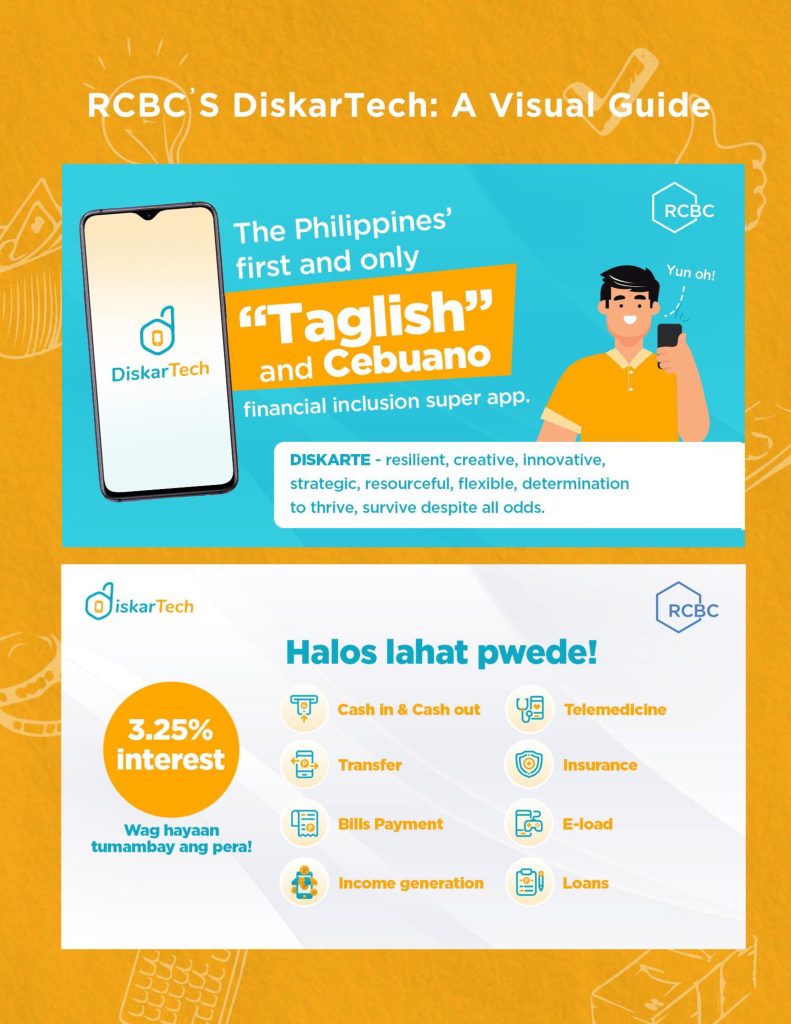

The Department of Education (DepEd), through the External Partnerships Service (EPS), signed a Memorandum of Agreement (MOA) with the Rizal Commercial Banking Corporation (RCBC) in October 2021 relative to their DiskarTech Program. The DiskarTech Program digitalizes the concepts of alkansya (savings), paluwagan (loans), seguro (insurance), and bayad (payments). It aims to promote financial stewardship practices with the teachers and parents by allowing the learners to experience building financial education milestones through DiskarTech. As part of the program, a supplementary learning material (SLM) was developed, titled Aralin sa Madiskarteng Pananalapi to support DepEd financial literacy campaign for teachers and learners.

The RCBC’s DiskarTech is in support of DepEd Order No. 022, s. 2021 titled Financial Education Policy and the Bangko Sentral ng Pilipinas (BSP) National Strategy for Financial Inclusion, which is aligned with the DepEd program to include financial lessons in the K to 12 Basic Education Curriculum.

