be the focal unit responsible for overseeing the implementation of this Policy. It shall:

- Identify the Entry Points on the integration of Financial Education Core Messages in the K to 12 Curriculum;

- Implement a strategic program to orient relevant teaching and nonteaching personnel on this Policy;

- Conduct and implement relevant support activities and advocacy programs to ensure the effective implementation of this Policy;

- Establish and implement a monitoring and evaluation system, in coordination with concerned DepEd offices, that will generate relevant data and information to determine the progress, outcomes, and impact of this Policy, particularly on learners in the K to 12 basic education system;

- Ensure the submission and collection of relevant reports and feedback from the field;

- Organize a Technical Working Group (TWG) comprised of representatives from the Bureau of Learning Resources (BLR), the

Bureau of Learning Delivery (BLD), Bureau of Assessment (BEA), Policy, Planning and Research Division (PPRD), National Educators Academy of the Philippines (NEAP), Teacher Education Council (TEC), and Bureau of Human Resource and Organizational Development (BHROD) and other concerned DepEd offices, to craft a roadmap to implement this Policy, which shall include periodic review of policy implementation as basis for making appropriate recommendations for its enhancement;

- Link with relevant domestic and international agencies in benchmarking financial literacy and capability levels of learners, and the impact of the integration of Financial Education in the K to 12 Basic Education Curriculum; and

- Facilitate partnerships with external organizations, in coordination with the External Partnerships Office and other concerned DepEd offices, to support the effective implementation of this Policy.

B. The Bureau of Learning Delivery shall:

- Design and develop appropriate learning management and delivery models for integrating Financial Education using the Core Messages and entry points identified by the BCD and provided for in the Lesson Exemplars;

- Develop and manage the training and capacity building program on Financial Education integration for teaching and non-teaching personnel in coordination with NEAP and BHROD;

- Design and develop appropriate learning management and delivery models of Financial Education integration for different learning groups of learners including Madrasah, Indigenous Peoples, and learners with special needs; and

- Coordinate and collaborate as needed with BCD and other concerned DepEd offices to ensure effective implementation of this Policy.

C. The Bureau of Learning Resources shall:

- Formulate policies, standards, and guidelines on the acquisition, allocation, procurement, and equitable distribution of relevant Financial Education learning materials across all levels of DepEd;

- Conduct research, monitor and evaluate Financial Education integration learning resource needs and use for appropriate improvement;

- Provide digital access to all Financial Education learning materials through the Learning Resources Management and Development Services (LRMDS) portal;

- Facilitate the procurement or acquisition and delivery of printed Financial Education learning materials, including donated materials, for use of teachers and concerned DepEd personnel when necessary; and

- Coordinate and collaborate as needed with BCD and other concerned DepEd offices to ensure effective implementation of this Policy.

D. The Bureau of Educational Assessment shall:

- Establish policies, standards and guidelines on the assessment of the financial literacy and capability levels of learners in line with the Monitoring & Evaluation Framework articulated in this Policy;

- Develop and identify relevant and innovative assessment tools and measures to evaluate and assess effectiveness of the integration of Financial Education into the K to 12 Basic Education Curriculum in line with 21st Century Skills and the M&E Framework articulated in this Policy; and

- Coordinate and collaborate as needed with BCD and other concerned DepEd offices to ensure effective implementation of this Policy.

E. The Bureau of Human Resource and Organizational Development shall:

- Develop and design systematic and strategic training and capacity building programs to build and develop competencies of non-teaching personnel in integrating Financial Education into their personal finance management, in coordination with NEAP and other concerned DepEd offices;

- Include the integration of Financial Education Key Concepts and Core Messages in the RPMS objective on the PPST priority indicator particularly on the part of applied knowledge of content within and across curriculum teaching areas. It shall also be included in the COT-RPMS Rating Sheet since COT-RPMS is one of the means of verification whether Financial Education Key Concepts and Core Messages are integrated in the delivery of the lesson in various discipline across grade levels;

- Coordinate and collaborate as needed with BCD, NEAP and other concerned DepEd offices to ensure effective implementation of this Policy, particularly in the areas of human resource development and employee welfare. This may include the establishment and implementation of a monitoring and evaluation system particularly to generate relevant data and information to determine the progress, outcomes, and impact of this Policy particularly on DepEd human resources; as well as the facilitation of partnerships with external organizations to achieve the objectives of this Policy.