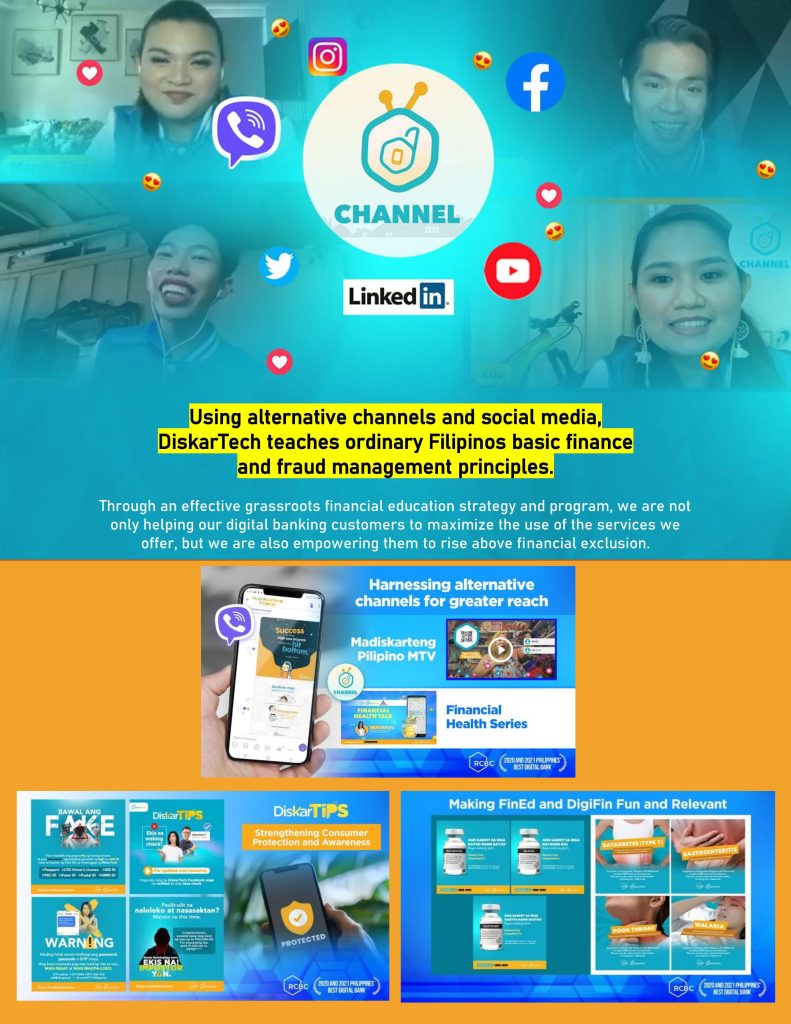

The Aralin sa Madiskarteng Pananalapi (Lessons on Smart and Resourceful Financing) is a primer, digital coffee table book on financial education that focuses on the philosophy and practices in earning, spending, saving, and investing money through inclusive digital finance technologies and applications. The materials are available and may be downloaded from DepEd Learning Resource Portal; viewed at podcast episodes and online episodes via DiskarTech TV, and browsed on DiskarTech social media accounts. Intended users of these materials are the Senior High School (SHS) learners and teachers from the Accountancy, Business, and Management (ABM) strand and Technical-Vocational Livelihood (TVL) track.