F. The National Educators Academy of the Philippines (in coordination with the Teacher Education Council – Secretariat) shall:

- Develop, in coordination with BHROD and other concerned DepEd offices, professional development interventions for teaching personnel, school heads, and supervisors integrating Financial Education particularly on the process of integrating the Key Concepts and Core Message in the K to 12 Basic Education Curriculum in various disciplines across grade levels. Personal finance management shall also be included in the said professional development interventions to enable the teaching personnel, school heads, and supervisors thoroughly understand and acquire the skills in Financial Literacy and Financial Capabilities before they can impart it to the learners by integrating it inside the classroom during delivery of instruction;

- Accredit Financial Education training programs, trainers and training providers that may be tapped by DepEd offices at the national, regional and division levels to provide relevant trainings on Financial Education. This includes the development of the necessary accreditation criteria and procedures;

- Link and manage partnerships with external organizations in developing and implementing relevant training programs on Financial Education for teachers, school heads, and supervisors; and

- Coordinate and collaborate (as needed) with concerned DepEd offices to ensure effective implementation of this Policy. This may include the establishment and implementation of a monitoring and evaluation system to generate relevant data and information to determine the progress, outcomes, and impact of this Policy particularly on the professional development of teachers.

G. The Teacher Education Council-Secretariat shall make a relevant recommendation to the Teacher Education Council (TEC) as a result of its coordination with NEAP, BHROD and other concerned offices at the Central Office.

DepEd Regional Offices (ROs)

To effectively implement this Policy at the local level, DepEd Regional Offices (ROS) through the Education Support Services Division (ESSD) in coordination with the Curriculum Learning Management Division (CLMD) in each Region shall:

- Ensure effective implementation of this Policy by all public and private schools in the region;

- Facilitate the deployment, delivery and utilization of the Lesson Exemplars and related Financial Education learning materials and tools;

- Ensure that school heads and teaching personnel in the field are adequately oriented, capacitated and trained to integrate Financial Education in the K to 12 Curriculum;

- Ensure that teaching and non-teaching personnel in the field are adequately trained on personal financial management;

- Provide feedback on the capacity building needs of teaching and nonteaching personnel and support the conduct of capacity building programs in coordination with NEAP, TEC and BHROD;

- Consolidate reports submitted by the Schools Division Offices (SDOs) and facilitate submission to concerned DepEd offices;

- Coordinate and collaborate as needed with concerned DepEd offices to ensure effective implementation of this Policy; and

- Assign a particular functional division as focal unit to implement the foregoing roles and responsibilities.

Schools Division Offices (SDOs)

To effectively implement this Policy, the SDOs through the Curriculum and Implementation Division (CID) in coordination with the School Governance and Operations Division (SGOD) shall:

- Provide the necessary support, feedback and reports to ensure effective implementation of this Policy;

- Coordinate and collaborate as needed with concerned DepEd offices to ensure effective implementation of this Policy; and

DepEd Schools

School heads shall implement all applicable provisions of this Policy, and coordinate and collaborate as needed with BCD and other concerned DepEd offices to ensure effective implementation of this Policy.

VII. ACTIVITIES AND TIMELINES

The specific activities and timelines to implement this Policy shall be articulated in a Roadmap to be developed by the TWG. The Roadmap shall cover all policy areas such as, but not limited to, capacity building for DepEd personnel, as well as establishment and implementation of the M&E Framework and the Partnership Framework.