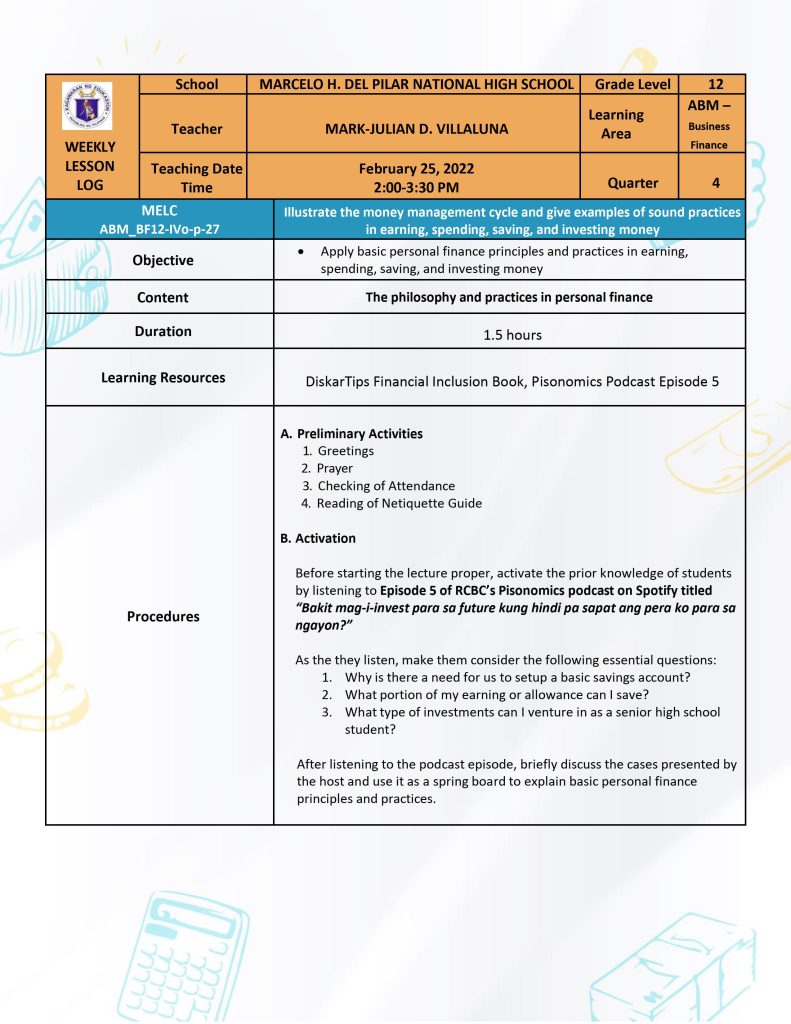

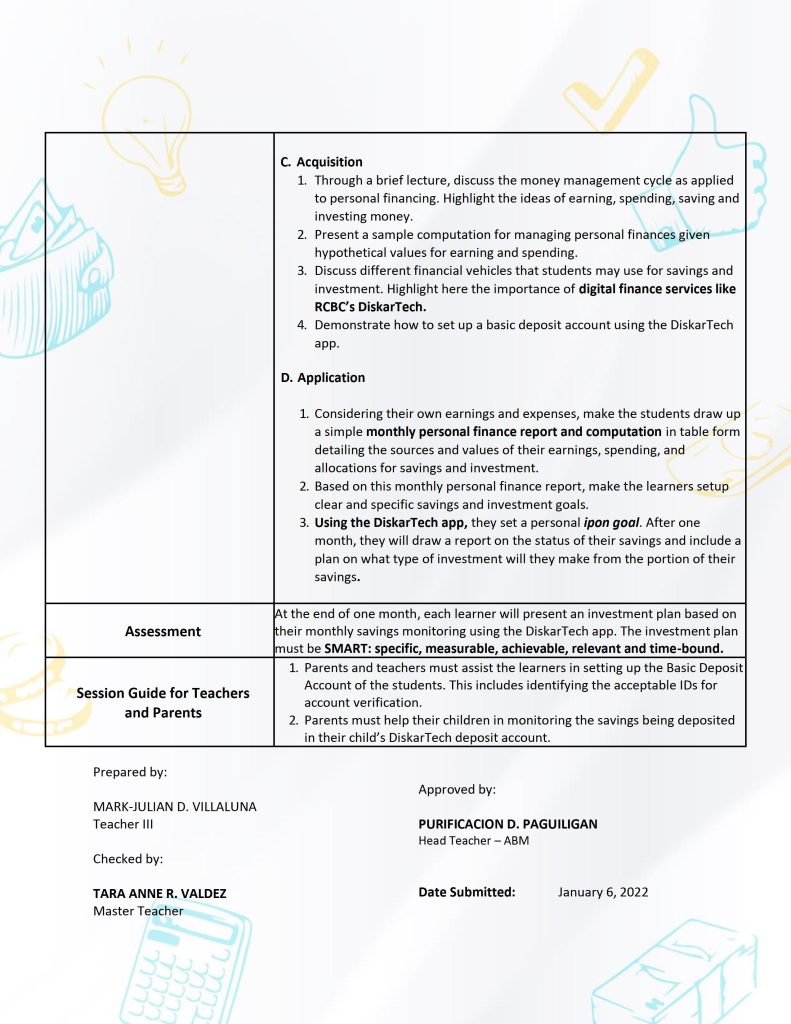

The SLM’s objectives are to

- apply basic personal finance principles and practices in earning, spending, saving, and investing money;

- appreciate the use of inclusive digital finance technologies like digital banking applications, e-wallets, and other digital finance platforms; and

- demonstrate a basic understanding of financial technology and financial inclusion.

All SHS learners, teachers, and parents from the ABM strand and TVL track are encouraged to access and download the DiskarTech application to experience digital personal financing.

For more information, please contact the External Partnerships Service, Ground Floor Mabini Building, Department of Education Central Office, DepEd Complex, Meralco Avenue, Pasig City through email at extemalpartnerships@deped.gov.ph or at the telephone number (02)8638-8639.

Aralin sa Madiskarteng Pananalapi (Lessons on Smart and Resourceful Financing)

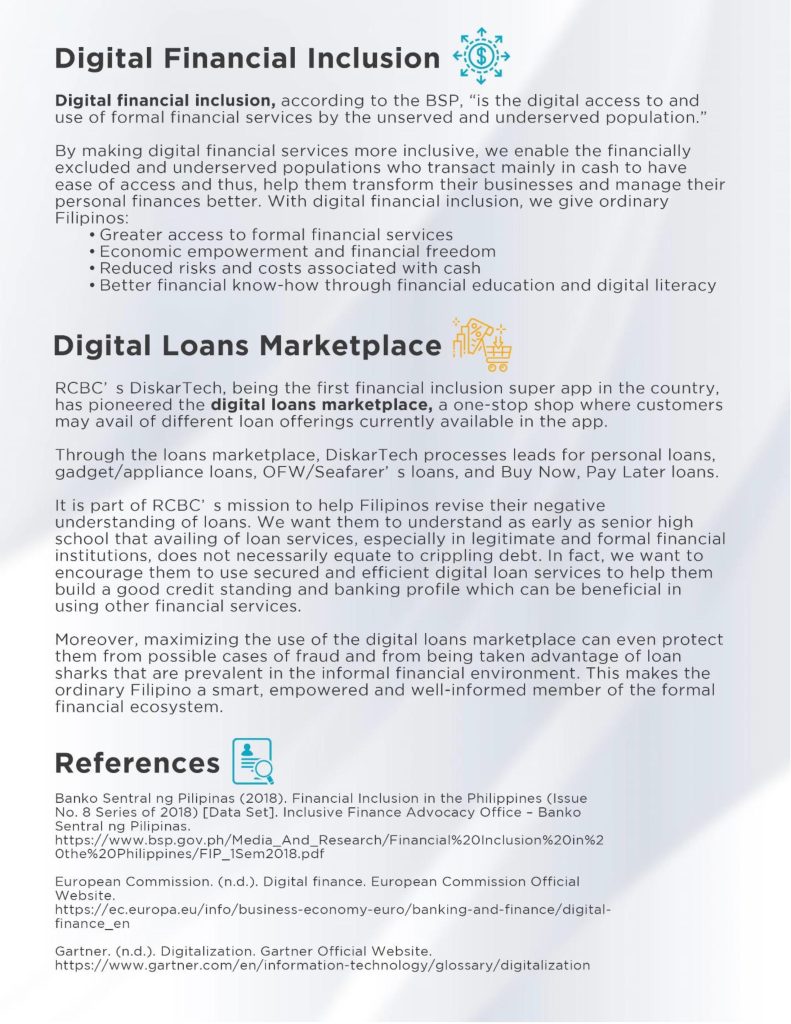

In the recent 209 Financial inclusion Survey published by the Bangko Sentral ng Pilipinas (BSP), it was noted that the Philippines has the lowest banking penetration in Southeast Asia. It was also estimated that the number of unbanked Filipino adults may reach 51.2 million.

Within this context, many small business owners and other marginalized sectors are often left with little choices when it comes to different financial services.

Moreover, low-income and minimum-wage earners are often intimidated by the prospect of starting a basic deposit account, partly because they lack the knowledge on the processes of opening one and the resources to maintain the required minimum balance, or they do not have the IDs required by the bank for documentation.

It is this gap that emerging digital finance solutions like Rizal Commercial Banking Corporation’s (RCBC) DiskarTech want to fill in not only through its innovative products that make banking services more inclusive and accessible for everyone but also through its efforts in pushing financial education and digital literacy forward.

Through this partnership with the Department of Education (DepEd), RCBC and DiskarTech propose the integration of the Aralin sa Madiskarteng Pananalipi (Lessons on Smart and Resourceful Financing) program into the current Accounting, Business and Management (ABM) curriculum of the DepEd’s senior high school program.

The integration of the said program is also a step forward to what the BSP envisions as a “digital Philippines.” Through an effective financial education and digital literacy strategy and program, we are not only helping our fellow Filipinos to maximize the services our banks and other financial institutions offer, but we are also empowering them to rise above financial exclusion.

As for RCBC’s DiskarTech, we have taken it as part of our mission to accompany our countrymen in this journey towards financial inclusion. We dream of a day when our unbanked and underserved sectors will soon become fully banked individuals; that each Filipino household has taken the values of saving up and investing to heart. This starts with a grassroots financial education strategy that includes lessons on financial technology and digital finance.

In the end, we want every Filipino learner to find their own diskarte as early as senior high school, equipping them with the knowledge and skills needed for them to soon experience asenso at ginhawa.

We believe that almost everything in digital banking innovation, supported by a strong grassroots financial education strategy, is within reach, hence echoing our DiskarTech mantra: Halos lahat pwede.