VIII. MONITORING AND EVALUATION (M&E)

DepEd Central Office

The Central Office through the Bureau of Curriculum Development (BCD), in coordination with concerned DepEd offices such as the Planning Service, NEAP and BHROD, shall be primarily responsible for the following during the monitoring and evaluation:

a. develop a Monitoring and Evaluation (M&E) Framework that measures the effectiveness and efficiency of the integration of Financial Education in the K to 12 Basic Education Curriculum, consistent with the existing DepEd monitoring and evaluation systems for learners (e.g. National Achievement Test or NAT, Early Language Literacy and Numeracy Assessment or ELLNA, among others as applicable), and for teachers (e.g. IPCRF, RPMS-PPST);

b. identify through M&E Framework the specific indicators and metrics to measure the effectiveness of the implementation of this Policy in improving the Financial Education and related competencies of learners and teachers;

c. establish the M&E systems and processes for monitoring progress of implementation and measuring outcomes and impact based on the Department’s M&E Framework, including data collection and systematization, reporting, and roles and responsibilities of concerned DepEd offices;

d. ensure that all concerned DepEd offices work together to implement the M&E Framework, and submit, as applicable all relevant data and information, in line with the M&E Framework and relevant systems and processes;

e. enforce a mid-term policy review and interpret data and analytics generated from the M&E Framework, systems and processes. Results of this mid-term policy review shall serve as basis for revisions or amendments of this Policy in accordance with the Roadmap; and

f. conduct an impact evaluation of the implementation of the Policy enhancements/amendments. The impact evaluation shall determine if the Policy objective of improving competencies of learners and teachers in financial literacy is achieved in accordance with the policy level outcomes.

DepEd Regional Offices (ROs)

The DepEd Regional Offices (ROs) through the Curriculum Learning Management Division (CLMD) in coordination with the Schools Division Offices and other concerned DepEd offices shall monitor and evaluate the integration of Financial Education in the schools within its jurisdiction

DepEd Schools Division Offices (SDOs)

The DepEd Schools Division Offices through the Curriculum and Implementation Division (CID) in coordination with the School Governance and Operations Division (SGOD), Regional Office (RO) and other concerned DepEd offices shall monitor and evaluate the integration of Financial Education in the schools within their jurisdiction.

Schools

The schools through the School Heads in coordination with the SDO shall monitor and evaluate the integration of Financial Education within the schools within their jurisdiction.

IX. EFFECTIVITY

This Policy shall take effect immediately.

X. REFERENCES

BSP, 2019, “Financial Inclusion Survey”,

http: / / www.bsp.gov.ph / downloads /publications / 2019/2019FISToplineRep ort.pdf

Center for Financial Services Innovation, 2017, “Beyond Financial Inclusion: Financial Health as a Global Framework”, https:/ /s3.amazonaws.com/cfsi-innovation-files-2018/wp-content/uploads/2017/03/18161330/2017 BeyondFinlnclusion Fulll.pdf

DepEd Memorandum No. 110, s. 2017 – “Technical Working Group on the Financial Literacy Program in Basic Education”

Department Order 42, s. 2016 – “Policy Guidelines on Daily Lesson Preparation for the K to 12 Basic Education Program”

OECD, 2014, “Financial Education for Youth: The Role of Schools”, https: / / read.oecd-ilibrary.org/finance-and-investment/financial-education-in-schools 9789264174825-en#pagel

OECD/INFE, 2015, “Core Competencies Framework on Financial Literacy for Youth”,

https: / Zwww.oecd.org/finance/Core-Competencies-Framework-Youth.pdf

OECD/INFE, 2012, “Guidelines on Financial Education for Schools”, https://www.oecd.org/daf/fin/financial-

education/2012%20Schools%20Guidelines.pdf

Republic Act No. 10533, s. 2013 – “An Act Enhancing the Philippine Basic Education System by Strengthening Its Curriculum and increasing the Number of Years for Basic Education”

Republic Act No. 10679, s. 2015 – “Promoting Entrepreneurship Financial Education among Filipino Youth”

Republic Act No. 10922, s. 2016 – “Economic and Financial Literacy Act”

Republic Act No. 7394, s. 1992 – “The Consumer Act of the Philippines”

World Bank, 2015, “Enhancing Financial Capability and Inclusion in the Philippines: A Demand Side Assessment”,

https://openknowledge.worldbank.org/handle/ 10986/25073